We’re living on borrowed time.

Avoiding reality isn’t a magic pill.

It’s not easy, but staring down death is liberating

Net worth isn’t immune from the Grim Reaper.

We don’t own our investments.

We rent them.

It’s not a question if the transfer of financial assets changes – it’s when.

Years from now, a stranger will occupy your home if it hasn’t been demolished and rebuilt.

Stocks and bonds suffer the same fate.

If the companies you own are lucky enough to be around, someone else pockets the dividends.

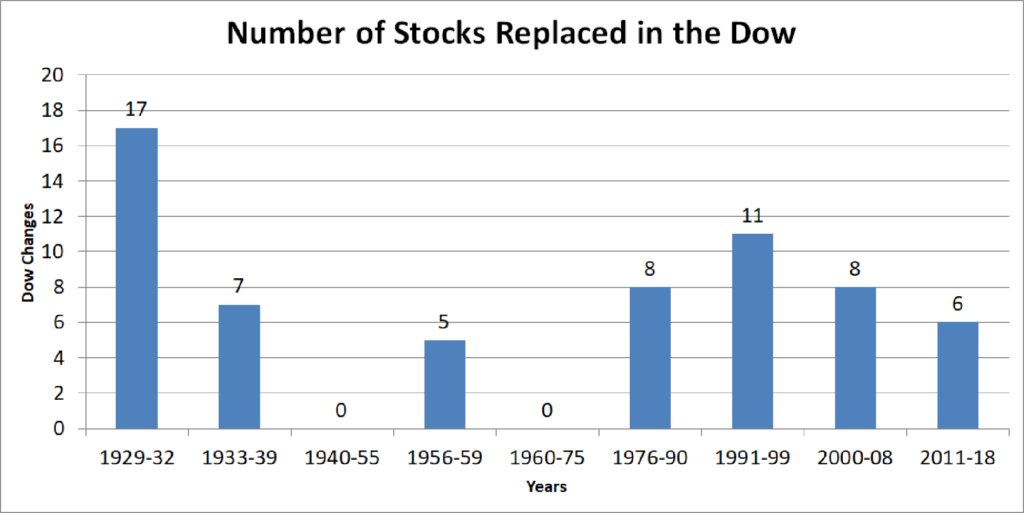

Data Source: Wikepedia

Most likely, the new owners will trade them in a microsecond. Sentimentality evaporates with a click of a mouse.

Where do the proceeds end up?

They’ll likely convert into some NFT or cryptocurrency that’s yet to be born.

Is it wise to devote your most valuable asset to obsessively looking after these properties?

The old saying “Nobody washes a rented car” is prescient.

What is your most valuable asset?

Time, of course.

We delude ourselves into thinking we have all the time in the world.

Our lives can last for many decades.

We shorten them considerably by squandering our time.

Besides obsessing over wealth, we occupy ourselves with other time extinguishing endeavors.

These include:

Stressing about others’ opinions on social media.

Sucking up to our bosses.

Attaching ourselves to unsavory characters to move up on the economic food chain.

Jumping from one investment fad to another.

Jealously viewing our neighbor’s possessions.

Multi-tasking and scheduling every minute of the day.

Counting our pennies and constantly checking our portfolios.

It’s amazing how we willingly sacrifice our valuable time over financial matters.

We would never think of letting others rob us of our material wealth.

It’s no issue giving up our most precious commodity to monitor impermanent possessions.

Seneca once remarked:

Men are tight-fisted in keeping control of their fortunes, but when it comes to the matter of wasting time, they are positively extravagant in the one area where there is honor in being miserly.

Our hubris is laughable.

How many people plan their goals for the sixties and seventies?

As if any of this appears in a guaranteed contract.

Some can retire right now but instead place their bet on the roll of the dice.

Fortune owes you nothing.

There’s a vast difference between living and existing.

Longevity doesn’t confirm enjoying a good life.

Unlike a stock or bond, time isn’t a means of keeping score.

We often give it little value because it’s unobservable.

To quote a famous poem: What’s essential is invisible to the eye.

Does it make sense to ignore the one thing that owns an unpredictable expiration date?

Time is irreplaceable and gives no warning when the clock expires.

Seneca states:

The greatest obstacle to living is expectation, which depends on tomorrow and wastes today; what lies in the hands of fortune you deal with, what lies in your hands you let slip away.

The busy you are obsessing over your finances, the shorter your life.

Ignoring the present destroys rather than creates wealth.

No one is saying neglecting your finances and not planning for tomorrow is wise.

Being self-aware and understanding the importance of today is a terrific addition to your portfolio.

Tomorrow may never arrive.

Deluding yourself into thinking you own the future is a form of insanity.

Stop crashing through life like a blind mole.

Try owning your time.

It’s the one possession, not for rent.