Immobility and chronic illness don’t belong in your retirement portfolio.

They’re enough curveballs lurking, conspiring to strike us down.

Just like investing, focusing energy on what’s controllable works best. Luckily, we have power over our weight.

Over a century ago, this was an outlier.

World’s fattest man in 1890 was large enough to be considered a “freak show” in the circus. pic.twitter.com/CImhjPJ8Py

— A SLICE OF HISTORY (@asIiceofhistory) August 9, 2022

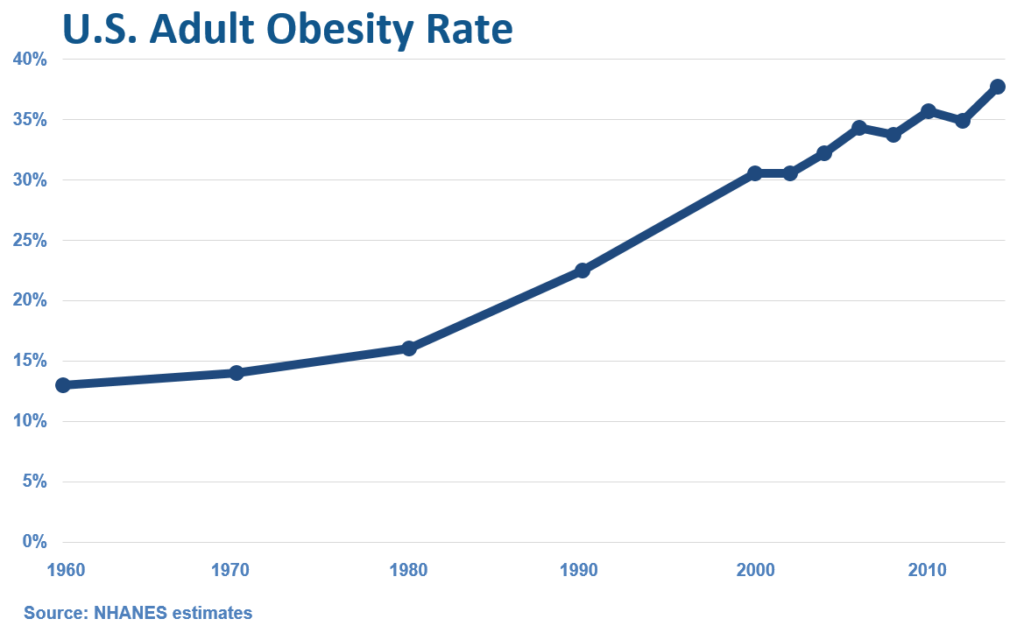

Norms changed, signified by this disturbing chart.

What happened?

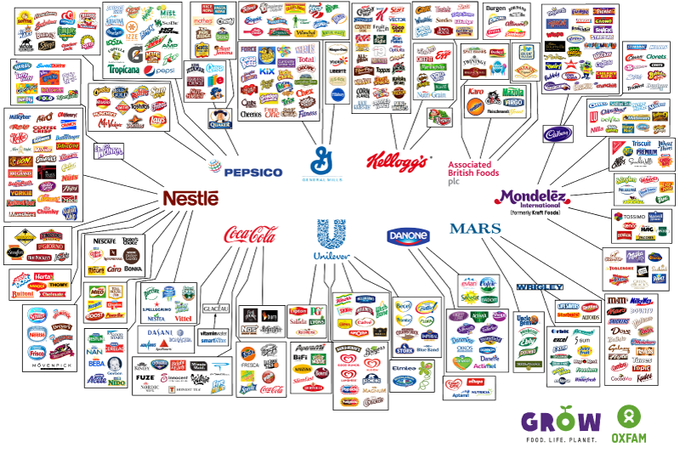

The food industrial complex ignited the obesity explosion. A small number of companies control what we eat. Marketing consists of addicting us to sugar and unhealthy fats. The government participated in the food cathedral by subsidizing the sugar, corn, and wheat industry.

Willpower isn’t enough to break the iron grip of food addiction. The current system loves throwing blame at individuals instead of the $billions allocated to keeping people overweight. Personal choices and responsibility are vital, but there’s more to the story.

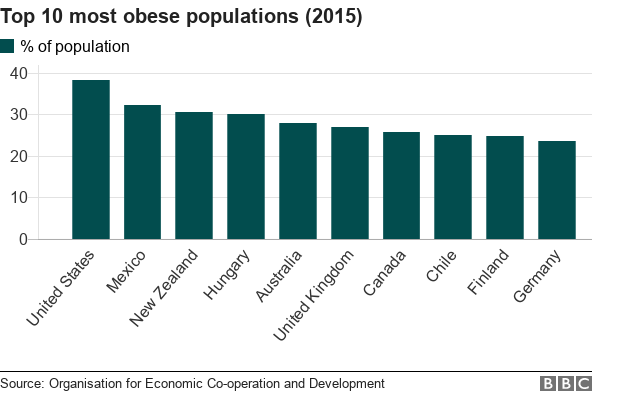

The epicenter of this crisis resides in The United States. Darius Foroux elaborates.

In a study, researchers found that people in Okinawa, Japan, live an average of seven years longer than Americans. They also have one of the longest disability-free life expectancies in the world.

Among the Okinawan residents that researchers studied is an energetic 104-year-old lady who still gardened and cooked. She occasionally cleaned up her kitchen, moving up and down with little difficulty.

How could they live long and actively? Okinawans tend to:

- Eat off of smaller plates;

- Stop eating when they’re 80% full;

- Have a strong social support group that lasts for decades

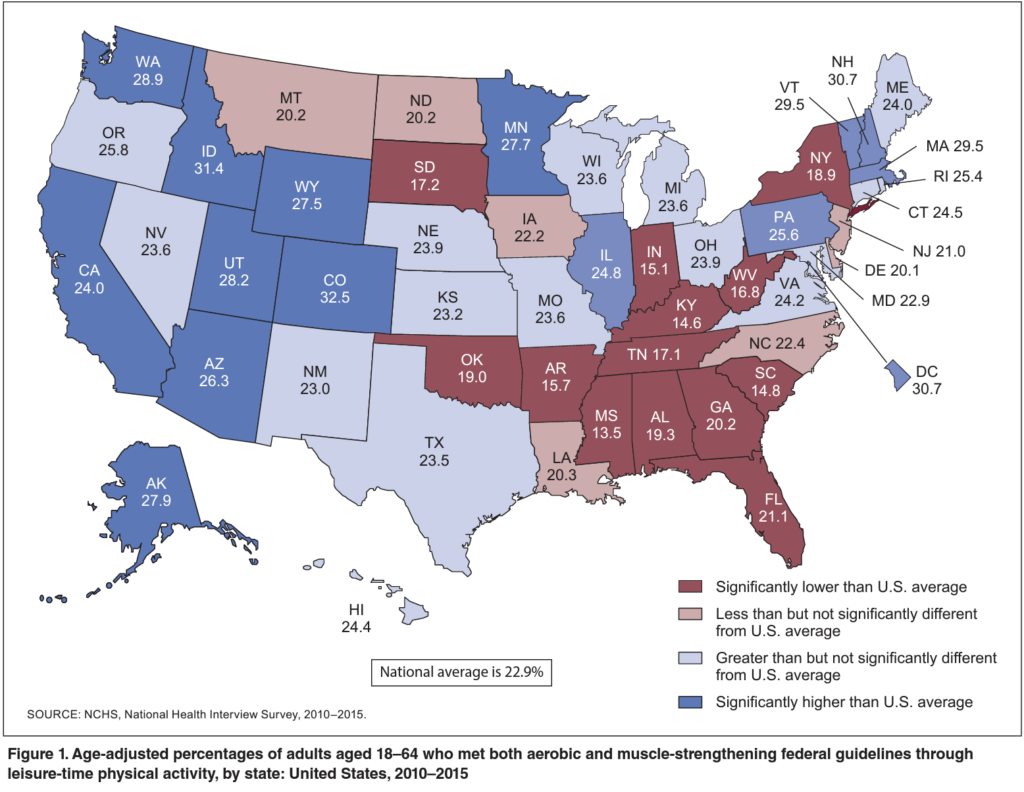

Americans major in immobility despite the fact movement is the ultimate medicine for the mind, body, and soul. Experts recommend 2.5-5 hours a week of vigorous exercise. Other alternatives include 5 to 10 hours weekly of moderate exercise or some combination of the two.

How many Americans meet these modest goals?

My friend, Phil Pearlman, provides a disturbing answer.

Kind of silly when 80% of the population is not doing half of those numbers.

The obesity crisis is a retirement killer.

What’s the point of accumulating a large nest egg if it comes with these attributes?

Not being able to play with your grandkids.

Taking a dozen different medications daily along with their resulting side effects

Limiting travel to destinations that don’t include walking.

Dying at a premature age.

Suffering from severe mood swings.

Inhibiting the options of your spouse and family.

Going through the day sleep deprived.

In what universe does this make retirement pleasurable?

Doesn’t working and accumulating your whole life deserve a better finale?

There is NOTHING more important in your retirement than good health. All financial planning options fail if you’re chronically ill or have a premature death.

As Dr. Benjamin Hardy states: Your future self is the exaggerated results of your current decisions.

Conversely, 60% of Americans aren’t obese, and the numbers are lower elsewhere.

Ninety percent of weight loss is diet.

Start by filling yourself with nutritious foods like fruits, vegetables, and nuts. We binge on junk food because they lack vitamins and minerals, tricking our body into thinking it’s still hungry. Food engineers purposely sabotage taste buds with sweets and unhealthy fats.

Drink water and tea. It’s amazing how many calories are in unhealthy drinks like soda and fruit juice.

Limit alcohol consumption. Purging low-hanging fruit results in dramatic weight loss depending on how much sugar and alcohol-laden beverages go down the hatch.

Finally, MOVE!

Is it too much to walk 45 minutes daily? Walk during work meetings. Have colleagues join you for outside strolls or move around the house while on the phone. Every step helps.

Spread it into 15-minute segments if necessary.

It’s NEVER too late to change.

Start small and let compounding do its thing.

Stop your tombstone from turning into a participation trophy.

It’s time to trim the fat from your retirement portfolio.

Hefty Investment fees aren’t the biggest threat to your returns.

The worst type of fat shaming is ignoring or enabling the problem.

Overweight your retirement toward mobility, not empty calories.