https://play.acast.com/s/the-goldmine/dont-let-illusions-of-control-ruin-your-financial-goals

We have less control over free will than we think.

Does belief in power over open-ended systems like the financial markets make any sense?

Despite the “pull yourself up by your bootstraps” society we live in, luck plays a tremendous role in success and failure.

Do we have any influence over where and when we’re born?

How about who our parents are and the genetic code we inherit?

Do you think we can regulate all the autonomous systems that call the shots over our bodies?

Good luck trying to manage any of these factors distinguishing between life’s winners and losers.

99.4% of our brain activity occurs outside our consciousness. Let that sink in.

Sam Harris makes a terrific point about our illusions of command.

“As a physical system, you are no more independent of nature at this moment than your liver is of the rest of your body. As a collection of self-regulating and continually dividing cells, you are also continuous with your genetic precursors: your parents, their parents and backward through tens of millions of generations.”

These scientific facts are indisputable. Yet, many refuse to grasp the role of chance in their lives.

Harris replies to the dissenters with the truth hidden behind sarcasm.

“Living in America, one gets the sense that if certain conservatives were asked why they weren’t born with club feet or orphaned before the age of five, they would not hesitate to take credit for these accomplishments.”

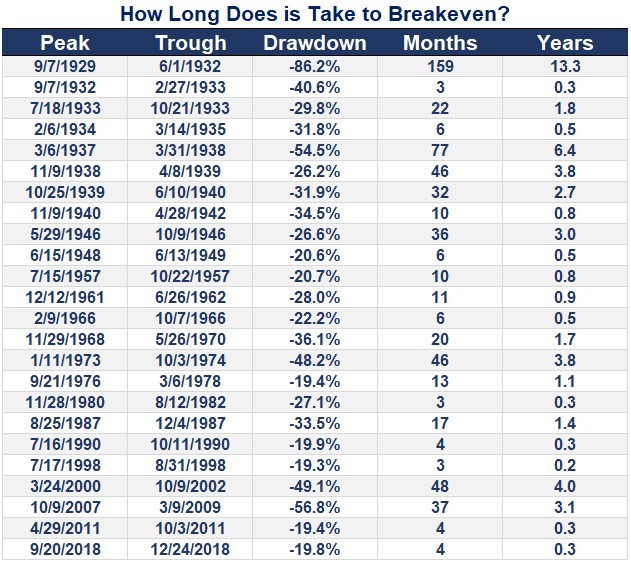

The same goes for successful investing. It matters quite a bit if you are retiring at the start of a 2o year bull market or in 1929 at the beginning of the great depression.

Neither has anything to do with investing acumen.

Is it skill that the former ends up with a bigger pot of gold than the latter?

The real answer – It’s more like being born in the United States rather than North Korea. This accident of birth determines everything.

A sense of being able to steer the uncontrollable is one of the worst qualities investors possess.

Pandemics, wars, natural disasters, and economic collapse are all part of the game. They can occur at any time. Usually, when you least expect them.

The markets couldn’t care less about your financial goals. Fate is a financial mercenary

Why think we possess a semblance of control over the markets when we have little mastery over our own minds?

Most thoughts pop up uninvited into our heads. Ruminating about these passing clouds is akin to fighting a civil war within our brain.

Civil wars are devastating to all participants.

As Sam Harris remarks, “Your brain is making choices on the preferences and beliefs that have been hammered into it over a lifetime.”

Reactivity rules all. This is a fatal formula for managing a portfolio.

All is not lost. We have some power despite all of the above.

We determine how much we save and pay for our investments.

Tax management falls into these restricted borders.

Since we can’t predict the future, diversification is another no-brainer.

We can recognize how crazy and uncontrollable our minds behave, putting guard rails in place to squash our worst investing instincts.

Losing our illusions of control gives us the highest probability of achieving our financial goals.

Liberate yourself from the shackles of illusions of market free will.

Control isn’t all it’s cracked up to be regarding your life and your money.

Understanding less is more makes all the difference.

Source: Free Will by Sam Harris