Doing the right thing guarantees nothing.

Life’s events are a constant state of flux. Nothing lasts.

Understanding this is the secret to life, never mind investing. Clinging to anything is playing a loser’s game. It’s the height of insanity not to anticipate the arrival of gloom. We expect things to last if we follow the rules.

Exercising and eating clean won’t keep you from never getting sick or worse.

A sports team can immaculately prepare for an opponent and get smoked.

Following a recipe to the tee doesn’t prevent a sour apple pie.

Your expensive wedding planner can’t stop it from raining.

Don’t take it personally.

Preparation and process are integral for success, but there are no warranties or do-overs.

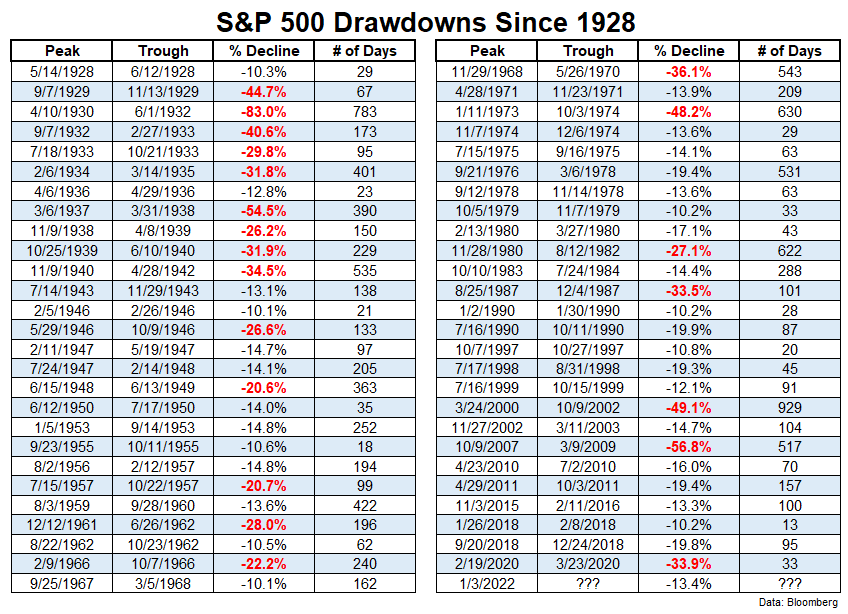

Investing in 2022 is a prime example of the best-laid plans going haywire.

They told you to invest in low-cost stock and bond index funds. Differentiate asset classes according to your risk level and time frame, and good things will happen. You followed the basic blocking and tackling rules of investing 101.

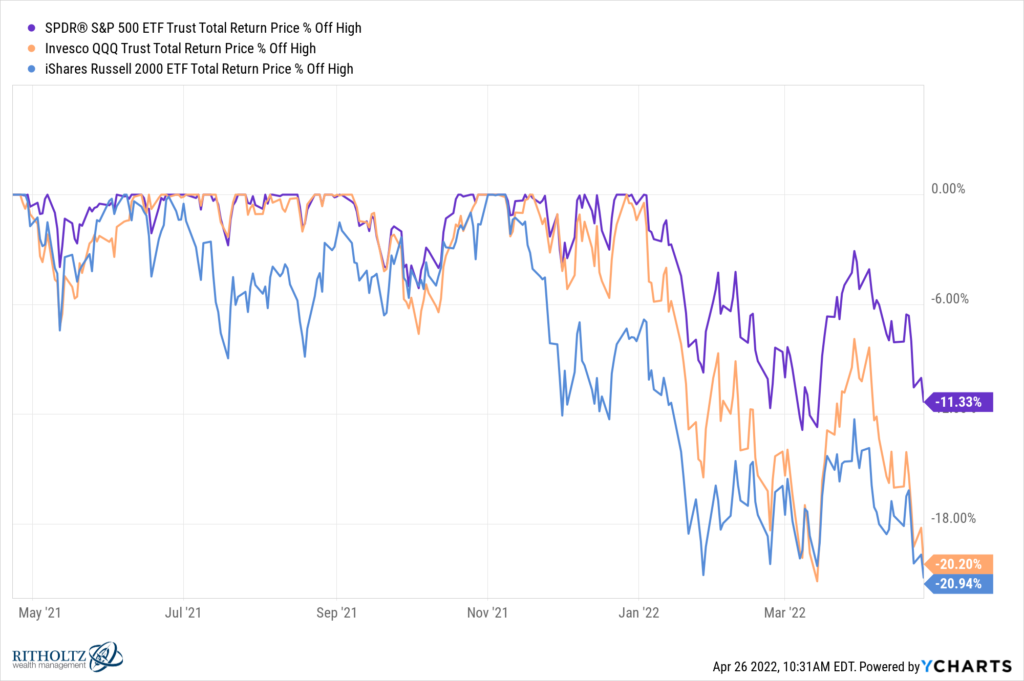

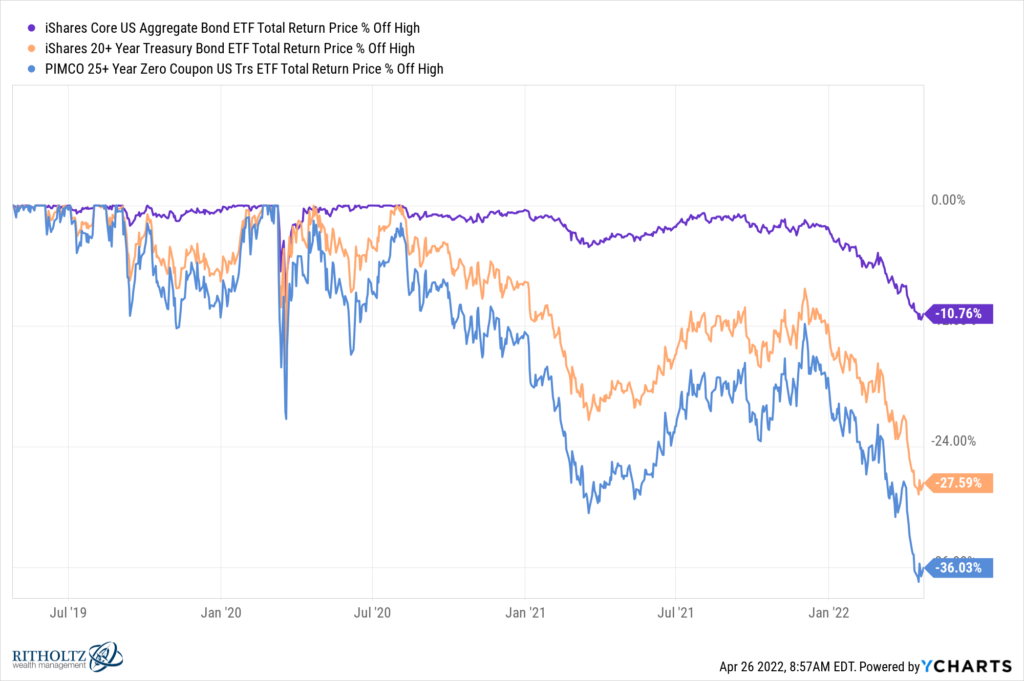

Here’s what happened to your offense and your defense.

What explains this debacle?

Things changed.

Everyone understands the contract that they sign with the stock market. I will invest and compound my wealth over time, and in exchange, there will be ups and downs. The diversified investor signs another contract that has been violated; when stocks go down, the fixed income side of my portfolio will buffer the downside. Well, that’s no longer happening, which is why, along with inflation and other factors, investor sentiment is in the toilet. Michael Batnick

Should you expect a future dominated by the gloomeisters?

Nope- Nothing lasts forever.

The secret is not clinging to good times or the bad.

Expecting transition is the best medicine for your sanity and portfolio. It’s not easy, but embracing impermanence smoothes out the glide path. Booms and busts are standard and subject to change at any moment.

Look to impermanence when seeking alpha.

Striving for stability isn’t easy, but it’s well worth your efforts.

Naval Ravikant stated; The greatest superpower is the ability to change yourself.

Possesing a static view of yourself or your money only leads to future misery.

Clinging to past returns or striving for future ones isn’t the answer.

Don’t grasp at what you want or run from what you fear. The Demons will always catch up to you.

Let it be. The right plan, process, and daily habits tend to reward their followers. Just be aware they promise nothing. It’s normal and natural for things to go wrong occasionally.

Perfect plans are a fantasy. The only fixed view you should possess is not having a fixed view.

Worshipping the teapot instead of drinking the tea doesn’t work.

Wisdom is dynamic. The more we practice, the more it grows.

A sign of progress is understanding that nothing is ever as good or bad as it seems.

Change isn’t going away.

Normal doesn’t exist.

Deal with it.

Chart Source: A Wealth of Common Sense