Too much of anything is harmful.

This includes medications and investments.

Diworsification is real.

Our healthcare system is the epicenter.

Polypharmacy is defined as the regular use of five or more drugs by one patient.

Keeping track of all these medications may be the least of your problems.

This issue is mainly concentrated in the elderly.

Older people confront a greater threat of side effects. Their livers are much less efficient at metabolizing and clearing medications from the bloodstream.

The risk grows exponentially because many drugs interact harmfully with each other. In addition, patients don’t always follow directions regarding proper dosages.

According to Knowable:

The World Health Organization considers polypharmacy a major public health issue, contributing to the millions of hospitalizations that occur globally due to adverse reactions to drugs and responsible for billions of dollars in unnecessary health expenses. Researchers and pharmacists are grappling with how to solve this overmedication problem.

Our archaic healthcare system is designed to treat trauma rather than long-term unhealthy lifestyles. Leading to heavy reliance on prescription drugs. Don’t wait for the Pharmaceutical industry to object. Perversely, keeping people sick and not dead makes them more money.

Like medications, owning too many investments cause toxic monetary side effects.

The average investor equates owning many funds, ETFs, or stocks to proper diversification.

This couldn’t be further from the truth.

Creating a White Lotus portfolio with a myriad of unnecessary, absurd, and harmful perks isn’t optimal.

Owning twenty technology stocks or ten emerging market funds secrete dangerous side effects. Not too much different than patients who consume incorrect dosages of their pills.

Legendary investor Peter Lynch coined the term Diworsification.

The Motley Fool describes this as:

Over-diversification occurs when each incremental investment added to a portfolio lowers the expected return to greater than the associated risk profile reduction. In a sense, an investor can hold so many investments that instead of diversifying their portfolio, they’ve engaged in a bit of “di-worsification” where their portfolio is worse off because there’s no added benefit to the incremental investments owned above a certain level.

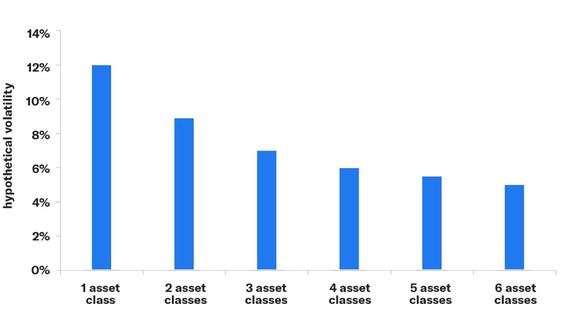

Without using fancy graphs, charts, and correlation ratios, the meaning is clear.

Owning investments that all zag at the time is a no-no.

We need some zigging in our asset allocation cocktail.

Source: Betterment

Quality bonds arent in a portfolio for their entertainment value.

Is it possible to have a well-diversified investment portfolio by focusing on simplicity?

You Betcha!

Target date funds are a terrific option for the average investor.

Owning one fund that owns a variety of investment assets is an ideal retirement strategy. Choosing a risk level attached to a retirement time frame in a one fund solution is beautiful.

Another option – owning a few low-cost broad-based index funds.

We do this in our teachers and Liftoff program.

Wealthy investors possess more nuanced needs, and these strategies might not be suitable.

For 95%of of everyone else, it’s an ideal retirement strategy. Far superior to owning a ton of investments in the same industry or asset class. This strategy provides insurance against buying the latest product from a commission-based financial salesperson.

Few index or target-date funds come with a 5% sales charge.

The best solutions are the simplest to implement.

This applies to your health and wealth.

A healthy investment lifestyle is still undefeated.