People own too much home; not to mention unnecessary investments.

According to Shawn Langlois of MarketWatch, “From 1978 through 2015, the median size of the single-family home increased every year until it peaked at 2,467 square feet, according to the U.S. Census Bureau.”

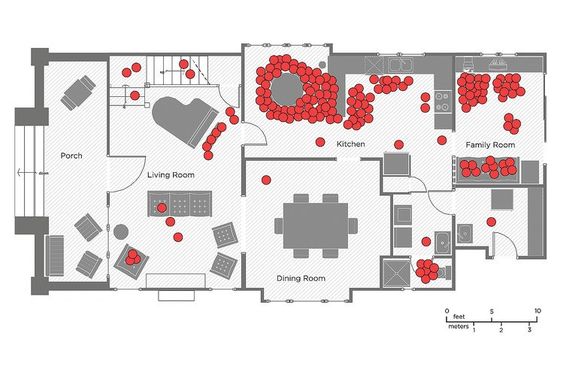

It wouldn’t be so bad if people used ALL the rooms in their McMansions; but it’s not even close. A team from UCLA completed a remarkable study. Newsflash: wW spend an inordinate amount of time in the kitchen and T.V. room.

The rest are magnets for clutter and expensive upkeep.

Source: UCLA

According to Steve Adcock, author of The Get Rich Slowly blog:

“The findings were not pretty. In fact, they helped prove how little we use our big homes for things other than clutter. Most families don’t use large areas of their homes — which means they’ve essentially wasted money on space they don’t need.”

Many realtors and mortgage brokers compound this problem by encouraging people to borrow as much money as possible to buy the biggest house they can supposedly afford.

The parallels to investing are striking.

The bigger the house, the more stuff can go wrong; the same is true for investments. Owning a bunch of individual stocks or mutual funds designed to “beat the market” bring its own set of problems.

Do you really have time to read 50 annual reports or pay attention to the personal lives of active stock fund managers?

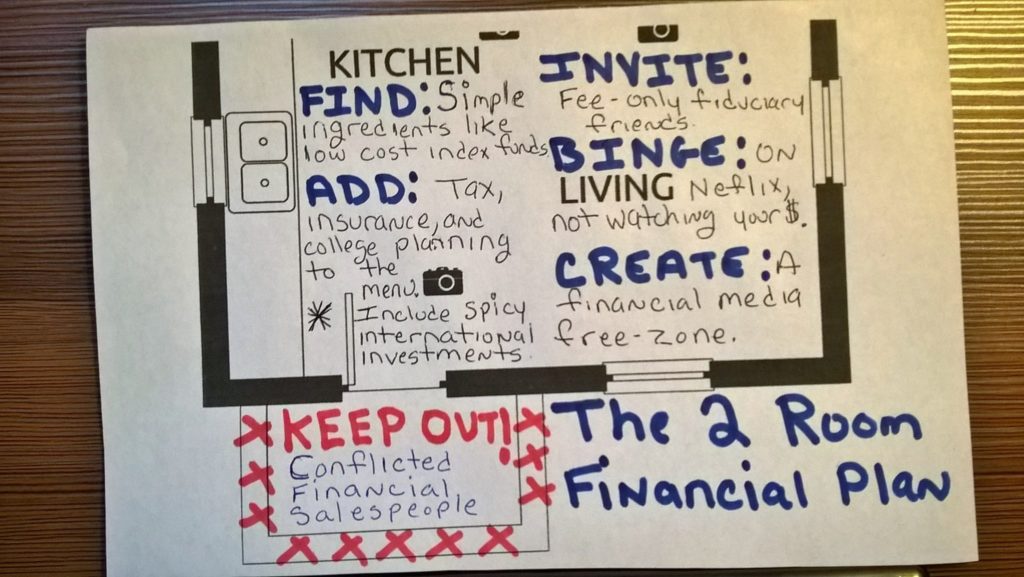

If the answer is no, downsize to a few inexpensive, diversified index funds and save yourself time, money and aggravation.

Smaller homes are easier and cheaper to clean. The same is said for rebalancing a portfolio of index funds; no worries about finding buyers and sellers. The same cannot be said if you clutter your plan with non-traded REITs or individual junk bonds. Good luck finding a cleaning service when the sh@t hits the fan.

Hefty taxes are a feature of giant homes. Unlike most mortgages, property taxes increase annually. The same is true for high-turnover portfolios. A manager with a mandate to beat the market uses relentless trading in his futile attempt to reach his goal. Like a highly taxed home. this becomes a wealth transfer. Instead of paying the government you pay an investment company that doesn’t provide schools, roads, and bridges.

Ego gets in the way of deliberating on a home purchase. “Wouldn’t it be great to impress my snooty brother-in-law with my media room and jacuzzi?”

The same holds true for investing; owning a hedge fund may increase your popularity at cocktail parties. But, there is a good chance it won’t beat a boring index fund.

Understand most of your friends couldn’t care less about the size of your home or portfolio. If they do, it might be time to find new friends.

Keeping with the two-room theme, how about if your investment blueprint looked something like this. (I think my penmanship is improving from a low base.)

Minimalize your home and your finances.

Time is your most precious commodity. Don’t waste it cleaning your gigantic house or worrying about investments you don’t need.

Sources: “Why the American Dream of owning a big home is way overrated, in one chart” by Shawn Langlois, MarketWatch, and “Don’t Let Ego Make You Buy A Bigger House Than You Need”, Financial Samurai