Self-deception is a raging epidemic.

A myriad of factors influences our point of view. Genes, family life, friends, experiences, and other items determine perceptions.

Why do we believe our experiences are reality?

James Low reinforces this concept.

These stories have a tilt or bias. This generates a selectivity in our attention which blocks many of the other possibilities we might entertain.

Delusion becomes fact. The worst part- We aren’t aware.

Neither is anyone else. Nobody wants to rock the U.S.S. Delusion.

Everyone’s wearing tinted sunglasses. Viewing reality in different shades turns fantasies into reality.

Yomgey Rinpoche hits the nail on the head. We tend to invest the inhabitants of our relative or conditional world – ourselves, other people, objects, and situations with qualities that enhance their semblance of solidness and stability. This strategy clouds our perspective even further. In addition to mistaking relative distinctions as absolute, we buy the mistaken view in layers of delusion.

Our truths are only opinions.

Investing isn’t immune.

Imagine cutting your investment teeth during the Great Depression. Experiencing a 90% drop in the market leaves lasting and irreparable scars.

Source: Macrotrends

No rose-colored glasses here. Black as night is the appropriate shade for this worldview.

Can you blame people for leaving their savings buried in their backyards?

This world no longer exists. Attachment to the past is delusional but completely reasonable in a fixed mindset.

Not meaning missing out on opportunities is acceptable.

Viewing reality as an illusion prevents participating in wealth creation and worse.

Fear protects against dying and living.

On the opposite end of the spectrum, look at this market.

Who could blame Baby Boomers for having an aggressive allocation to stocks, especially those involved in technology?

Is it a surprise two 50% market drops completely blindsided them at the beginning of the following century?

Their own brand of sunglasses shielded them from reality.

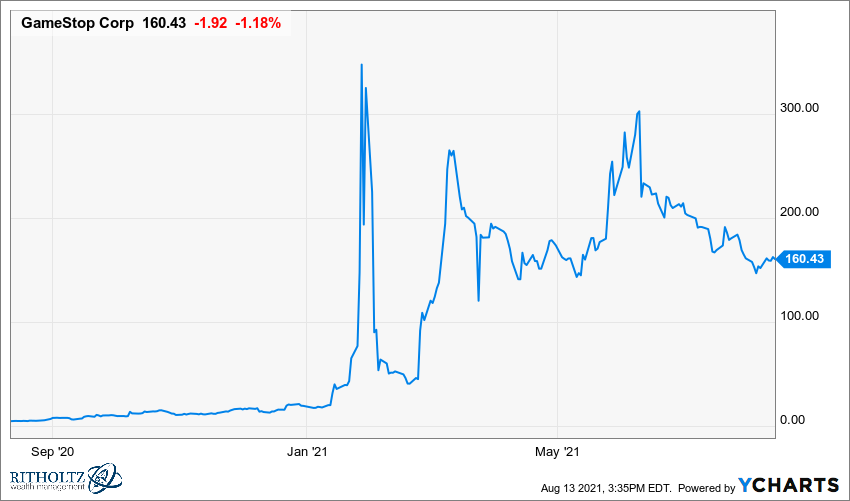

Today, investors wear the latest fashion in eye-shade. Cryptocurrencies. SPAC’s. Meme Stocks and NFTs.

Millennials are influenced by the latest and greatest.

Delusion or reality?

Betting against human nature isn’t wise.

Attachment and clinging are tough habits to drop.

Throwing luck into the mix doesn’t help.

Darius Foroux points this out.

Let’s say you have two people, Person A and Person B. They are both value investors who follow the strategy laid out by Benjamin Graham in the 1930s.

Person A was born in 1930. Person B was born seventy years later, in 2000. They both start applying the Graham investing strategy at a very early age, let’s say when they were 15 years.

Person A becomes Warren Buffett, once the richest man on earth, who experienced one of the biggest booms in value stocks when he was young. Person B loses half of their money because value stocks are out of favor in the 2010s.

Same strategy, same actions, different times, different outcomes. Becoming rich and famous is mostly a matter of luck.

Transient events constitute our experiences. Viewing them as permanent compounds our problems

There are opportunity costs to our illusionary views.

James Low points this out:

I can find no solution

Since the problems are not real

A snake that’s a rope

It gives a bite you can’t heal.

Take off your sunglasses.

Stop living in a cocoon of false assumptions.

Events are temporary moments in time, not permanent narratives

There’s nothing to fear except clinging to a past that no longer exists.