Investing-speak from the mouths of babes.

Dina and I are referred to as “the money people.” This is the term sixth and seventh graders use when they ask their teachers when we are coming back. We have certainly been called worse. I am sure the AXA representative could think of some other choice words to call us (he was met the other day by an enraged mob of teachers we “alerted”).

We have visited several classrooms this year and have decided to take a different route. We are there to pique the student’s interest. The idea is to get them to talk about money issues that THEY are interested in.

We handed out index cards at the beginning of class. The students were instructed to write down a question or comment that concerned them about money. We prompted them with suggestions.

“Do you frequently hear a word on Shark Tank and you don’t understand what it means?” Another prompt was, “Do your parents ever speak about mortgages or credit cards and you know it is important, but don’t know why?”

We also gave them a second index card that we collected at the end of the period. The class was instructed to write down something that they learned from our 40-minute two-way conversation (not monologue). It is always better to speak to kids rather than at them. This also holds true for adults.

I was amazed by the quality of some of the questions:

- What percentage of your income goes to taxes?

- What is equity?

- Why does money have that weird smell? (my personal favorite)

- Can you invest at any age?

- How can you trust a bank?

- How do credit cards work and how do you use them?

- What happens when you declare bankruptcy?

- How do you earn money at a young age?

- What was the first known type of currency?

- Why is money green and not red? (never gave that much thought)

We patiently answered their questions and tried to give them examples they could understand. We gave them things to think about:

“How could you make money from all the adults wasting their time on Facebook?”

This lead to investing concepts like buying stocks in companies instead of the products they sell. Often these conversations take strange, yet productive turns. Looking at the second index cards, we found out the students learned a thing or two.

- I learned that you can get arrested for not paying your taxes and that taxes go to pay for roads, bridges, and schools.

- The government raises taxes on items that are bad for you like cigarettes.

- A good accountant can help you save money on your taxes.

- Having self-control can help you in the long run.

- People who make their money illegally ask for only cash.

- I learned saving money is harder than spending it.

- I learned what immediate gratification is.

- I learned a mortgage is what you pay from what you borrowed.

- I learned the importance of a credit score.

- I learned about mortgages. I want to have a mortgage I guess? (Hmmm, buy a house but have to borrow tons of money – let me think about that.)

- I learned about Warren Buffet, the Stock Marketer. (best description of him, ever)

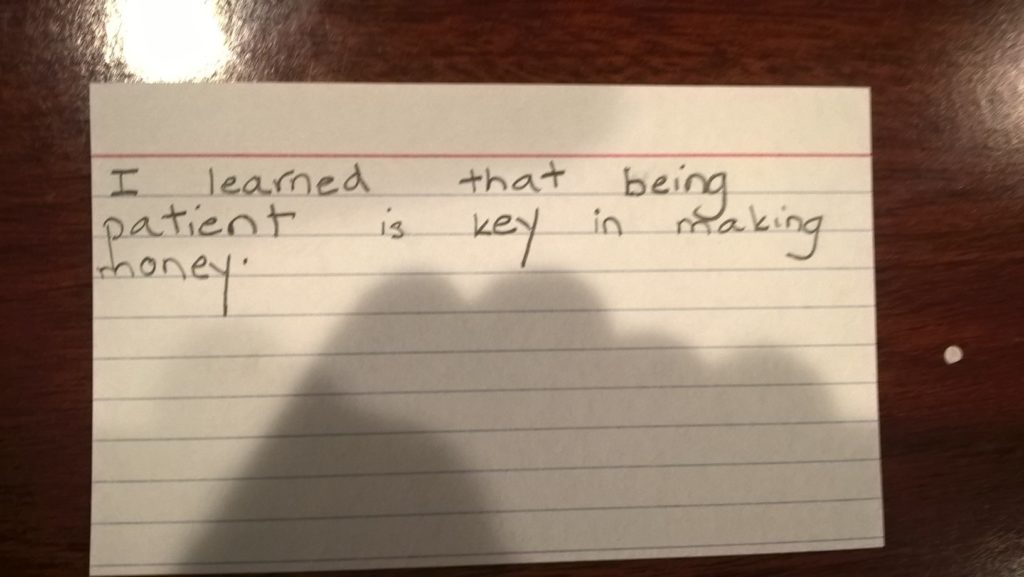

- I learned that being patient is the key to making money. (future multi-millionaire and client)

Imagine if public school teachers facilitated discussions like this on a daily basis in classrooms around the country? There are many reasons this is not done. The biggest one is most teachers do not know anything about money themselves. This is why our 403(b) program is something much bigger than us. If we can educate teachers about investing and good financial planning, they can pass this on to their students. This becomes a virtuous cycle rather than the death spiral we currently observe.

We just wish there were a lot more “money people;” our nation’s students and their teachers desperately need them.

Let us know if you want us to help a local school and their teachers.

There are few subjects more important to our children.