“Every person who doesn’t have enough money has a money story.”

Michael Stein M.D. recently wrote a book appropriately titled Broke. Detailing his experiences working with impoverished clients within his medical practice. Not surprisingly, their health is sabotaged by their various financial predicaments.

Not having their own financial planner commiserate with Dr. Stein emerges as their money therapist. Their tales are simultaneously shocking and heartbreaking.

Dr. Stein occupies a unique position. Through no fault of his own, medical bills bankrupt more Americans than any other type of expense.

Like wealthy Americans, his patients crave security and less anxiety. Their financial states make this impossible. He watches in horror as their health and money slowly deteriorate with no end in sight.

Working in the financial planning profession, where perversely, a quarter of a million dollars is considered a small account, the money stories we see are far different than those found in Stein’s book. Perspective becomes warped if millionaire problems surround you.

In comparison to Dr. Stein, though important work, helping our clients with their issues is child’s play. Our job entails helping investors choose and fund a plethora of good and better alternatives. Dr. Stein has little power over his patient’s finances. This factor overwhelmingly influences their mental and physical health. Their options range from not good to awful.

Worse, they’re both fully aware of this disconcerting fact.

Making sound health decisions when you’re not sure where you’re sleeping that evening or when you’ll eat your next meal is unimaginable.

The facts Dr. Stein weaves in 3about poverty in America throughout his book are gut-wrenching.

More than half of the U.S population will live in poverty at some point before 65.

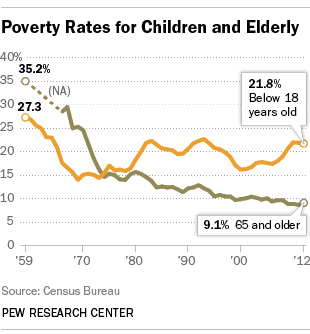

21% of all children in the world’s richest country live in poverty.

5 million Americans live on less than $4 a day.

Getting 6 hours of sleep is essential for a healthy body. If you’re below the poverty line, these chances are minimal. 3

If you spend more than half your childhood in poverty, there’s a 32% chance you’ll drop out of High School.

Bill Gates, Jeff Bezos, and Warren Buffet’s combined wealth is equal to half the wealth of the entire U.S. population.

The data is disheartening. The personal stories place a human face on this bleak picture.

Including people so poor they rinse off paper plates.

Things we take for granted are exorbitant luxuries for about half our country.

One patient told Dr. Stein:

“The most in savings I ever had was $600. I want a car, but I have to save. I also owe $350 to get my license back. Then I’d have to up my game to be able to pay for car insurance.”

The devasting effects on families leave a legacy of unrepairable damage.

“After my heart attack, I quit working. I don’t even have the gas money who lives with my ex an hour away. I try to get to him once a month, as it says in our custody agreement. But I can’t even do that. Try telling an eight-year-old you can’t see him because you don’t have the money.”

Where do you begin to help these people?

A patient confesses his thoughts on many well-off Americans.

“They blame the poor for being poor. “

The only thing worse than living in poverty is believing nobody cares. It’s all your fault! Isn’t a message of compassion.

I’m not smart enough to develop a solution for this national calamity.

What I do know is, the next time I hear someone going apoplectic over the annual 10% stock market correction, I’ll send them this book free of charge.

Some people need to understand, losing the genetic lottery really sucks.

Source: Broke by Michael Stein M.D.