Investors try to do the right things but often the wrong reasons. Mixing our monkey brains with money creates strange concoctions akin to buying cotton candy in order to eat the stick; flying on planes for the snacks; or visiting the dentist for the magazine selection. Basically, we get distracted.

There are no shortages of distractors out there. Salespeople are trained to take advantage of our worst impulses. With encouragement we often:

- Buy whole life insurance for its investment component.

- Read Barron’s to find a Top advisor.

- Purchase a variable annuity in a tax-deferred account for tax-deferral benefits.

- Make the minimum payment on a high balance credit card for the travel points.

- Switch into inappropriate investments in exchange for a “free” dinner.

- Let politics become the basis of formulating a retirement plan.

- Sell stocks in bear markets for safety

- Spend thousands on kid’s sports teams, chasing elusive scholarships.

- Purchase an appliance for its warranty.

- Consolidate all financial accounts at a major bank for the sake of convenience.

- Contribute to a retirement plan to use as a piggy bank

- Buy an I.P.O. for excitement.

- Select an investment advisor to make a new friend.

- Take social security early because we fear an early death.

- Ignore term life insurance because we think we’ll live forever.

- Watch financial media for personalized advice.

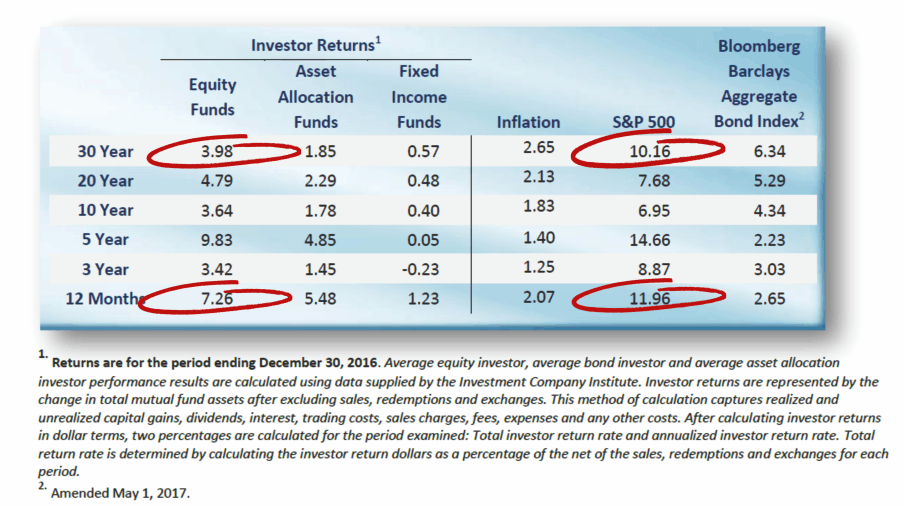

- Invest to beat the market.

- Purchase a home because it’s a good investment.

- Buy things because they’re on sale.

- Read financial books to become the next Warren Buffet.

- Keep an investment solely for tax implications.

- Send a child to college to claim bragging rights over family and friends.

- Choose a career purely based on salary.

- Invest in Bitcoin to be cool.

- Save for college with accounts in your child’s name.

In most cases, we have good intentions.

We miss the big picture due to fear, greed, manipulation, or ignorance – The Four Horseman of Financial Apocalypse.

How do we avoid these big mistakes?

Understanding the importance of fees, knowing the time frame, and ignoring FOMO is a good start.

Making sure you’re receiving and not paying compound interest should be your default setting

Knowing what you’re investing in and why – takes precedence over daily noise.

If these tips don’t work, remember this.

Cotton candy tastes much better than cardboard.