Investment fees slash and burn retirement portfolios returns like napalm dropped on a jungle.

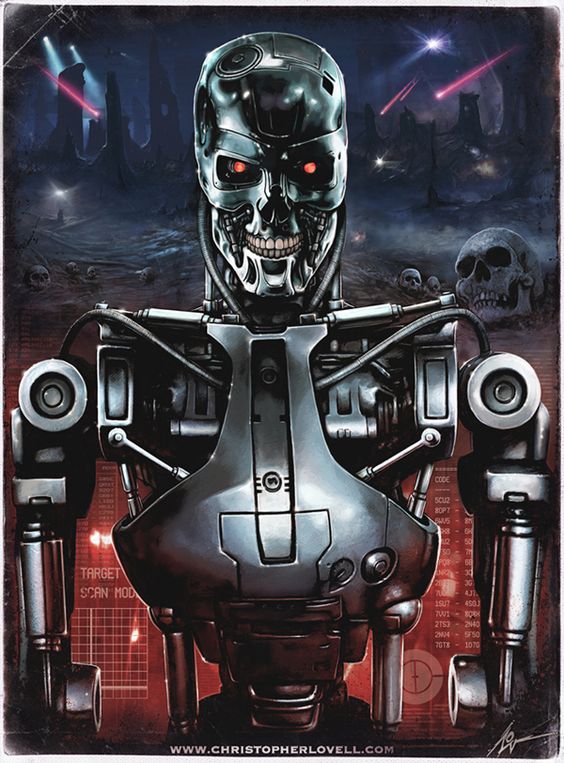

In the words of Kyle Reese, describing the relentless Terminator from the classic 1984 film:

“You still don’t get it, do you? He’ll find her! That’s what he does! That’s ALL he does! You can’t stop him! He’ll wade through you…

Listen, and understand. That terminator is out there. It can’t be bargained with. It can’t be reasoned with. It doesn’t feel pity, or remorse, or fear. And it absolutely will not stop, ever.”

That is what conflicted financial salespeople do; they stop at nothing to put you in an investment that you don’t need and they make sure you grossly over pay for it. They will stop at no account, no matter how small, no matter who owns it.

This is no exaggeration. I wish it were.

Last week, we met a prospect who symbolized everything that is wrong with this business. The perpetrators of financial exploitation need to be exposed and punished.

Things started with the usual suspects, a public school teacher’s 403(b) portfolio. This was filled with high-cost variable annuities with annual fees totaling in excess of 2%. That certainly is enough in and of itself, but it gets worse.

Next, we looked at her husband’s Rollover IRA account: jammed with several indexed-annuities. These monstrously complicated and expensive products are SOLD to unknowing investors as “stock market returns without the risk.” If this truly existed, the other investors would be the tooth fairy, Santa Claus, and Bigfoot.

These particular products “eat” the first 10% of a market decline. Corrections of 10% are a feature, not a bug, for stock markets; if these common draw-downs scare you so much, investing in the market is a bad idea.

Furthermore, this very expensive and complex “insurance” feature offers little protection from much more severe 50% (or more) portfolio-ravaging bear markets.

The story gets worse.

“Are you currently investing in your 401(k)?”

He replied, “Yes, I am a very aggressive investor who likes to put the pedal to the metal.”

“Okay then; do you realize you are paying an excessive amount in your rollover account for protection against market declines that you just told me don’t bother you?”

I showed him the surrender charges on these products and described how that was what the salesman collected in upfront commissions.

He was embarrassed and angry but he realized the logic of my arguments. We see this again and again; smart people sold unnecessary products due to their lack of financial literacy. In this case, the victim has a highly specialized advanced degree and is very successful in his career. Obviously, he is a pretty bright guy but intelligence doesn’t guarantee protection against an unscrupulous salesperson.

The conversation turned to insurance. No need to wait for an answer. Yup, the same person also sold them some whole life policies; what a surprise!

Their data sheet displayed their children each had individual policies.

“Do you realize that since your children produce no income that you are dependent on, these policies are unnecessary?” I asked him, “Are your kids both child stars who are supporting both you and your wife?”

The answer was obviously no.

“Why did the salesperson say your children needed these policies?”

He replied, “They would be a great way to save for college.”

Unfortunately, this is not an isolated example. We can predict what products people own based on who is currently managing their assets.

The story has a happy ending. We are able to save this nice family trying to do the right thing from the salivating jaws of financial predators.

The bad news is there are millions of other families like this out there who will not end up so lucky. In fact, they have no idea what is being done to them and as time marches on the damage compounds.

Much more needs to be done to stop financial predators from applying the axis of evil of financial exploitation: high-fee products for retirement, insurance needs, and college savings.

Like the terminator, they won’t stop unless you destroy your financial relationship with them.

Rise up against the fee machine and take back your finances. We can help you with this.

When financial salespeople say jump, don’t ask how high; just say GOODBYE!