Acknowledge, allow and accept. This advice will help you to endure the inevitable pain caused by the next bear market. Experts in the centuries-old practice of meditation have a formula for suffering.

S = P x R. The amount of suffering you experience is equal to the actual Pain (P) times the mind’s Resistance (R) to the pain. So, S = P x R. The idea is to stop resisting the pain to lessen it. Since anything that is multiplied by zero equals zero, you see where this is going.

The quicker you realize market corrections and bear markets are not “bugs” in the financial system, the happier you will be. Acceptance of these facts is critical to creating your own form of Advil for financial pain, without the ulcer inducing side effects.

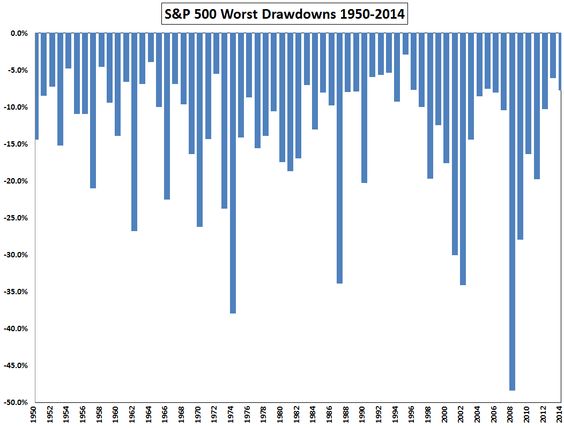

My colleague, Ben Carlson came up with this terrific chart showing the constant pain you must endure to be a successful stock investor.

Looking at Ben’s chart, we can see stock investors absorb a lot of pain on the road to building wealth. The wrong question to ask is: “Will I experience pain by investing in stocks?” The right question sounds more like: “How much is it going to hurt?”

This brings us back to our formula. The only sane response to stock market bedlam is to accept it. If you resist, you will just multiply your suffering exponentially.

The question then becomes, “How can I resist my urge to jump out of a window or sell all my stocks when the bear begins to growl?”

Though despite what the equation says (remember, investing does not work well with cute and neat formulas), you most likely will not be able to eliminate all the pain of the temporary decimation of your well-crafted portfolio. The idea is to limit the agony by not making things worse by fighting against the natural laws of the market.

Here are some tips on how to acknowledge, allow and accept that bad stuff that happens in the stock market. In other words: learn to love the bear.

If you are a long-term investor, do not become a short-term resistance trader when things are looking like they are falling apart. The market tends to go up over time. Short-selling stocks is not the way to wealth and happiness for 99.9% of us.

The wrong time to buy insurance is after your house has burned down. The same goes for stocks. Market corrections are normal. The cost of insurance as a form of after-the-fact resistance will only increase your pain when the market eventually recovers.

No matter what you might think, nobody that you watch on T.V. can stop a plunging market. Allying yourself with pundits who are looking out for themselves, rather than you is a form of resistance that will only increase the torture.

Do not start investing like an 80-year old pensioner when you are 35. Putting all of your money into bonds and cash because you are upset with current volatility is not a good strategy. Resisting a bear market with “safe” investments will make your long term pain terminal rather than temporary.

Resist changing your long-term strategy. Think of a football game. I doubt the New England Patriots would think of putting Tom Brady at defensive end just because they were losing at halftime. The same goes for your portfolio. A drastic change caused by frayed nerves is a form of resistance that is guaranteed to fail.

In the words of the Buddha, “When the uninstructed experiences a painful feeling, he feels two things – a bodily one and a mental one…When the instructed noble disciple experiences a painful feeling, he feels one thing; a bodily one, and not a mental one.”

The temporary decrease in your portfolio cannot be helped. How you react to it can.

Resistance is futile. Embrace the suck.

Source: The Mind Illuminated by John Yates, and Matthew Immergut with Jeremy Graves