The $2 trillion economic relief plan passed on Friday impacts almost every layer of American life.

Your retirement plan isn’t exempt.

Here are three important components all workers currently saving for retirement and retirees need to know.

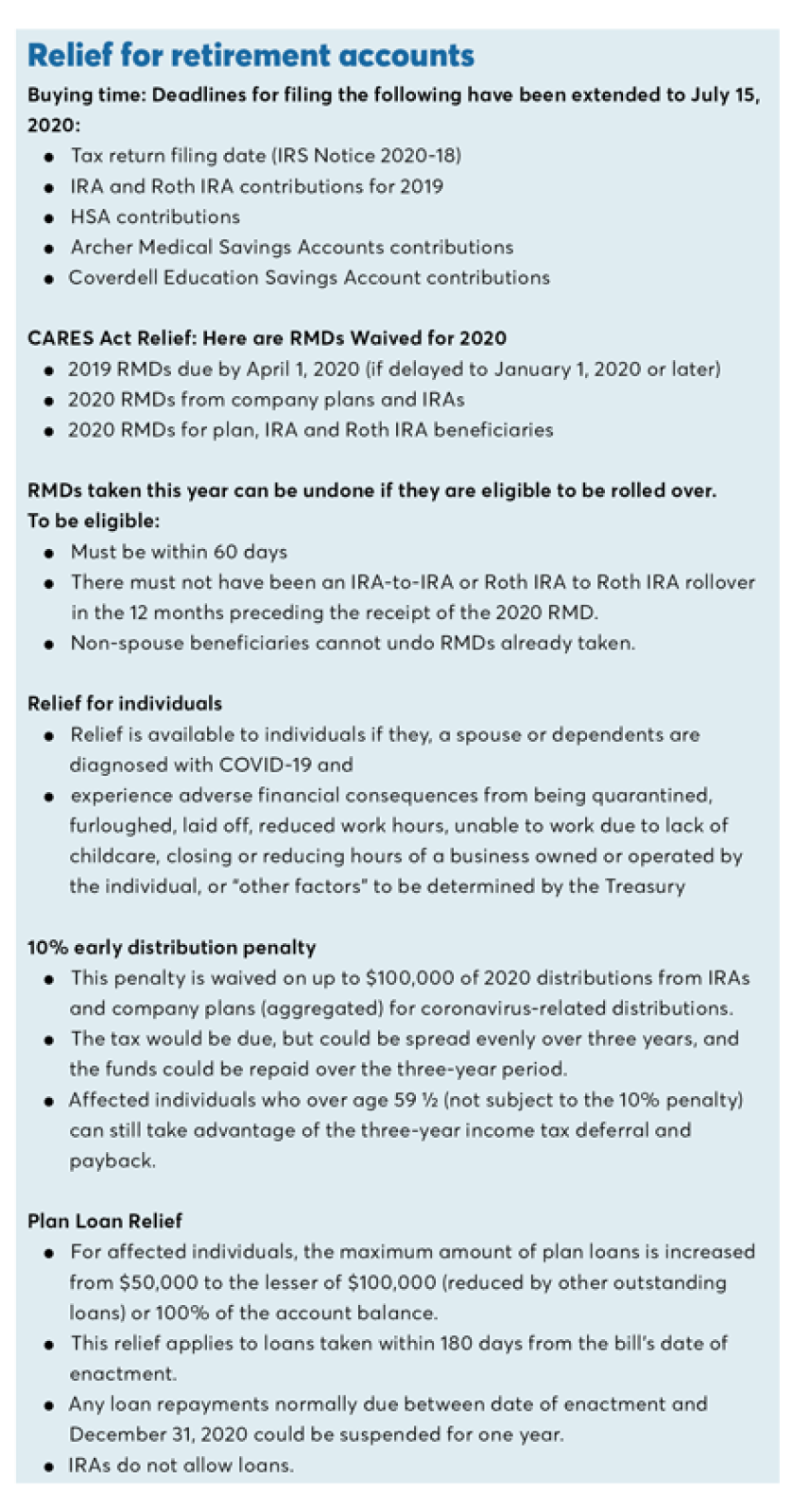

Required Minimum Distributions are suspended for 2020 for IRA’s and workplace plans.

This is important for a couple of reasons. The formulas for these distributions are calculated on 12/31. The market was much higher than it is currently. If this rule was not suspended, investors could be forced to sell stocks that have substantially depreciated. RMD’s don’t take into account your need for the funds. They are mandatory but not in 2020. The suspension gives additional time for the market to potentially recover.

Some fortunate retirees must take their RMD’s and pay taxes even though they have significant outside assets. This new rule enables them to avoid this forced distribution. This applies to anyone over the age of 72.

As of this moment, it’s unclear if inherited/beneficiary IRA RMDS is suspended as well according to our Tax Ninja Bill Sweet. The IRS has yet to give definitive guidance on this issue.

Up to $100,000 will be allowed to be withdrawn penalty-free from workplace or I.R.A. accounts

The package eliminated the 10% penalty for individuals under 59 1/2. Regular income taxes still need to be paid on withdrawals. They can be spread out over three years from the date of the original withdrawal.

Another benefit of this legislation is you can reimburse your withdrawals before the three years are up. This amount is far above the standard contribution rates. Usually, it’s a bad idea to prematurely withdraw funds from a retirement account. In this instance, it might be a matter of survival. This ruling may serve as a lifesaver for many people as a bridge loan until the economy rebounds.

This carve-out only applies to coronavirus-related withdrawals. According to the New York Times:

You qualify if you tested positive, a spouse or dependent did or you experienced a variety of other negative economic consequences related to the pandemic. Employers can allow workers to self-certify that they are qualified to pull money from a workplace retirement account.

Borrowing limits have been increased for workplace plans

The limit has been increased from $50,000 to $100,000 for 180 days after the bill passes. In order to take this loan, you’ll need certification your life has been affected by the Coronavirus. In addition, if you already have a current balance and were obligated to pay it back by 12/31 you’ll get an additional year. You can’t borrow from your IRA.

Source: Financial Planning

The stimulus package created many new possibilities for leveraging retirement accounts. The first being triage. Families desperate for funds to keep a small business alive or cover loss of employment have another option in their toolbox.

For the lucky ones, they’re additional beneficial tax planning strategies. These items should be discussed with a trained tax professional. (This post is only a basic overview of a complex matter and should never be construed as tax advice.)

Most don’t have the luxury of looking at this crisis as a buying or rebalancing opportunity.

As Economist John Maynard Keynes once stated, “In the long run we are all dead.”

Don’t be shamed into not temporarily accessing these funds. Personal finance is much more personal than finance.

Surviving another day takes precedence over retirement saving.