Investors pay too much attention to things that mean too little.

College athletes could teach them something about blocking out distractions.

Before a 1997 Penn State vs. Minnesota football game, a Nittany Lion’s fan mercilessly heckled Minnesota’s kicker, Adam Bailey.

Happy Gilmore was a popular movie during this period. The heckler spewed lines from one of Happy’s detractors to throw him off his game during warm-ups.

“You suck, ya jackass.” Every time Bailey lined up for a kick he shrieked, “You will not make this, ya jackass!”

It worked. Bailey missed most of his pre-game attempts.

When the game started, 90,000 fans, including his nemesis, had no effect on his kicks.

What gives?

According to Bailey, “I was laughing too hard. The guy was doing a perfect impression.”

But, when he lined up for the kicks that mattered, all Bailey heard was white noise.

“You hear the crowd, but you also don’t really hear the crowd,” Bailey explained.

Investors need to do the same thing. Focus on what really matters — the long term. Capitalism does its thing. Markets rise over time.

The distractions of financial hecklers rear their ugly heads in various forms:

- Noisy weekly economic data distracts you from important trends.

- Political Partisans (whose sole purpose it is convincing non-believers the opposing party is the spawn of Satan); their mission is to crash the economy.

- Natural disasters (such as hurricanes, tsunamis, blizzards, and tornados) make life miserable for some in the short term. Will this stop people from drinking Coca-Cola and using their iPhones? Profits drive markets forward.

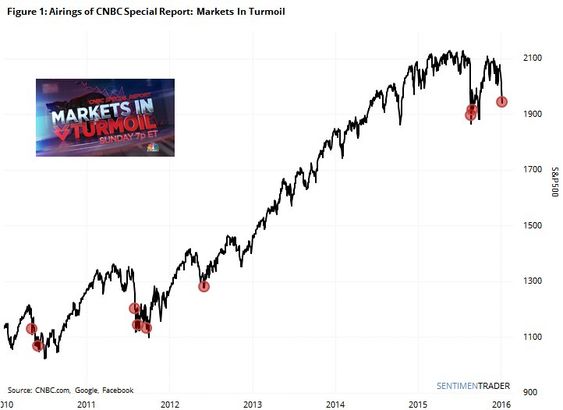

- Media prophets of doom see a bear market and recession behind every market hiccup. Like a broken clock, they will eventually be correct; but not before you lose plenty of money and sleep listening to their gibberish.

- Normal market corrections; 14% temporary annual declines are part of the game. Volatility is a feature, not a bug, of equity markets. Take it for what it is and move on with your life.

Investors need to act like the visiting teams who enter Arizona State’s basketball arena.

The infamous Curtains of Distraction are designed to make ASU’s opponents free-throw attempts a living hell.

Two black curtains are located in the student section behind the opponent’s basket. As these poor souls are about to shoot, the curtains open and revealing outlandish scenes, such as:

- A Miley Cyrus wrecking ball impersonator;

- Two unicorns making out;

- A student in a kayak paddling as the student section sings “Row, Row, Row, Your Boat;”

- A Richard Simmons look-alike in 80’s gyms shorts, fro wig, and a headband; and

- A reenactment of Chris Farley auditioning for the role of a male stripper.

Despite this mayhem, ASU’s opponents’ free throws were largely unaffected.

Investors must believe in the dark what they were told in the light. Things will be okay if you stick with a well-constructed financial plan.

Today’s hecklers speak Italian. They will never go away.

The only thing that matters is how you react to them.

Source: SuperFans by George Dohrmann.