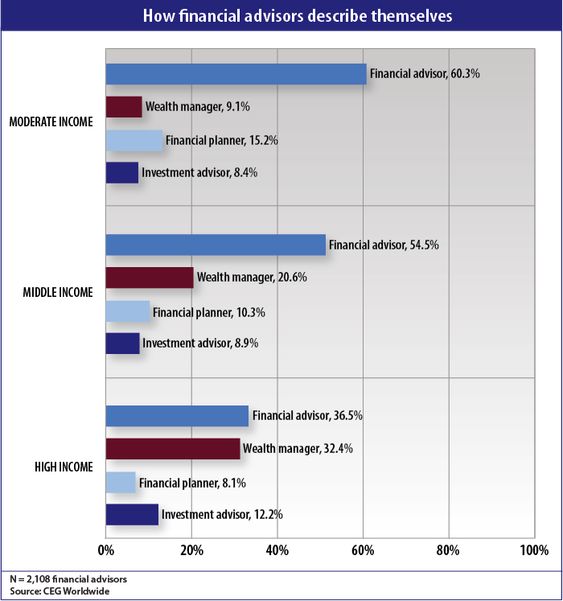

ONLY 6.6% of financial advisors practice true wealth management.

What in God’s name do the other 93.4% do?

This is according to a study conducted by CEG Worldwide. (No relation to Prestige Worldwide, though many people have portfolios that could have been created by the Step Brothers.)

Who is steering your financial boat? It turns, more investors have “advisors” out there who ARE NOT:

1. Using a consultative process to establish close relationships with clients to gain a deep understanding of their goals and their most important financial wants and needs. (Unless a cheap free meal followed by an aggressive sales pitch is the best way to understand someone’s retirement goals).

2. Offering customized choices and solutions designed to fit each individual’s needs. This might include investment management, insurance, estate planning and retirement planning. This does not mean cross-selling products. Financial salespeople often find expensive proprietary products like whole life insurance and security-based loans to fill their quota gaps.The only customization that goes on here is investors will end up paying as much as humanly possible in unnecessary fees based on assets, income and their level of financial illiteracy.

3. Delivering these customized solutions in close consultation with the clients and their other professional advisors. Wealth managers collaborate with clients and their other professional advisors to identify clients’ needs and create custom solutions to meet those needs. Often financial salespeople let years go by without contacting their clients; unless, of course, they have something new to sell them.

Think about this, only about 6% of clients are actually receiving what they really need from a financial advisor.

The SEC is currently thinking about forcing financial salespeople to disclose themselves as just that, salespeople, to prospective clients. The only way they could label themselves as anything to the contrary would be if they agreed to abide by a strict fiduciary code of conduct.

We could not agree more. Take a look at how salespeople use misleading titles to mask their true intentions.

What are unsuspecting clients left with?

Certainly not wealth management practitioners.

There are many charlatans. These are people who unashamedly lie to the public. There is a wide range of these characters. We can go from 2006 private REIT peddlers, who promised high returns without volatility; to 2018 Initial Coin Offering shams, that offer riches without sacrifice, hard work, or knowledge. Return without risk is their siren song. Often, we do not hear this term to describe these culprits. Famed investor, William Bernstein, provides a good reason. “The reason that ‘guru’ is such a popular word is because ‘charlatan’ is so hard to spell.”

Next in line, are false prophets. These guys make a living by boasting about their supernatural ability to predict the future. This is complete B.S., but it is an excellent marketing technique. (Think of stock price targets, three-month S&P 500 forecasts priced all the way down to three decimal points, and the obligatory market crash calls.) Listening to the blathering of prophets of doom has cost people more money than if there had been an actual market meltdown.

Finally, we have the core group: the mercenaries. These are the people who have no interest in data, market history, behavioral finance, or lifetime learning. They are simply in the business to make money. The product they hawk is of no consequence. Collecting a $20,000 commission on a $200,000 complicated variable annuity product fits the bill perfectly.

Some may say we are exaggerating. If anything, we are understating this problem. We travel way off the reservation each week, speaking with hard-working, middle-class American public servants. High-commission financial garbage is a feature, not a bug, in their world.

If your current advisor is not fulfilling their duty as a real wealth manager, we would love to hear from you.

In the meantime, try to keep away from the Goon Squad.

Stay safe out there.

Source: Are You Really a Wealth Manager? by Jonathan Powell, CEG Worldwide