No good deed goes unpunished.

Throw cosigning a student loan into the mix.

Undergrads receive $27,000 from the government’s Stafford Loan program.

These loans possess the most favorable rates and repayment features.

The problem – private and public school tuition/room and board blow past this limit.

Students and their parents must wade into the Parent Plus and Private market to fund the balance.

Parent Plus loans are the parent’s obligation. In contrast, private loans require a co-signer.

This journey is fraught with peril for those entering unprepared. Higher rates and harsh repayment features dominate the landscape.

Cosigning a loan is risky.

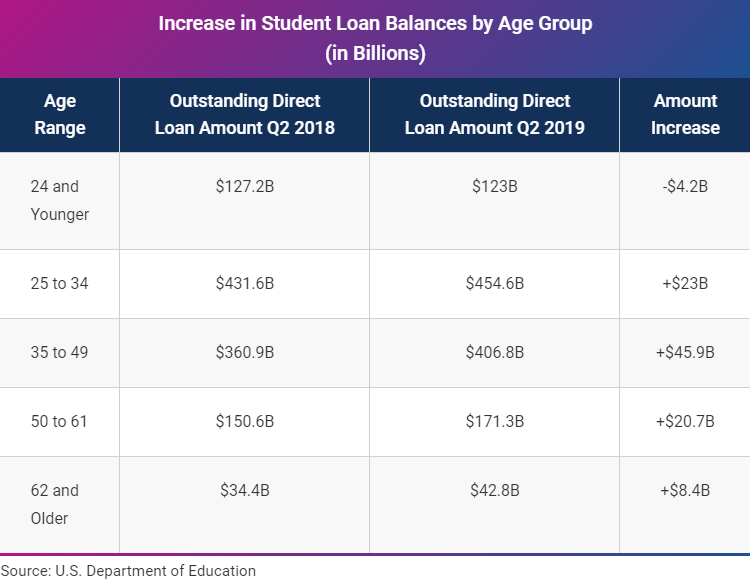

There’s a good reason the fastest growing sector of the college loan market is for those aged 35-49.

Parents plug the funding gap.

The dangers of including your name on the bottom line are abundant.

Default and credit score liabilities top the list. If junior stops paying, the co-signer is on the hook. Both credit scores plummet.

It takes seven years for credit to recover after a default.

Regardless, your credit score is temporarily hit upon signature.

Thinking about applying for a mortgage as a co-signer?

Be prepared to pay a higher interest rate or possibly be declined. The co-signed loan increases the Debt/Income ratio banks factor in when making their decision. The higher the debt, the less likely the loan’s processed.

Divorce won’t free you from this obligation.

Late payments lead to debt collectors hounding you.

Your obligation doesn’t die with the primary borrower.

If a tragic death or disability occurs, you may still be on the hook.

Many private loans don’t cover debt forgiveness under these circumstances.

Student loans are one of the few obligations where bankruptcy provides no shelter.

Is there any way to escape this obligation?

You can ask for a loan release. The chances of getting one are slim and none.

Proactivity is required when undertaking this quest.

Most companies don’t publicly offer the fact this option is available. Don’t ask, don’t tell.

If there’s an escape method, it comes with strings attached.

The borrower usually needs 24-48 months of on-time payments for consideration.

Some companies limit the number of requests to cosigner’s release applications.

How about student loan refinancing?

This could remove your name. There’s a catch.

The primary borrower must meet credit and income requirements. A record of on-time payments is essential.

This doesn’t imply a parent should never c0-sign a student loan.

Just do it wisely.

Follow these steps, and the odds of this act of generosity blowing up in your face decrease substantially.

- Discuss your concerns with the primary borrower. Please make sure you fully understand their job prospects, income potential, and maturity before committing to this hard-to-get rid-off obligation.

- Act promptly at the first signs of distress. Communicate with the lender and discuss potential options to avoid calamity.

- Do your homework before signing. Look for features that offer maximum repayment flexibility. These include deferment, forbearance, and the availability of co-signer release.

- Practice sound debt management. Maximize cheaper and more flexible Government Stafford loans before applying for anything else.

Co-signing a student loan is no joke. Understanding the risks of things going south is a priority.

Jeopardizing your retirement plans is a real possibility if you act recklessly.

Remember, a cheaper school is a better option than financial ruin.