Elite Colleges are an education cartel. OPEC wishes it possessed this type of pricing power. $1.7 trillion in student loan debt isn’t a mirage. How did we get here?

Recently stumbling upon this terrific site, College101, the answers weren’t challenging to find. Looking at Accreditation, Admissions policies, Earnings Outcomes, Graduation Rates, and Wage Premiums – sunlight emerged as the best disinfectant. Let’s do a deep dive into the following charts attempting to unravel what went wrong and why.

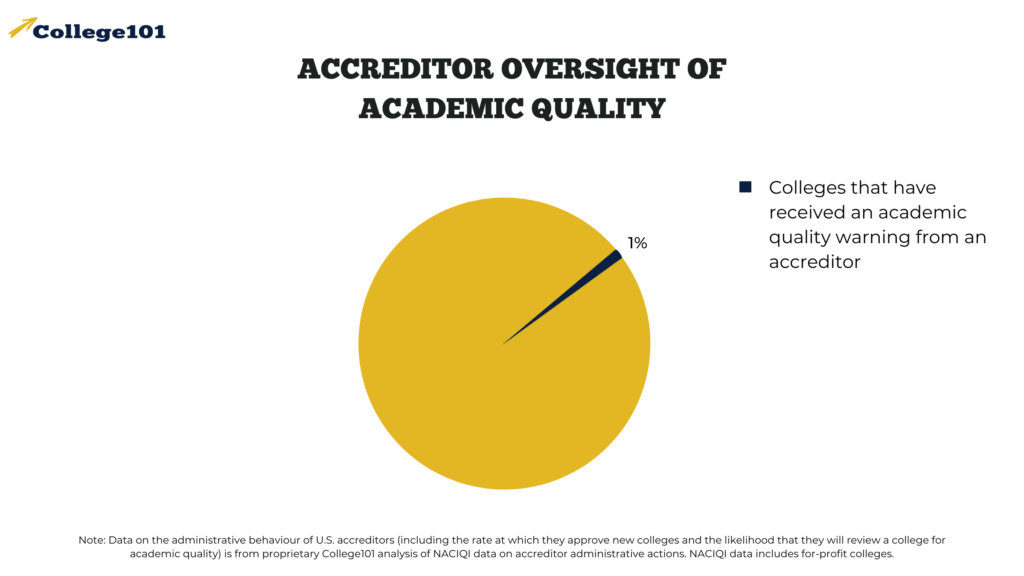

College oversight is laughable. Politics and other factors make it virtually impossible to receive an academic warning, never mind losing accreditation. Is it a wonder why graduation rates are low why the cost is high?

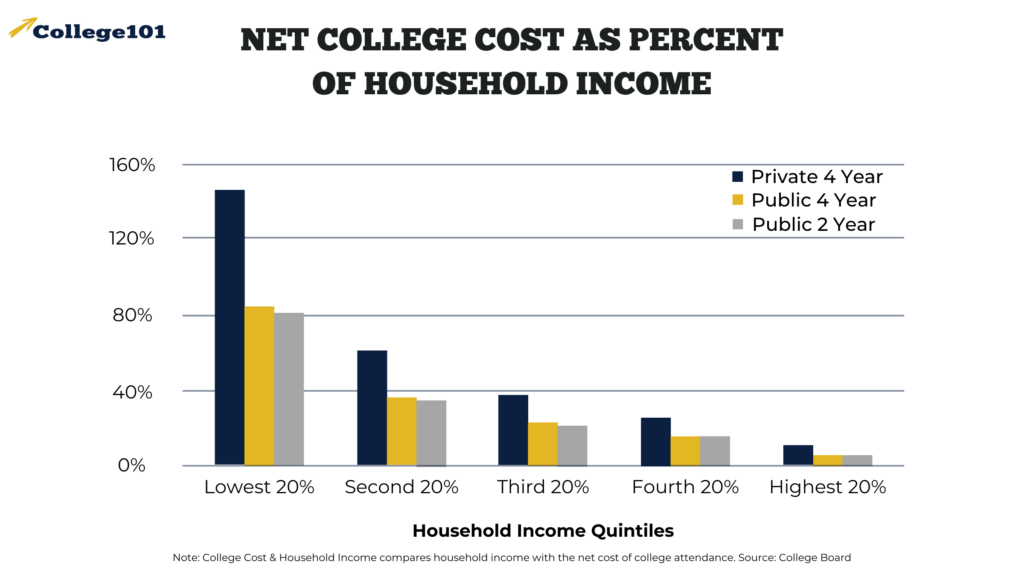

Education is the great equalizer. Unfortunately, college is the least affordable for the bottom 40% of the U.S. income pyramid. Educational inequality hasn’t prevented colleges from spending a fortune marketing their schools to wealthy parents.

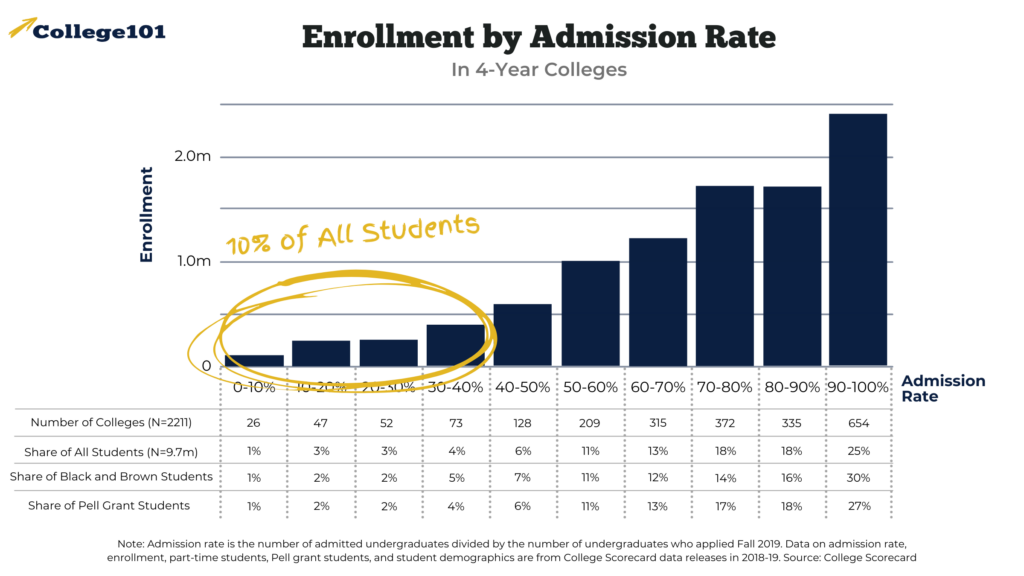

Elite schools brag and compete for the crown of progressivity. The admission data paints a different picture. Low income and minority students are absent at the twenty-six most competitive U.S. Colleges. Rejectionist cultures are so uncool.

“Let’s build something wonderful so that we can share it with almost nobody,” said every Ivy League President. #Gross.- Scott Galloway

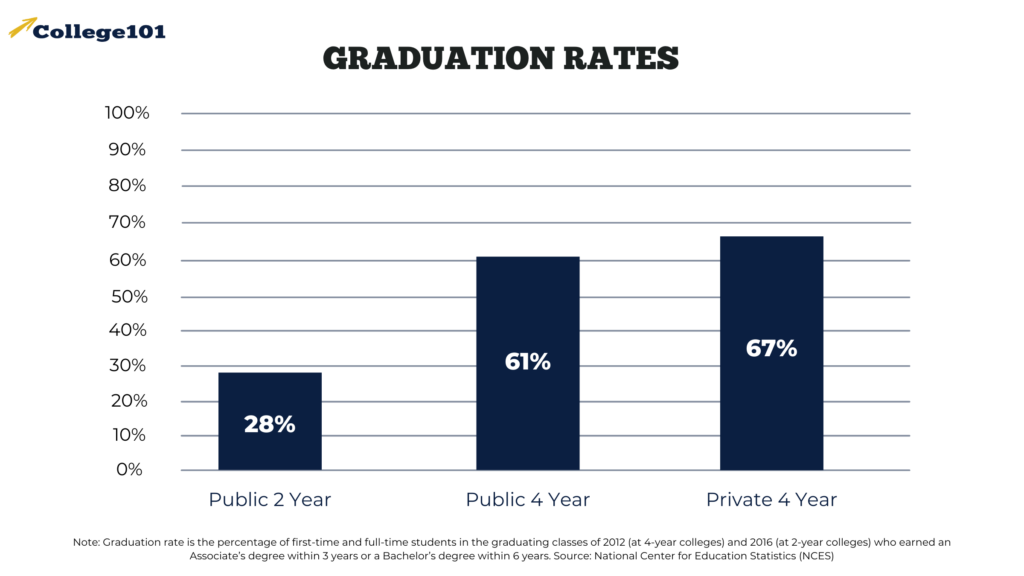

Graduation rates vary across the board. Community colleges graduate only 28% of admitted students. Many students in these institutions come from low-income households and are first-generation attendees. Surprisingly, a third of students attending expensive private four-year schools fail to receive a diploma.

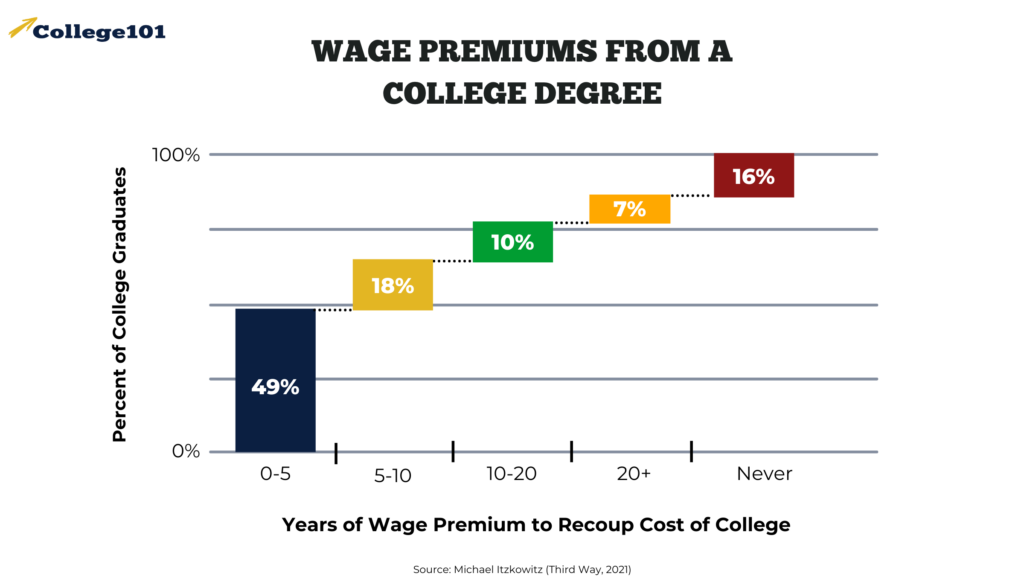

Half of the college students recoup their costs of attending school within five years due to the corresponding wage premium associated with their degree. Interestingly a significant portion of twenty-three percent NEVER recoup their expenditures or take twenty-plus years in doing so.

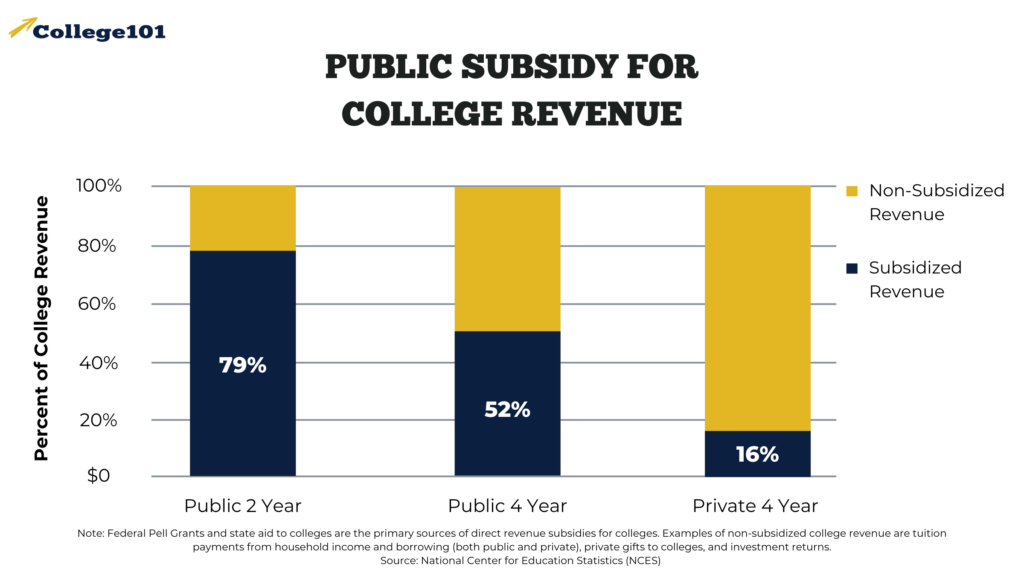

The public contributes significantly through the tax system funding higher Education. Public two and four-year institutions receive most of their revenue through public funding. Do graduation rates and student debt levels justify these expenditures? Should schools be more accountable to the public they serve?

Higher Education is ripe for creative destruction. Turning 90% of applicants away shouldn’t be a badge of honor. The best schools should teach more students, not less. Too many students pick schools as if they were a luxury brand rather than an institution of higher learning. Scott Galloway has some terrific thoughts on how to make things more equitable.

- Expand online learning. One size doesn’t fit all lifestyles. Satellite campuses and online-hybrid models need consideration.

- Implement certification programs for high-demand skills at our nation’s most prestigious schools.

- Marry record corporate profits to record student debt. Create incentives for companies to become more involved in educating their workforce through a subsidized college pipeline.

- Leverage the power of our elite schools. These are the best institutions in the world. Scarcity isn’t the answer.

Investing correctly in Education provides immeasurable returns. As these charts display, we can do much, much better.

Price fixing, low admission rates amongst elite schools, education inequality, and a lack of innovation and accountability are a direct threat to the future of Democracy in America.

Providing a variety of educational On-Ramps for young people to achieve the American dream is within our grasp.

Doesn’t the next generation deserve a fighting chance for social mobility?

If you want to learn more, please listen to this terrific podcast Scott Galloway conducted with Stig Leschly, the CEO and Founder of College 101.