‘None are more hopelessly enslaved than those who falsely believe they are free.” – Goethe.

Don’t confuse wealth with freedom.

Money is a medium of exchange that seldom reaches its full potential. The more we acquire, the less we enjoy. Owning too much stuff reverses contentment. We’ve become chained to our possessions and maintenance costs, fueling an endless journey on the hedonic treadmill. Running and never arriving at a destination.

Francis Bacon summarizes this incongruence. Money is a terrific tool, yet a terrible tyrant.

What will change the minds of thirsty shopaholics?

Imagine this scenario.

Shortly after birth, a doctor diagnoses a terminal disease. The illness is 100% fatal despite your wealth. Death arrives at a time and place of maximum unpredictability. It may strike in the next five minutes or a hundred years into the future.

What kills you?

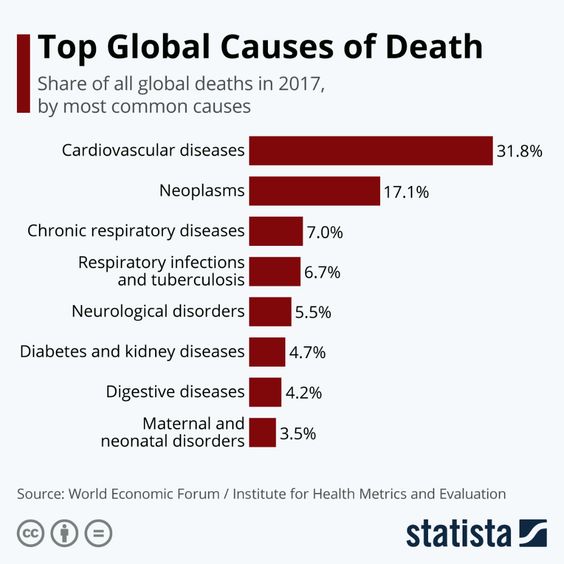

The answer – Nobody knows. Heart disease, cancer, or a brain aneurysm are strong contenders. Mortality may meet its match from an undiscovered illness. Natural or unnatural causes lead to the same result. A drunk driver or bus with failed brakes are potential culprits. Meeting your fate by the hand of a deranged lover as part of a sordid love triangle is another option.

A rogue asteroid may do us all in.

The possibilities are endless, the result pre-determined. The typical response is, “I’m glad that won’t happen to me.”

Money or not, death is the great equalizer—democracy’s finest moment.

A new perspective opens a world of possibilities.

Dramatically changing your view of time is the first move.

My colleague Nick Maggiulli offers:

You might not think this has anything to do with investing, but it has everything to do with investing. How you invest, your time is far more important than how you invest your portfolio. In other words, asset allocation matters, but attention allocation matters far more.

Being self-aware of mortality is a gift.

Knowing this, are these the best courses of action?

Paying attention and stressing over daily market noise.

Waiting until your children are collecting social security before gifting them money.

Creating a bucket list for the 70-year-old you while the 50-year-old version toils in a miserable job.

Acquiring a McMansion to keep with the Joneses because you can.

A new paradigm must emanate.

Jeremy Walter provides a starting point. As a dad to small kids, I sometimes think that we all have it backward: we spend our 30s and 40s working hard towards career goals when in reality, it’s this time that’s most valuable with our children! Perhaps we should all coast through our middle years then work hard when the kids start heading out on their own.”

Paraphrasing David Bowie, Time may change wealth, but wealth can’t change time.

Here’s something from The Daily Stoic.

On April 14, 1912, William John Rogers sent a postcard from the Titanic to his friend James Day. Dear Friends, Rogers wrote, Just a line to show that I’m alive & kicking and going grand. It’s a treat. The next day, the Titanic sank. Rogers, a third-class passenger from Wales, went down with the ship, his body never identified.

We’re all passengers on the Titanic.

Freedom is in the eye of the beholder. If wealth possesses your time, something is very wrong.

What are you going to get when you trade your freedom away? Check to see what your proud new possessions will be worth. An enslaved Stoic philosopher said this many centuries ago. Epictetus often commented he was far more independent than his wealthy masters.

Don’t underestimate the cost of status and possessions.

Price and value are very different things.