Certainty is no indication of truth.

The mind has no shame.

Financial delusions run rampant amongst investors.

Why does this happen?

How is this behavior unhelpful?

What can we do about it?

Realize conductors aren’t running the show.

If there were, they would be driving the local to Crazyville.

Our minds are much more like a three-ring circus than we care to believe.

We perceive things based on past experiences and our own prejudices.

This happens with everything: especially politics and our finances.

Our mind accepts these delusions quite willingly. Our neural pathways become affixed to our own distorted views of reality. Serious problems emerge from this type of thinking.

These well-traveled roads become fixed views. Breaking them is an arduous task few are willing to undertake. It’s much more comfortable for most to embrace familiarity, no matter the present price and future unhappiness.

Once connections become firmly established, no amount of sanity can counteract prevailing established viewpoints.

We become prisoners of our own illusions.

Think of how many people refuse to believe in evolution, the efficacy of proven vaccines, and other matters that science rendered non-contestable a long time ago.

Clinging to anything is a fool’s errand. Nothing is permanent—everything changes.

This thinking ruins more than a financial portfolio.

Most of what we worry about never comes true. Instead, it only destroys our second most precious commodity- time. It then devours or most precious, attention.

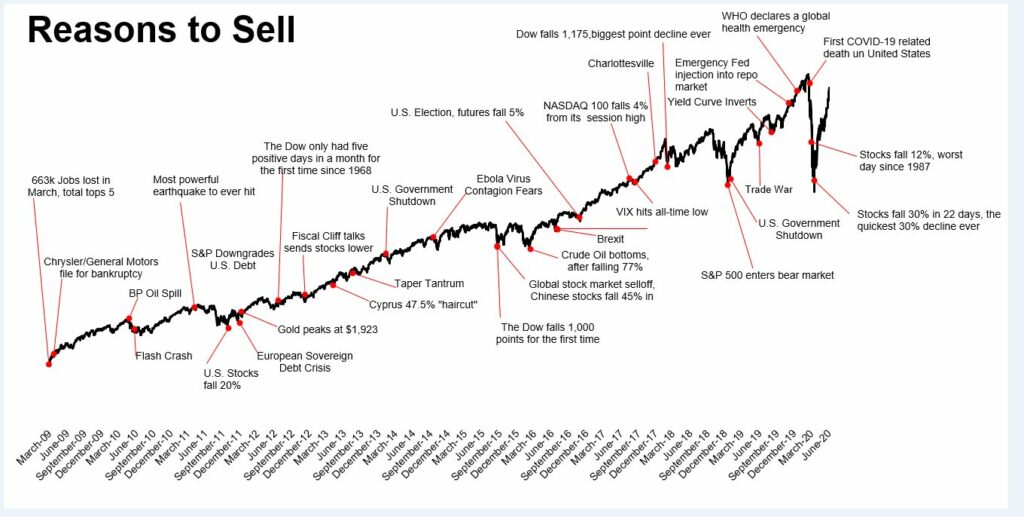

Think about the markets over the last decade.

We’ve heard every reason on the planet why the world was coming to a ghastly end.

Perceived extinction-level events are a feature, not a bug of the market sentiment.

Many investors view the markets as The Red Wedding on autoplay.

Modern-day Armaggedons include but aren’t limited to:

The BP Oil Spill

The Flash Crash

The European Debt Crisis

The Ebola Virus

Brexit

Charlottesville

Trade Wars

Government Shutdown’

COVID-19

You get the picture. It’s amazing that despite the certainty, many investors can’t even remember some of these, no doubt widow makers.

Nothing is usually half as important as we think it is.

We’re flying blind through treacherous markets without the clarity to see our repeated patterns of cognitive follies.

We’re not advocating detachment.

However, sticking your head in a hole like an Ostrich isn’t a wise strategy for building wealth.

Non-Attachment is a much better use of one’s time.

Pay attention, but not so much.

The only constant in a state of relative reality is unpredictable change. Herein lies the problem.

Don’t allow your questionable perceptions of relative reality to be mistaken with the absolute version.

The ultimate investor superpower is understanding they aren’t reliable leading indicators.

Buddhism teaches, Whatever has the nature to arise will also pass away.

Investing isn’t excluded from nature’s laws.

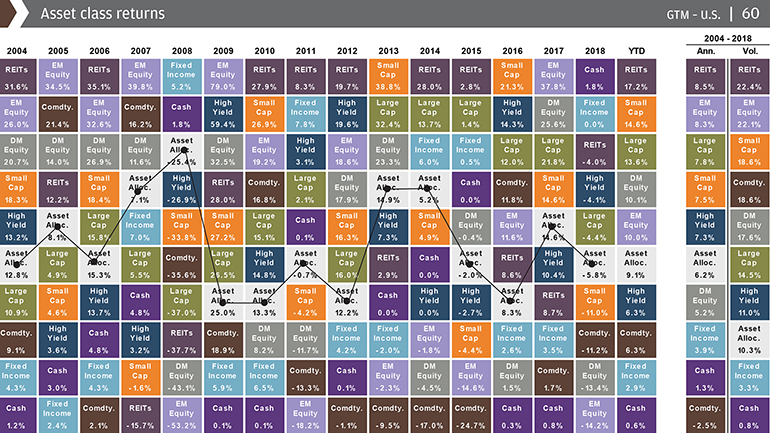

There’s a reason diversifying your assets works. It takes our often delusional perceptions and throws them out the window.

Letting your mind run wild isn’t a viable alternative.

The problem is mind reconstruction takes a lot of time, energy, and discipline.

Owning a basket of low-cost index funds is a simpler path to follow.

Always remember, your unchecked mind has no shame.

Letting it run your money is a terrible idea.

On another note, I was named to Investopedia’s Top 100 Advisors List For 2021. It’s an honor and a privilege to be included with such an accomplished group of terrific people.