What could possibly go wrong with collecting a nice pension?

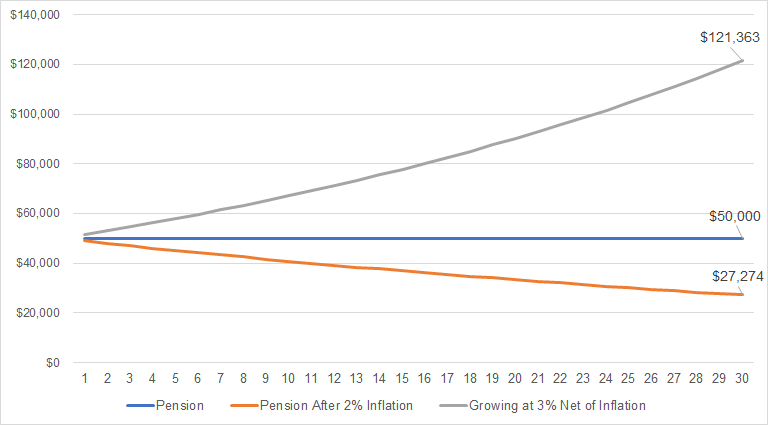

Without an annual inflation adjustment, things are not as rosy as you think.

Unlike social security, many pensions suffer reverse compounding of purchasing power over time.

Public servants have pensions which are terrific in the short term, but not so much as the decades pass.

Pension recipients are comfortably numb regarding the ravaging effects of inflation.

Inflation-challenged workers believe in the mistaken idea that no further savings are necessary if they possess a pension. Everything will be just fine with a $50,000 annual guaranteed income.

Or will it?

Source: Michael Batnick

A 2% annual inflation increase destroys almost 50% in real purchasing power after 30 years.

The $50,000 in a conservative stock/bond mixture will almost triple with a 3% real return over the same period.

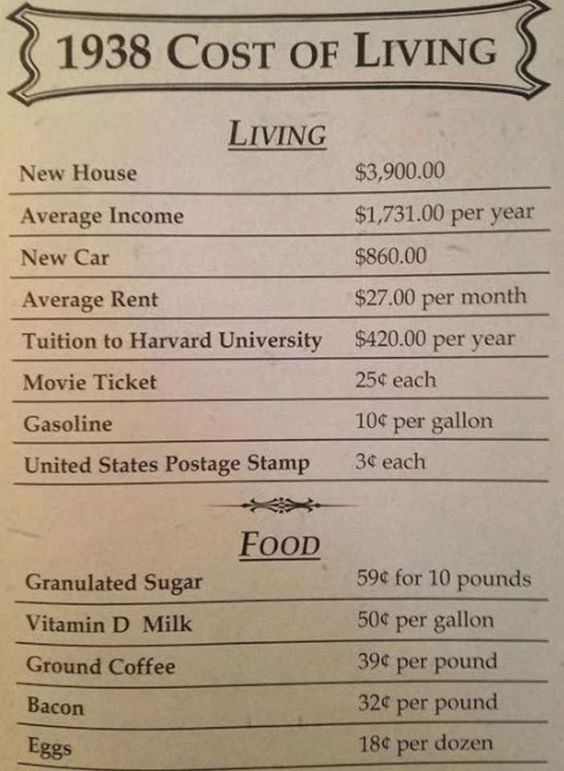

There are valid concerns about unfunded pension obligations spreading like a virus. What goes unnoticed? The slow erosion of current purchasing power over time which doesn’t matter – until it does. Imagine being born in 1938 and using this chart to make decisions about the cost of living in 2018.

Planning for a 3% or so annual inflation adjustment would be fine. If not, good luck paying your rent and healthcare expenses.

The latter represents the way many public service employees incorrectly view retirement spending.

Compound interest generated by the stock market is the antidote to a much-decreased future standard-of-living (including those fortunate enough to be blessed with a pension).

Many recipients look this gift horse in the mouth. They fail to properly leverage this enormous benefit with a globally diversified low-cost stock portfolio.Only about 30% of K-12 public school teachers contribute to a 403(b) retirement savings plan. Twenty or so years from now, the effects of this decision will blow up in their faces.

Teachers receive annual statements showing expected annual pension benefits. For example, 60% of a final three years’ average salary of $80,000 would equate to an annual pension of $48,000 with no inflation adjustment.

Due to state tax caps, many teachers won’t receive the 3% yearly salary increase projected in the formula. Many teachers have gone years with frozen salaries

The final pension number could be considerably lower than stated. Combine this with no index to inflation and Houston … we have a problem.

State constitutional conventions have the ability to change promised benefits. Lifespans may reach into the hundreds. Both aren’t factored into this already murky scenario.

A pension is something to supplement your retirement lifestyle, not completely finance it.

Prices go up over time. If your paycheck doesn’t follow suit, be prepared to buy less stuff and downsize – a lot.

It’s difficult to control the spending habits of government but you can control how much you save in a tax-deferred retirement plan.

The most powerful retirement savings combination consists of a decent pension combined with a portfolio of global stocks and bonds.

The alternative is watching your pension check slowly shrink over time.

By the time you notice, it’s too late to do anything about it.

Sadly, the days of movies costing a quarter are long gone.