Bad money relationships are worse than romantic debacles.

High-intensity drama is painful. Living paycheck to paycheck generates worse long term negative effects.

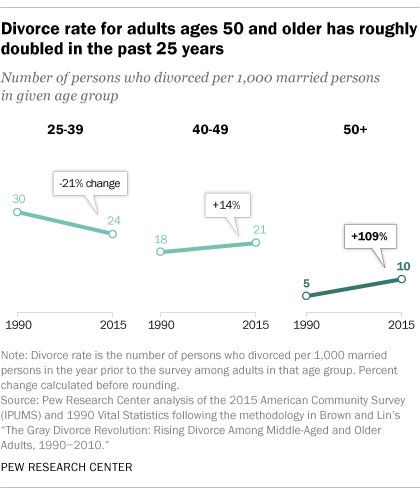

The divorce rate for couples over 50 has skyrocketed over the past 25 years. Differences over money are the number one reason in many circumstances.

There are many ways why things go south in relationships. Surprisingly, most contain the same features as a dysfunctional relationship with money.

The Huffington Post spoke to several therapists about relationship destroying behavior. Their answers provide warning signs and ways to counteract a nasty break up before it’s too late.

Bad habits can be changed. We need to be self-aware and recognize them before it’s too late.

- Zoning out in front of the t.v or smartphone before going to bed. Relationship experts say this prevents couples from being present and connecting. They’re certainly other things partners can do before bedtimes. This is a G-Rated blog. We’ll leave that for your imagination. Investors get caught in this same quagmire. Focusing on the daily noise of the market by watching incessant financial television encourages emotionally-driven decisions. They never end well. It’s been proven people who constantly monitor their portfolios garner lower returns than their more apathetic peers. The bottom line is your partner, and your portfolio will thank you if you find better things to do with your time.

- Obsessing about being right. This is an arrow to the heart of a healthy relationship. According to Kelsey Borresen, “It’s difficult to have a productive argument when both partners are more concerned with winning than they are with resolving the problem at hand.” Compromise and choosing your battles are keys to relationship peace. Nobody likes a know-it-all. The same goes for managing money. The market is merciless to those who don’t respect its whims. Just ask anyone who recently purchased Gamestop at $400. The best quality a good investor possesses is knowing what they don’t know. Unless you are a fortune-teller, this means diversifying your portfolio and preparing for the unexpected. Uncertainty is the only certainty in financial markets. The worst attitude investors can have about their money is insisting on a need to be right.

- Avoiding vulnerable conversations. Avoiding uncomfortable conversations in a relationship is easy. When to get married, have kids, etc., are life-changing decisions. Not having these discussions isn’t the solution. We don’t want to be hurt, judged, or rejected. Unfortunately, the alternative is worse. Bottling up feelings explode into arguments resulting in lasting bitterness. The same applies to difficult financial conversations. Not disclosing debt, putting off buying insurance, or creating a will results in irreparable harm to your financial future. The least resistance path isn’t conducive to wealth creation, including having awkward but vital conversations with your partner.

Finding happiness in a bad relationship is impossible. Don’t compound this issue by transferring these behaviors to managing money.

Getting divorced is very expensive. Losing a good chunk of your wealth due to arrogance or neglect makes things that much worse.

Avoid both calamities by following these tips.

Your partner and portfolio will both be eternally grateful.