“If we don’t educate our children about money, one day a broker will teach them lessons they’ll never forget” Jonathan Clements

Some people are ahead of their time; think Jack Bogle, Jason Zweig, and Jonathan Clements.

Jonathan has always been one of my favorite financial writers. I recall reading his column in the Wall Street Journal when I was teaching public school. That was decades before I ever dreamed I would be working for one of the best RIA firms in the world.

Jonathan always stuck up for the little guy. He was not ashamed of lambasting Wall Street malfeasance; and in the 1990’s, this was not hard to find. Jonathan’s writing was a jargon-free zone. He really cared about changing things that so desperately needed changing.

I was crushed when he left journalism for six years to work for Citigroup.

But Jonathan is back – and he is better than ever. His HUMBLEDOLLAR blog is a must read.

I was so excited when he sent me a copy of his latest book, From Here to Financial Happiness.

It’s a 77-day guide to get your financial house in order. In a little over two months, spending 5-10 minutes a day, readers have the chance to make a seismic shift in how they manage and, more importantly, think about their money.

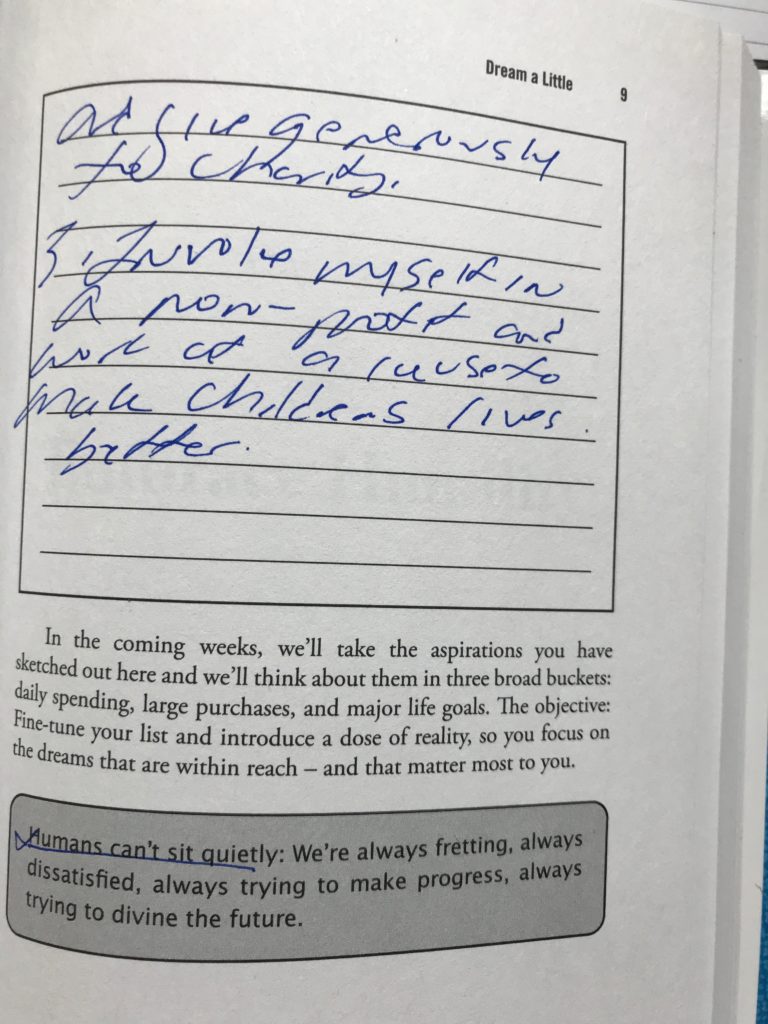

The book is interactive. Space is provided in journal form to record reflections on each topic. Being a former teacher, I understand the value of active vs. passive learning. (Full disclosure, I completed many of the user-friendly assignments)

Jonathan forces readers to list basic items like assets and liabilities. In addition, he makes them think about the value of money, time, and happiness – the real motivators for saving.

I could not think of a better gift for young people or anyone else who needs financial guidance but doesn’t know where to turn.

Here are some wise thoughts in his own words:

- This stuff isn’t all that exciting, though the results will be.

- Life should not be an impulse purchase.

- Humans can’t sit quietly.

- If we devote too many hours to getting ahead in our careers, we’ll have less time for friends and family.

- The reality is money management is best when it is simple and cheap. If you don’t understand a product, don’t buy it. If you don’t understand a strategy, don’t pursue it. If costs are high, find a less expensive alternative.

- In the financial world, complexity may suggest sophistication -but it is usually a ruse to bamboozle and fleece investors.

- As time passes, our memories get airbrushed. We forget the struggles and worries of earlier times and focus on the high points.

- Don’t use an insurance agent as your principal financial advisor. (I highly concur.)

- To add to our wealth, focus on minimizing the subtractions: taxes, investment costs and foolish financial bets.

- If you purchase an overly large house, you’re throwing away money. It’s like renting a huge place, but only using half the rooms.

- Chronologically retirement may be the last of our life goals, but we should always put it first – because it’s the only goal that’s not optional.

There are many gems too numerous to mention. If you’re interested in improving your financial health or helping someone else repair theirs, run — don’t walk — to get this book.