Helping your child build a superior credit score offers more significant future benefits than maniacally obsessing about their SATs.

Unlike the SAT, credit scores retain permanent shelf lives.

Owning a poor credit score produces toxic side effects. Being unable to buy a car, home, or possibly find meaningful employment is unthinkable for most young adults. Expensive SAT tutors are no longer considered a luxury. Basic financial literacy doesn’t exhibit a similiar response.

Who is helping teens with the vital life skill of establishing good credit?

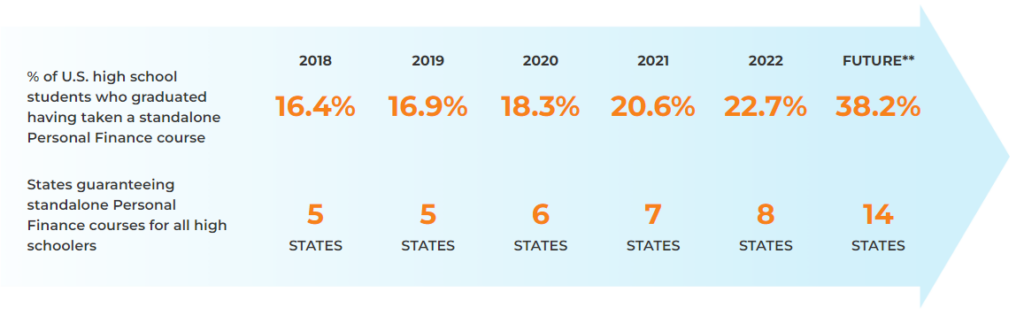

High Schools aren’t. Most don’t require the bare minimum of personal finance education.

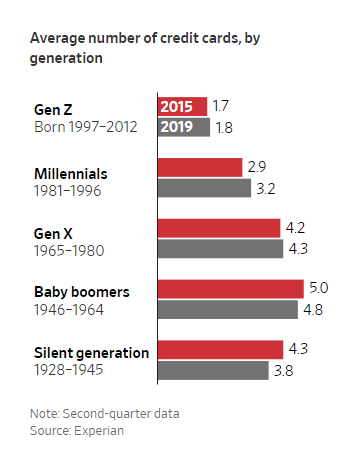

Parents must fill the breach by assisting their children in applying for a credit card. Credit cards are essential for young people to build an acceptable credit score. There are caveats. Credit Cards are combustible if the teen is immature and the parents can’t manage their debt.

Provided these criteria aren’t present, here’s how teens can start establishing a solid credit history.

Securing a credit card isn’t a slam dunk. The law insists applicants between 18-20 years old provide proof of income or a cosigner.

Significant obstacles block the way. Many young people don’t earn enough income. In addition, numerous credit card companies don’t offer a cosigner option.

Card companies define appropriate income differently. It’s wise to shop around.

According to the Wall Street Journal:

The Credit CARD Act of 2009 doesn’t spell out exactly how much income a young adult needs to qualify for a credit card, and it varies by issuer. But for applicants who are 18 to 20 years old, whatever income they have must be their own. A regular allowance from parents, wages and tips, trust-fund payouts and investment income or benefits directly received all count as income. However, young people can’t claim their parents’ income, even if they’re students. Applicants could be required to show documentation such as bank statements or a W-2.

Parents can assist low-earning children. Adding your teens as authorized users is an option. This feature permits young people to own a card in their name and build a credit history.

The Journal offers this advice.

Parents can add their children as authorized users on their credit cards. This allows young adults to have a card in their name and build a credit history for later in life. Parents should first ensure that their card issuer reports authorized users to the credit bureaus, as well as their card’s full on-time payment history. According to credit bureau Experian, your child will reap the most benefits in terms of building a credit history if you have a longstanding account with a spotless payment history and a low credit utilization rate, meaning you are using only a small slice of your total available credit.

All isn’t puppies and ice cream. Parents are on the hook to pay for a teen’s spending bender. Discuss the ramifications of irresponsible financial behavior with your young adult before adding them to your account. Consider tracking their spending using the company’s online tools.

Consider debit cards. Debit cards are a fantastic tool for teaching budgeting skills. Unfortunately, usage doesn’t build a good credit history.

We found a workaround. Our son uses a Step Card. This Visa Debit Card is designed for young people and reports their spending history to credit bureaus, allowing them to build a credit history without a credit card. They’re no monthly, overdraft, minimum, or service fees.

Our son Joe was most interested in what colors the card came in. Not abnormal behavior for a 19-year-old. He settled on blue.

In a low-income year, this option provided a credible alternative. After securing a higher-paying job, Our son now possesses a credit card along with the Step Card, turbocharging his path to a superior credit score.

Acing high school exams are no match for an excellent credit score.