“If everyone’s not a beauty, then no one is.” Andy Warhol

Some people hoard things; others prefer money.

Hoarding fascinates people. Shows containing homes bursting with stuff needing Lewis and Clark forging a path to the bathroom are rating bonanzas.

Some hoard due to anxiety or depression. Hoarding alleviates these feelings, generating a safe place. In reality, social isolation is often the result.

When Hoarding interferes with daily functioning, it needs to be addressed by medical professionals.

What if some forms of Hoarding make sense?

Malcolm Gladwell explores this in his podcast, Revisionist History. In Dragon Psychology 101, Gladwell discusses successful people living in clutter filled homes.

Did you ever listen to a song that brings back powerful memories?

When I hear 80’s music, I think of Jones Beach—perceiving the white sand and cool ocean breezes, living for 80’s music, and WLIR’s Screamers of the Week. The dreams of a 19-year-old kid overwhelm my system with nostalgia. When I hear certain songs, for a moment, these days thought gone forever magically return.

Psychologists say music listened to as a 19-20 significantly shapes your life.

Imagine feeling this way about every memory? Some people do.

Receipts, newspapers, furniture, and other objects overflow with intense longings.

These feelings connect to past positivity rather than current depression.

Andy Warhol was a hoarder. After he passed, the contents of thousands of boxes gathered in a Pittsburgh museum. First thought to be a profound art statement, it was determined much of the collection was just junk.

How does this relate to hanging on to inherited assets?

Some value money’s past more than its future.

They’re many reasons for this.

According to HerMoney:

To build my savings account, I worked full-time and hustled on the side for three years. I had roommates for longer than I would have liked, and I said “no” to expensive shopping sprees. To me, seeing the number in my account grow makes me proud — but also, I get a bit of a mama-bear attitude. I know how long it took to build it — and I want to take care of it with a watchful eye.

Think about inheriting assets from a beloved relative. A vacation home brings back youthful memories. Company stock may represent a parent’s lifetime employment. Discarding things is emotionally painful. It’s more about disappointing a loved one than depression or anxiety.

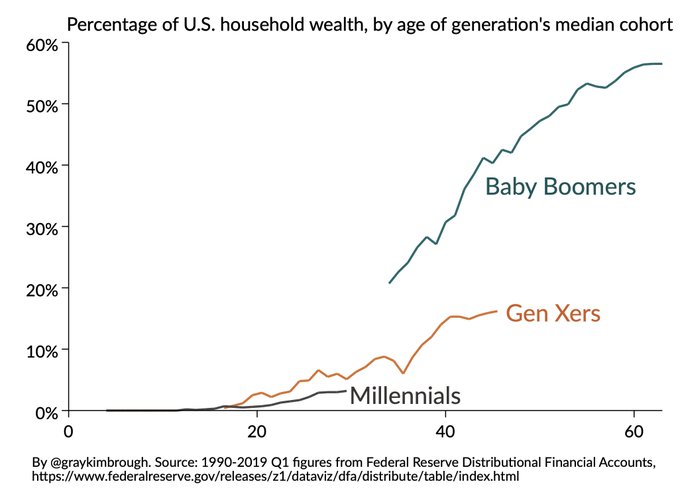

Our ginormous wealth generation increases the prevalence of this issue.

Removing emotions requires a plan.

The laws of logic must overrule feelings of wistfulness.

Directly attacking the situation is wise.

Discarding guilt is imperative.

Selling a home or liquidating a concentrated stock position may dramatically benefit future generations. The best remedy for alleviating a guilty conscious.

Psychologist Dr. Yvonne Thomas offers sage advice.

Be conscious of separating what society or your loved ones think and feel about making and managing money from your true beliefs. Only then can you accurately determine the place money should have in your life.

Gradually Implementing this strategy is essential. Purging everything in a fire sale produces trauma. Creating a measured scheduled approach is more comfortable to process.

Reason number gazillion why wholistic goals-based financial plans are worth their weight in gold.

Always remember – Beauty is in the eye of the beholder even if that eye wanders far and wide.

Source Are You Too Emotionally Attached To Your Money? by Lindsay Tigar

Little known fact – I was once a member of Duran Duran