Your retirement account doesn’t care who’s President.

The November election is fast approaching.

Commence firing with rounds of: “This is the most important election EVER!” Disregard the fact these same people say this every four years.

The fun starts when the stock market apocalypse season begins – The election edition.

On cue, e-mails like this start filling my in-box.

“I have a friend who is telling me that if Trump loses the election, the market will tank and I will LOSE ALL MY MONEY! ….They said they would pull all of their money out a few days before the election.”

Besides the fact these individuals think they can accurately forecast the short-term returns of the market and presidential elections, there’s something more sinister lurking in their hyperbole.

When partisans on both sides begin unleashing scare tactics, this puts the retirement funds of hard-working Americans into great jeopardy.

On the night President Trump emerged victoriously, stock futures plunged. We’re now at or near record-highs.

When Barack Obama was elected, the predictions were more hysterical. This prophecy plunged into the dust bin of history.

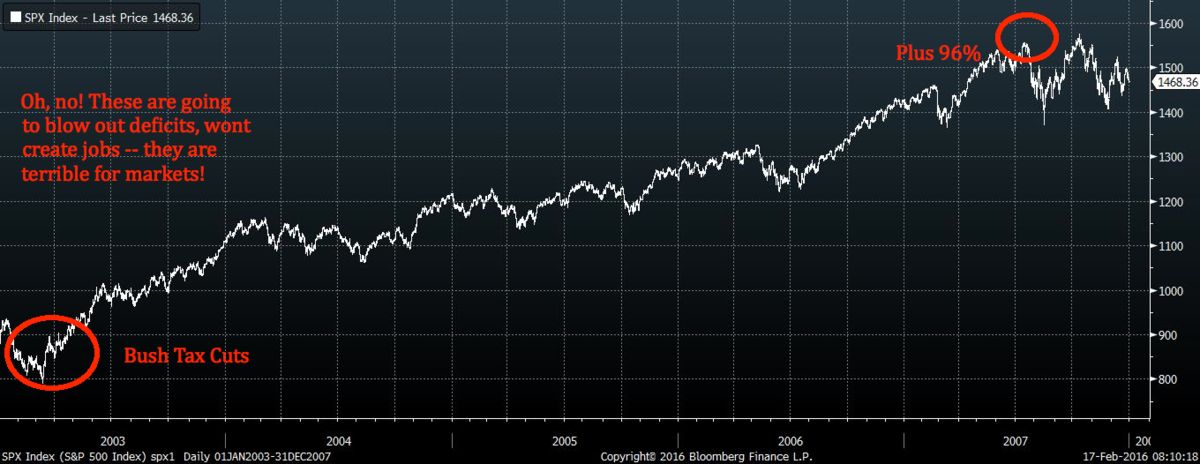

Not to be outdone, Democrats declared a state of financial emergency when George W. Bush emerged victorious after the disputed 2000 election.

Not to be outdone, Democrats declared a state of financial emergency when George W. Bush emerged victorious after the disputed 2000 election.

Source for both charts: Bloomberg

Source for both charts: Bloomberg

The idea that one person dominates the economic behavior of the world’s 8 billion people is incredible. Unfortunately, too many believe this.

If their candidate wins, we’re off to the races. If not, look out below. Rinse and repeat.

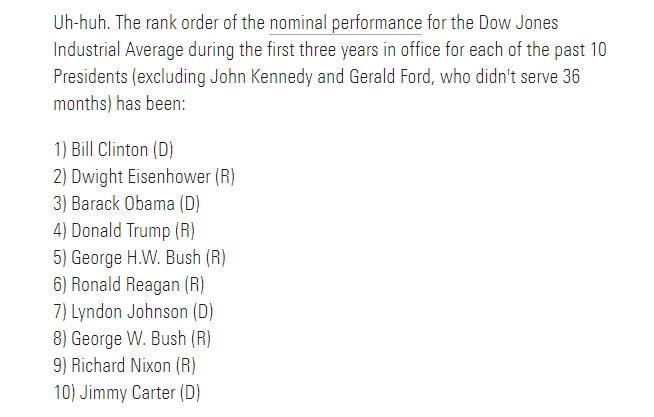

According to my colleague, Barry Ritholtz, don’t believe the hype.

How about listening to one of the world’s greatest investors?

“If you mix politics and investing, you’re making a big mistake.” Warren Buffet

John Rekenthaler provides the data in Presidential Elections Don’t Matter (for Investments)

Combining tribalism, emotion, and investing is a recipe for disaster. The results are predictable.

According to the Irish Times:

Investors become more optimistic when the party they supported was in power, the researchers found, resulting in them receiving stock markets to be less risky and more undervalued. When the political climate was aligned with their political identity, investors increased their allocations to risky assets and showed a strong preference for volatile, small-capitalization, and value stocks.

If their side loses, these same people tend to go off the deep end.

The opposite was true if their preferred party was out of power. Then, disgruntled investors upped their allocations to markets outside the U.S. They were also more likely to actively trade their portfolios, presumably because they had less confidence in a buy-and-hold approach during periods where their preferred party was out of power.

Does this sound like anybody, you know?

Research shows investors’ returns were noticeably lower when their political party wasn’t holding power—the investment equivalent of cutting off your nose to spite your face.

What changes should investors make to their retirement accounts due to the upcoming elections?

It’s time to use a four-letter word: NONE.

In a correctly structured retirement portfolio designed to match your time horizon and goals, diversification takes care of this problem. The North Star of financial planning is preparing for a wide range of unpredictable outcomes. Competent planners can’t predict the future, but they can qualify for an unlimited possibility of crazy things happening. You can add “the most important presidential election of our time” to the list.

The President isn’t the stock market, no matter how hard you wish.

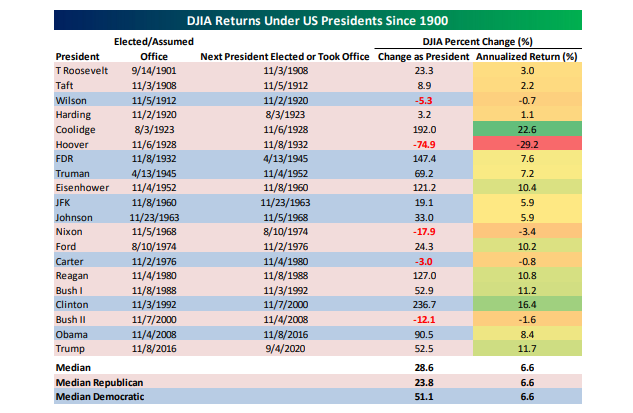

Democratic and Republican administrations experienced their fair share of bull and bear markets.

Who would have ever thought the annual returns under Presidents Obama and Clinton would be higher than Ronald Reagan’s? Not to imply either party is better for the markets. It underscores the unpredictability of this type of thinking.

As of Friday, the returns of U.S. Presidents since 1900 under both parties are identical.

Source: Bespoke

Vote for the candidate that’s most aligned with your values.

Don’t be fooled into thinking; this leads to making more money.

It may just do the opposite.