Reacting to someone else’s cues won’t make you rich; resisting them just might.

Get ready for Jomo – the joy of missing out.

When joy replaces fear, good things start to happen.

Danish psychology professor, Svend Brinkmann, published a paper outlining the benefits of a Jomo lifestyle. Miranda Green of the Financial Times wrote about his findings:

“‘Opting out and saying no,’ he writes, are skills we lack ‘both as individuals and as a society’ — not least because of the huge social experiment of tech-enabled connection (and therefore comparison with others) and mass consumption.”

Fomo-sapiens become marketing cannon fodder and slaves to their electronic devices. Jomo-sapiens wisely resist the allure of the bright lights.

According to Green, we are being driven bonkers by social media arms merchants.

“Someone recently told me that advertisers and online content providers use the phrase ‘share of thumb’ to describe the competition for your attention as you tap on a smartphone. It has been in my head ever since and I’m ready to resist.”

Investors must strengthen their Jomo to resist the artillery barrage of marketing materials camouflaged as data by the financial industrial complex.

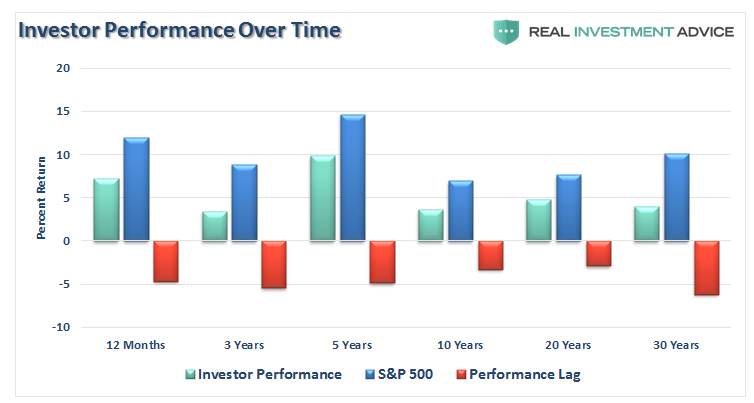

They are losing this battle. Few investors achieve returns comparable to an unmanaged index.

David Swensen sums this up: “The mutual fund industry is not an investment management industry. It’s a marketing industry.”

Fomo feeds this insatiable beast.

How do jomo-sapiens invest? Good investing is more about what you don’t do.

Jomo-sapiens avoid:

- Relying on their gut instincts;

- Worshipping at the altar of forecasters;

- Mixing politics with investing;

- Buying things they don’t understand;

- Having a margin account;

- Looking to get rich quick;

- Checking their portfolio more than their FB feed;

- Thinking they’re smarter than the market;

- Ignoring the steak in search of the sizzle;

- Trying too hard;

- Acting on their friends’/family members’ stock tips;

- Believing their McMansion is a better investment than a 401(k); and

- Equating the terms fun and investing.

Jomo-sapiens are a boring lot, preferring a good book to drinking games. They thrive on declining, rather than accepting, invitations.

Fomo’s inventor, Patrick McGinnis, describes its philosophy as “taking your cues from someone else”.

In contrast, jomo-sapiens excel at the most vital part of successful investing – sticking to a plan, no matter what.

Fomo steers more people off course than the worst bear market.

Good investing is boring and so are many of the people who shine at it.

Embrace the joy of missing out. Your portfolio won’t miss the excitement.

Source: “Allow yourself to embrace ‘Jomo’ – the joy of missing out,” by Miranda Green, Financial Times, January 6, 2019.