Why is the state of financial literacy in America so bad it’s almost comical?

The methods of distributing information leave much to be desired.

Mass broadcasting reaches a wide audience while sending the wrong message.

Noise censors the truth like invisible radiation.

Why do some messages go viral while most plunge into obscurity?

Derek Thompson provides the answers in his fascinating book, Hit Makers.

President Obama’s chief speechwriter, Jon Favreau, explains things well.

“If you take a small thing and repeat it throughout the speech, like a chorus in a song, it becomes memorable. people don’t remember songs for the verses. They remember songs for the chorus. If you want to make something memorable, you have to repeat it.”

Obama’s “Yes, we can” is a perfect example of a repeatable chorus.

Conveying financial information in a similar manner leads to disastrous results.

Blasting out a chorus filled with short term unrealistic melodies and scare-tactics rarely ends well.

Remember this popular on-line trading commercial?

The theme: “the dumbest guy in high school just got a boat, why haven’t you?”

How does one get a ticket to this oceanic dance party? Trading stock’s on-line of course! This poisonous magic pill is a common, repetitive feature of how Americans are consuming financial advice. Who needs years of compounding? Tesla $1,000 here we come!

The financial media loves to scare the bejeezus out of people during every market correction.

Is this helpful to people trying to stick to a long term financial plan?

Unfortunately, facts don’t fit into the 24/7 if it bleeds it leads cycle.

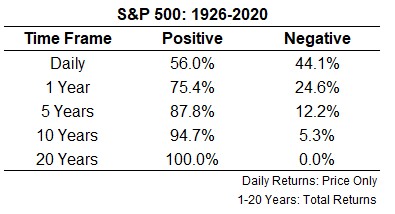

Source: Ben Carlson

Not to be outdone, the print media periodically unleashes Anguished Trader Guy for every market correction.

Celebrities love singing in this chorus. Turning up to tout a questionable product or endorsing financial firms who couldn’t spell fiduciary if you spotted them the F, I, D, U, C, I, A, and R.

The S.E.C. put out the following warning.

Celebrities, from movie stars to professional athletes, can be found on TV, radio, and social media endorsing a wide variety of products and services – sometimes even including investment opportunities. But a celebrity endorsement does not mean that an investment is legitimate or that it is appropriate for all investors. It is never a good idea to make an investment decision just because someone famous says a product or service is a good investment.

Why do we keep falling for the same tricks?

According to Thompson, “people process the rhyme, and then they seek the reason.”

They are attracted to the familiar, making the above narratives more compelling.

Our species is prostaglic, we are obsessed with predicting the future of everything. Attempting this in the financial markets is a recipe for disaster.

Most believe things go viral by word of mouth. Not so, Influencers spreading the message quickly through a large established network is the preferred route.

We all want a story whether it’s reality-based or not.

Thompson sums this up beautifully.

“Stories are a kind of sorcery….they can seduce the mythmaking mind and can suppress the kind of deeper thinking that is also quite necessary to understand the truth of things. A great story that serves the wrong purpose is a dangerous thing.”

So is a bad chorus.

Do you yourself a favor, don’t sing along with it.

Source: Hit Makers How Things Become Popular By Derek Thompson

If you are interested in learning more about this topic. Watch this from The Compound.