If it’s more enraging, it’s more engaging – Johann Hari

The planet’s most prominent companies are systemically stealing and destroying your attention.

Resistance is futile.

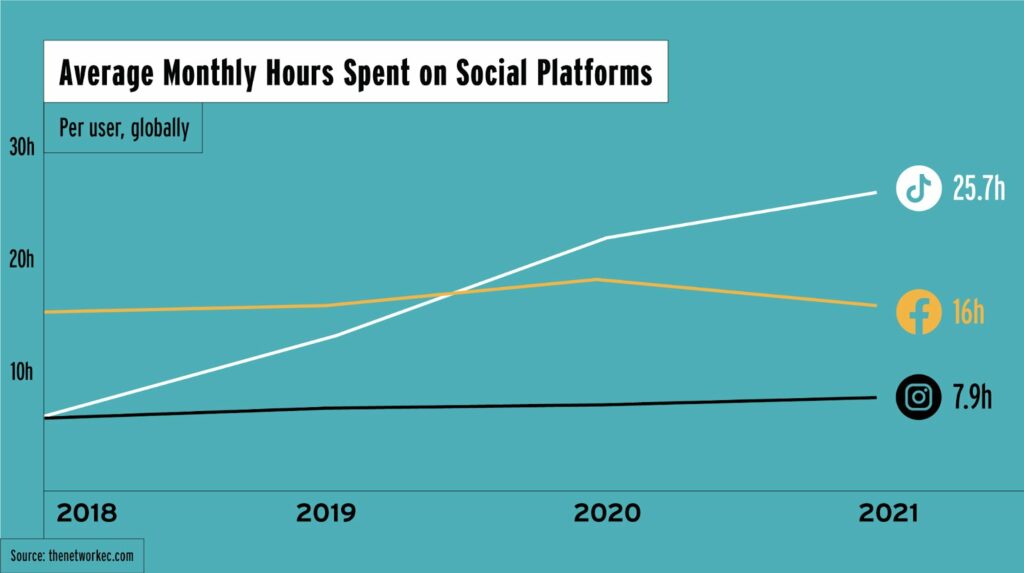

Algorithms created by brilliant engineers are a fully operational Death Star regarding attention span. Facebook, Google, TikTok, Instagram, Twitter, and YouTube, are attention-stealing Jedis.

Internet advertising companies crave users staring at their screens for as long as humanly possible – if not longer. Covertly gathering information made their founders fabulously wealthy. The users/products are increasingly depressed and angry.

Management faced many options in designing attention-stealing algorithms. The choices included making users happy and connecting with friends to forge deeper relationships.

The Attention Merchants pegged rage and disturbing images.

Why would such highly educated techies do this to their fellow man?

Scrolling is the lifeblood of their business. The side effects are devastating.

Johan Harri succinctly describes their business model.

Unfortunately, there’s a quirk of human behavior. On average, we will stare at something negative and outrageous for much longer than we will at something positive and calm. You will stare at a car crash longer than you will stare at a person handing out flowers by the side of the road, even though the flowers will give you more pleasure than the mangled bodies in a crash.

Negativity Bias wins again.

NYU found for every word of moral outrage added to a tweet, the retweet rate increases by twenty percent. Facebook posts focusing on social discord double likes and shares.

The worst part – we believe our entertainment is free. On the contrary, a 2018 study displayed a conservative estimate of the value of personal data to the likes of Google, Amazon, and Facebook, coming in at $76 billion.

Shoshana Zuboff coined the phrase Surveillance Capitalism.

She writes: Google is to surveillance capitalism what the Ford Motor Company and General Motors were to mass-production-based managerial capitalism.

Intermittent variable rewards like heart emojis and likes solidify the chains of servitude to social media overlords.

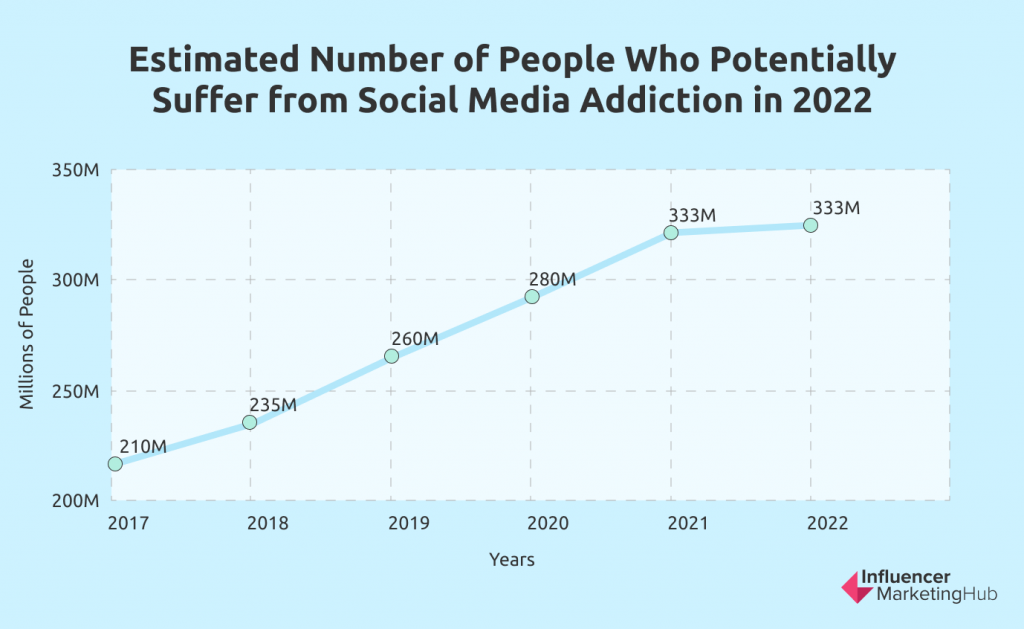

As one study determined, we check our phones 2,617 times a day. Just like that -our attention span is demolished.

Leaked Facebook documents to The Australian showed: Executives boasted to advertisers that by monitoring posts, interactions, and photos in real-time, they could track when teens feel “Insecure,” “worthless,” “stressed,” “useless,” and “a failure” and can micro-target ads down to those most vulnerable. It’s an endless, wanton commodification of our attention, with little or no concern for the repercussions for individuals.

Imagine the ramifications for your retirement plan?

Picture financial hobgoblins paying a king’s ransom for this information, catching you at your most vulnerable moments and destroying your financial future

Nefarious ads emerge as your continuous doom scrolling generates every possible worst-case economic scenario. (These recently appeared on my FB feed.)

Bear markets breed target-rich opportunities to entrap retail investors when they’re least mindful.

There’s little chance willpower saves the day. Please don’t count on it. Attention hijacking despots know you better than you know yourself. Putting the fear of God into investors while the market is plummeting doesn’t create an optional environment for rational decision-making. Ignore daily market noise, don’t doom scroll, and step away from the internet during volatile markets.

Anger and fear are unwelcome additions to your retirement plan. Take control of your attention, or someone else gladly will.

In the words of H.L. Mencken, “For every complex problem, there is a solution that is clear, simple, and wrong.”

Technology improved our society in many ways. Don’t let that overshadow the dangers lurking in the shadows.

If you want to learn attention self-defense, check out this post from my friend Phil Pearlman.

Sources: Don’t Be Evil by Rana Foroohar and Stolen Focus by Johann Hari