There are no shortcuts regarding learning and investing.

Good processes, not temporary outcomes are the keys to positive long term results.

Focusing on short term noise is a proven wealth destroyer. Motivating children by short term grades instead of a love of learning is like throwing Napalm on their brains.

Most schools provide on-line portals enabling parents to check their children’s grades in real-time.

Like many things, good intentions were overwhelmed by unintended consequences infecting the process.

There’s nothing wrong with making sure your child is up to date with school work before things get out of hand.

Somewhere along the line, this mutated into something more sinister.

Many parents become obsessed with the addicting random bells and whistles alerting them to incoming grades.

When I was teaching, there was a tool where I could track the frequency of parent’s access to the site.

What I saw was shocking. There were some Moms and Dads logging in dozens of times in a single day!

I only gave a couple of Homework assignments a week along with a bi-monthly quiz and an every six-week unit test – What in God’s name were they expecting to see?

As far as I was aware, the site didn’t contain the winning numbers for the next day’s lottery drawing.

I remember giving a 5 point min-quiz. One girl received a 4/5. Immediately after I entered her grade, her Mom e-mailed me. “Why didn’t my daughter get a 5 and what could she do to raise her grade.

I was very tempted to reply, “Nothing, and you need to get a life.”

Portal Parents create tremendous anxiety in their children. Equating grades to a kid’s self-worth is awful parenting.

Children become conditioned to learn something short term, get a good grade, and then forget everything – Rinse and Repeat.

Good outcomes but horrible process’.

Julie Jargon writes in the Wall Street Journal,

“Obsessive grade-checking is also symptomatic of the desire, peculiar to a generation that has grown up with everything just a swipe away, to receive instant gratification. This can lead to anxiety and disappointment in some students.”

The same applies to obsessive portfolio checking.

Like those compulsive and over-protective parents, What are you expecting to see?

Dan Egan has some unsettling answers.

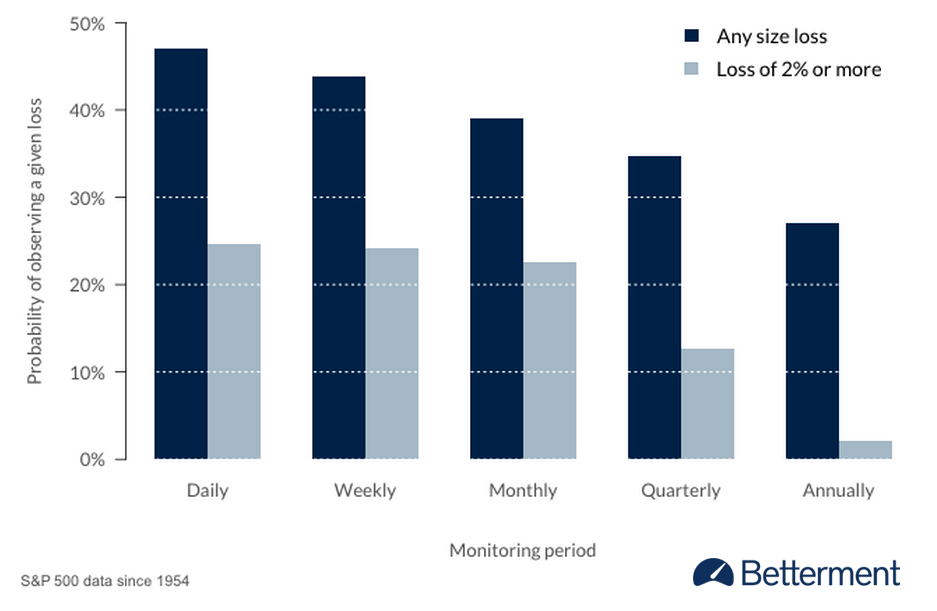

The more frequently you monitor your portfolio, the more likely you are to observe a loss.

This is likely to cause short-sighted decisions and could hurt your investment performance.

If you are checking your portfolio more than once per quarter you’re doing it too much.

Investors who log in less than once per month reduce their chances of seeing a loss by 6%.

Behavioural finance expert Dan Kahneman adds:

“When directly compared or weighed against each other, losses look larger than gains. This asymmetry between the power of positive and negative expectations or experiences has an evolutionary history. Organisms that treat threats as more urgent than opportunities have a better chance to survive and reproduce”

Daily stock gyrations are influenced by random events and irrational emotions. Human brains which evolved from a bunch of scared monkeys can’t process this vital fact.

Placing long term Creedence into short term fluctuations is a fools’ errand.

“It’s a great idea to base my financial future on the flip of a coin.” – said no one ever.

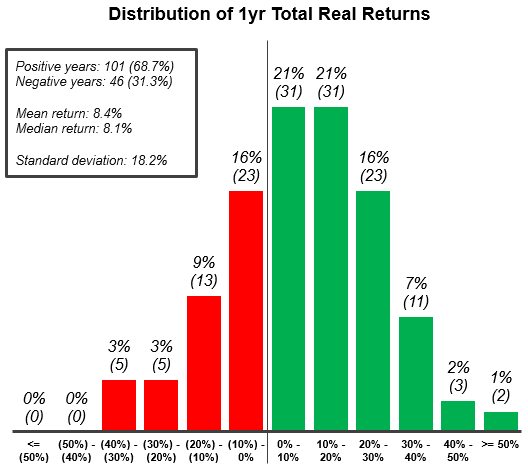

With investing, time is usually on your side. Even on a yearly basis, stocks on average are likely to rise.

Source: Visual Capitalist

It’s a horrific idea to judge your child’s future on the results of a daily quiz or quarterly grade.

Using your financial portal like a helicopter parent is worse than the destructive effects of a bear market or economic recession.

Your kids and money benefit more from a long term process-oriented approach.

Incessantly logging into your computer frequently checking things that don’t need checking never made anyone rich.

Getting a life is better advice.

Sources: Are You Checking Your Portfolio Too Often? Investment Masters Class

The New Parental Obsession: Checking Kids’ Grades Online, By Julie Jargon, The Wall Street Journal

High-Frequency Monitoring: A Short-Sighted Behavior by Dan Egan