Looking for that 19th Nervous Breakdown? Here it comes, brought to you courtesy of the Alliance for Lifetime Income.

According to Tobias Salinger of FinancialPlanning Magazine, “Backed by 24 of the largest issuers and asset managers, the new Alliance for Lifetime Income will be the sole sponsor of the Stones’ 2019 “No Filter” U.S. tour, which sports the motto: “You can get what you need when you have protected lifetime income in retirement.”

This is before Mick Jagger’s health issue cancelled things, but you get the idea.

Twenty-four of the nation’s largest insurers and asset managers back the Alliance. They are putting their money where their mouth is to spread the word on the joys of annuity ownership.

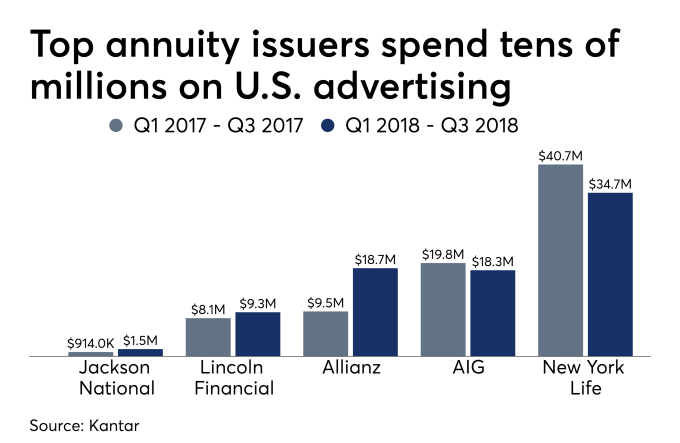

The five firms — four of which belong to the organization — purchased $126.2 million worth of ads in 2017.

“Knowing there are millions of Stones fans following the band or going to these concerts, and many of them are either retired or are thinking about retirement, this sponsorship is a unique opportunity to shine a light on a solution that’s been hiding in plain sight.”

Keeping up with the Stones theme, here’s a playlist for people thinking about purchasing some of these annuities:

- Play With Fire (1965)

- Let it Bleed (1969)

- Shattered (1978)

- Under My Thumb (1966)

- You Can’t Always Get What You Want (1969)

- Sympathy for the Devil (1968)

Clients may just end up like some Stones fans attending the 1969 concert in Altamont, California. Hiring the Hell’s Angels for security and paying them in beer seemed like a good idea at the time. Things didn’t end well. On the bright side, the conduct of Hell’s Angels makes 18-year surrender charges sound less extreme.

In contrast, here’s the Alliance’s take on it:

“For Stones fans and millions of other Americans, the answer could be an annuity,” the organization’s website says. “… get a glimpse of how protected lifetime income from an annuity can help you live the life you want in retirement… with time on your side.”

I was asked to play the devil’s advocate in this article:

“Annuities have their place, The way they are distributed is completely wrong. That’s the problem. The distribution channel and the incentives for them — it couldn’t be worse.” Placing the right annuities in retirees’ portfolios and policing the bad apples are two entirely different items.

The Alliance doesn’t realize it’s not “a few bad apples” giving these products a bad name, but entire orchards of conflicted salespeople.

Are they up for the job?

The evidence isn’t encouraging.

My friend and fierce consumer advocate Micah Hauptman said it best in this tweet.

Looks like they're more concerned with improving the image of annuities than improving the products and the incentives tied to their sale. The fact that they hired an “image expert” as their ED rather than someone who knows investing and financial planning speaks volumes https://t.co/dR8qZ6aB8A

— Micah Hauptman (@MicahHauptman) April 8, 2019

You can read the rest of Tobias’ article here and make up your own mind.