Shopping and buying aren’t the same things.

In the U.S., shopping is a bigger sport than the NFL or NBA.

The funny thing is we don’t realize what we’re buying.

They’re trillion-dollar industries based on the sport of shopping.

The arms race to purchase things we don’t need is fortified by gift cards, garage sales, and self-storage units. The layers of defense are deep.

Why are people enthralled with shopping?

There are many reasons. Money is a deeply personal matter. We’ll have our own issues.

This applies to investing. Buying Bitcoin at $40,000 when your retirement account is underfunded isn’t optimal. Jealousy of a neighbor’s success motivates us more than common sense. Proving again, comparison is the thief of joy.

Seth Godin has a scientific observation for this infatuation.

Shopping releases chemicals in our brain. In many cases, particularly with luxury goods, it’s this emotional shift that we’re actually paying for, not the thing we’re buying.

There’s nothing wrong with casual shopping. The problems start when buying more stuff becomes a substitute for the things we’re really searching for.

My colleague Barry Ritholtz has a terrific take on the Bargain Hunter’s Dilemma.

Do you really want or need it, or is it just on sale?

Barry speaks about how this affliction affects both rich and poor.

When you are broke, there is an entire underlying psychology of unfulfilled desire. It creates the danger of wanting what you cannot have simply because you cannot have it. And when you are poor, you cannot have nearly everything. This leads to questionable decision-making.

Consumerism doesn’t discriminate.

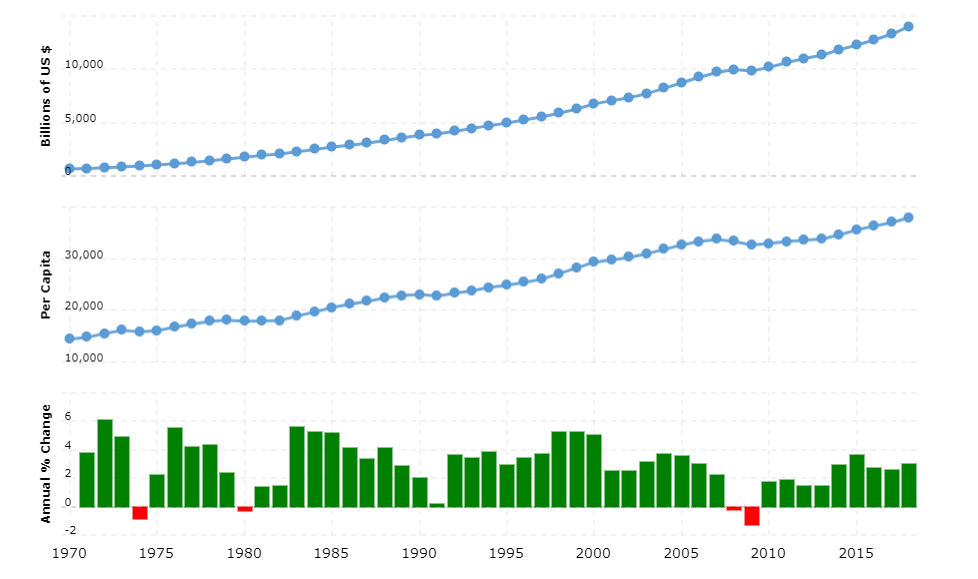

Source: World Bank

“Catalog consciousness” affects each of us to some degree.

We go online or open a catalog. Turning the pages, searching for something to want. We can’t stop until we locate an item, whether we need it or not. A sale seals the deal. The anticipation of fulfilling the want is the hook.

How do we stop ourselves before it’s too late?

We need to change our mindset.

Try buying things as if they’re already broke.

Soon they will be.

The thrill of a new purchase wears off pretty quickly. No matter how much we spend, we jump right back on the hedonic treadmill hunting for our next hit.

How many people with maxed-out credit cards remember even half the things they purchased?

Worse, most of these items are worth next to nothing.

Buying things with the expectation that they’ll only provide a temporary dopamine rush is a game-changer.

Applying mindfulness about the long term costs of a big purchase is a real difference-maker.

People need to spend to finance and grow our economy, but we need some guard rails.

No one is saying you should try dumpster dive for day-old bagels for breakfast to cut costs. On the flip side, pausing and thinking before spending never hurt anyone.

Learning to spend a little less in the present and a bit more in the future isn’t easy. We live in the moment, not in our 401(k) plans.

The costs and benefits of financing your future self are complicated. That’s the reason we need to spend more time pondering this dilemma.

Try it the next time you’re about to make an impulse purchase.

You might be surprised what you might find out about yourself.