Why can’t we plan our working lives the same way we plan for retirement?

Waiting for 75% of life to pass by before doing stuff you enjoy is a pretty dumb strategy.

The concept…the very idea…of retirement is dumb.

Waiting until some arbitrary age to enjoy life PLUS stopping all meaningful work all at once…DUMB.

I will never retire.

I will just do more of that stuff I like, and less and less of the stuff I don't.

— Carl Richards (@behaviorgap) July 31, 2019

Going full throttle and then completely stopping makes no sense.

There are exceptions. Health and Caregiver issues are prime examples. Fortunately, this doesn’t apply to everyone.

Like yearly returns, random retirement ages provide nice narratives but no context.

According to my colleague Blair Duquesnay, “The calendar years are arbitrary. They are convenient marking periods but provide little information about investor success.”

The same goes for retirement. Leaving work at 65 and basing the decision on shorter life expectancies from past decades is perplexing at best, fatal at worst.

Why does life have to completely change at this age? Why isn’t this a continuous process instead of a zero-sum game? Why do so many blindly follow this damaging advice?

After having lunch with my friend, Lauren, who recently retired from teaching, I had a revelation.

She was immediately pressured by ex-colleagues into joining the Canasta club and other such frivolities.

In addition to her reservations about hanging around all day “with a bunch of Yentas”, Laurens searching for something more.

“I need a purpose,” she told me. – Bingo!

Everybody does. This primal urge doesn’t magically disappear in retirement.

Lauren’s temporary plan is substituting a few days a week in her old district.

Subbing for teachers she previously worked with and teaching enjoyable subject matter are non-negotiable items l. In addition to valuable interactions with young people and friends, she’ll get paid $160 a day. Purpose and money co-exist vert peacefully.

She’s also getting involved in a local chorus and re-establishing a passion for playing the guitar.

Screaming at Fox News /MSNBC all-day ranks very low on the joy-meter.

Planning the next early bird special and discussing the medical issue du-jour are one-way tickets to Bitterville.

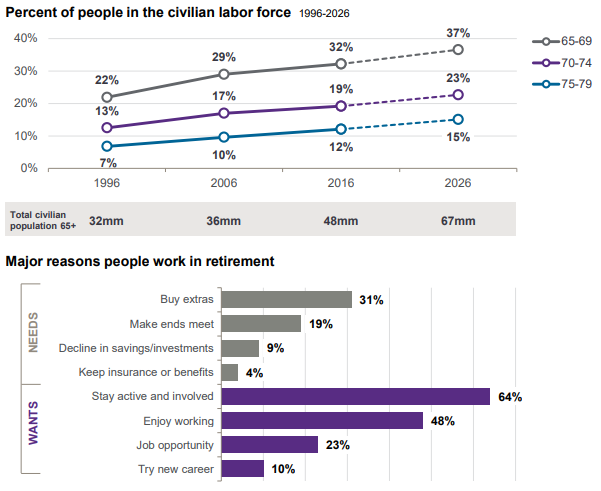

Source: JP Morgan Guide to Retirement

Why can’t people gradually phase in more enjoyment while eliminating stuff they hate a couple of decades before retiring?

Doing this isn’t impossible.

Slowly cutting work hours is a terrific idea. Shifting from a 45-hour workweek in your forties to a 35-hour schedule in your fifties does the trick

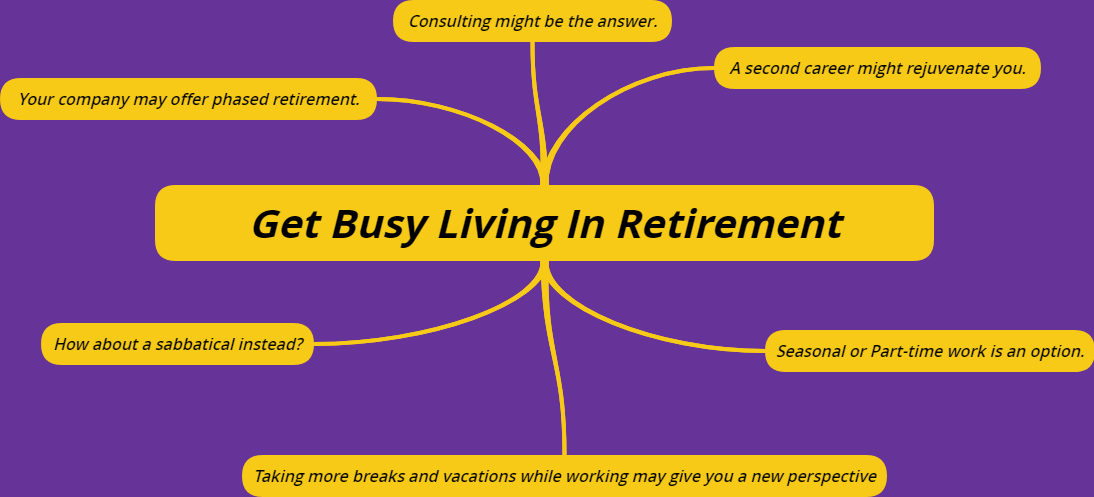

Some companies offer phased retirement programs.

Retiring and working part-time is worth exploring. New fields or something connected to current expertise are excellent choices. Interaction and purposefulness add years to life in addition to providing valuable service.

Seasonal work is another option. Many industries experience busy periods begging for additional manpower. Providing a terrific opportunity to earn extra money and staying connected make this a win/win for both parties.

Second careers may be the answer. The challenge of starting something fresh invigorates the brain providing a huge jolt of energy to a stagnant lifestyle. Many non-profits provide opportunities for starting over.

A sabbatical may work. Making a rash all or nothing decision seldom is a terrible retirement option. Stepping away for a bit and returning invigorated is the perfect compromise.

Taking more breaks and vacations WHILE working makes tons of sense. Why back-load all the fun? Do more RIGHT NOW while you physically can. This also helps in stemming the urge to permanently retire to fulfil distant dreams.

Consulting provides the best of both worlds. Working on what you want, when you want, offers a masters degree in life satisfaction.

The worst option is stopping all meaningful work abruptly.

Depression and physical illness lethally fill the vacuum.

Ridding the world of typical retirement stereotypes is a noble goal.

Sacrificing enjoyment and saving it for a day that may never come is preposterous.

Robert Laura sums this up.

“Do you know what retirement means? To withdraw from life. I’m not withdrawing from life – I can work circles around you and most people younger than me… plus I have years of knowledge and experience to rely on.”

Viewing retirement as a metamorphosis rather than a final destination is the healthier choice.

Stopping everything that’s productive equates with death, more than life. Defeating life’s Death Stars is impossible but slowing them down is not.

There’s a huge difference between meaningful work and having a job.

Who knew? Working might be the best part of your retirement

Source: 10 Ways to Gradually Retire by Emily Brandon, U.S.News,