Why are some insurance salespeople making up retirement plans????

It’s not too hard to figure out the answer.

Can anyone say “Huge Commissions.”

Collecting 70%-100% of hefty first-year premiums provides the incentive to hock this plan.

For the uninitiated, there’s a subsection of The Internal Revenue Code named 7702. The code explains the tax implications of life insurance contracts.

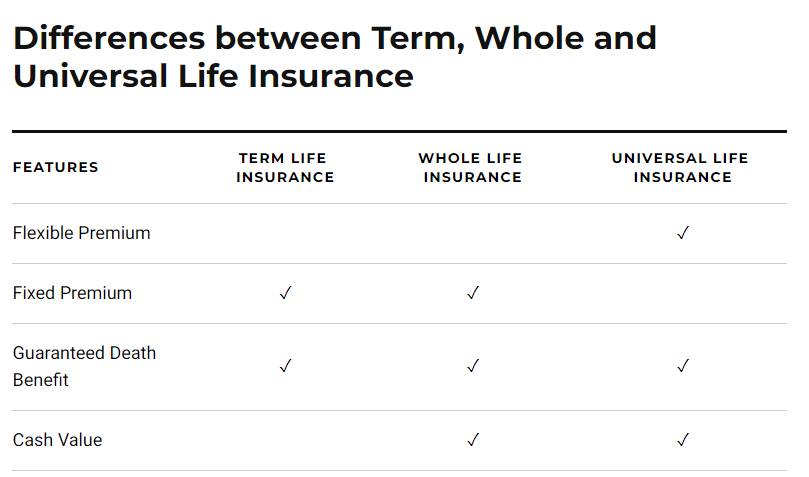

Deceitful insurance salespeople are using this to mimic the 1978 subsection that created the 401(k) plan. They’re falsely labeling variable universal life insurance policies as a better alternative than a 401(k) or 403(b).

Adam Nash describes the sales pitch. “Unlike traditional retirement plans like 401(k) and IRA accounts, “life insurance retirement plans” have no limit on contributions or size, and no requirements for withdrawals at a certain age.”

These perks serve as financial chum as the sharks circle their prey.

Never mind the fact that most purchasing these “Plans” aren’t maximizing their current workplace plan limits. Not exactly a minor inconvenient truth.

The 7702 retirement plan is neither an account nor a plan.

It’s a contract between the client and the insurer. According to Nash:

“The terms are set at the beginning and generally are highly favorable to the insurance company, and you can’t change them as your life evolves. While the terms on variable universal life policies are more flexible than whole life, the economics are designed to be extremely profitable for the insurance company.”

Contrast this to a 401(k), IRA, or an ERISA 403(b). These are accounts in your name but held by a custodian. Both custodians and plan sponsors are subject to strict regulations designed to protect investors.

It’s no accident insurance products most profitable to the companies are widely offered in these pseudo-retirement plans.

In some cases, variable annuities and variable university life insurance policies are suitable for a select group of investors. It’s not the product that’s the problem, its a highly conflicted distribution channel. F

Who do you think are frequent victims of this unholy arrangement?

If you guessed public school teachers, you win a free slice of pizza in the teacher’s lounge.

Sophisticated investors would never fall for this slick marketing.

Companies and salespeople look to dump this upon unsophisticated, trusting, and often fearful educators.

We recently heard of salespeople hijacking an educator’s financial literacy conference to push this load of crap onto teachers’ laps.

The insurance industry is very creative in designing schemes to fleece teachers.

Wouldn’t it be nice if they devoted this same energy to helping these valued public servants achieve their financial goals?

Don’t hold your breath.

Source: 7702 Retirement Plan? There’s No Such Thing by Adam Nash