Reactive habit patterns ruin more portfolios than bear markets.

Acting mindlessly and reflexively is easy to do but difficult to unwind.

There’s a way out of this negative feedback loop – if you’re willing to put in the work.

Dr Judson Brewer, an expert on changing bad habits, has the solution.

Make it R.A.I.N. on your investments.

Not like this!

When things get hairy, we instinctively react by feeding rabid emotions. Pushing them away is another damaging alternative. We mindlessly react with a familiar pattern of behaviour – no matter how much damage we’ve experienced in the past.

Giving in to strong cravings or fighting them with ever diminishing willpower doesn’t work.

Our tendency is to Minecraft our thoughts. No matter how irrational they are. Building entire worlds around myths is our modus operandi.

Embracing the horror, not distancing ourselves from it provides the solution.

Stepping back instead of stepping in makes all the difference.

Recognize – We need to recognize our cravings, not ignore them. Doing this immediately makes them less powerful. Not letting the imagination run away with fears is the first step in good decision making 101.

Accept – We need to allow our craving to be there. Doing this, we can start understanding rather than reacting.

Investigate – Turning toward emotions and becoming curious rather than terrified works wonders. Eating a dozen cookies shortly after a big meal isn’t because we’re hungry. What are the much darker and deeper hidden motives?

Note – Noting cravings and identifying their real source is paramount. Letting senses rip is a reality check. Instinctive flight or fight reactivity isn’t conducive to solving modern problems.

Implementing R.A.I.N. is highly effective in breaking even the most hardcore nicotine habits.

Needing to practice un-resistance is essential. Noting and curiosity alleviate our biggest fears.

Asking yourself, “Is this going to last forever?” is a brilliant strategy. Maybe things aren’t as scary as they seem.

What does this have to do with investing?

Some traders are exploring using mindfulness strategies like R.A.I.N. in their trading processes with encouraging results. These same concepts are just as valuable for retail investors.

Think back to 2007-08. What was going through your mind as prophets of gloom were screaming the world was ending? Watching a portfolio disintegrate is terrifying.

Turning towards fear was the last thing you wanted to do. Pushing it away quickly and stopping the pain was paramount.

Selling all your stocks and going to cash until things “Calm Down” is the default reactionary choice for too many of us.

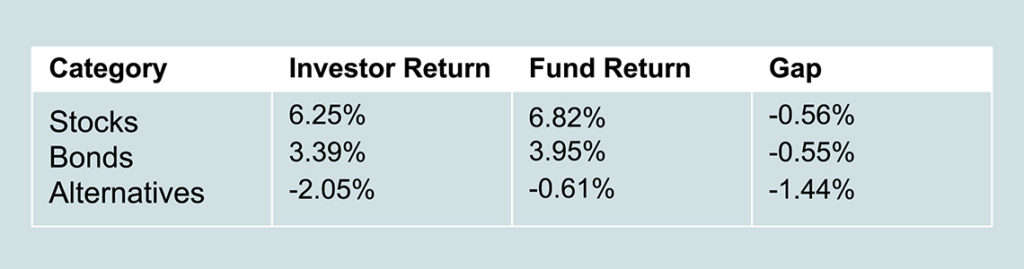

Is it any wonder the average investor underperforms the funds they invest in over multiple 10-year periods?

Source: Morningstar

It’s essential to practice R.A.I.N. with smaller and less important cravings. Giving you the muscle memory for attacking more emotional cravings as they arise.

Though initially painful, making it R.A.I.N helps explore things instead of reacting to then. Considering the long term consequences of giving in to panic will help prevent it from occurring.

Gritting your teeth and stepping into the breach isn’t fun. The alternative is worse.

Something to consider when trying to tame a strong craving.

Take some time to explore this before eating another doughnut or wrecking a long term financial plan with an emotional decision.

You may find the answer quite revealing.

Paying attention to controlling your reactive cravings is the ultimate wealth-builder.