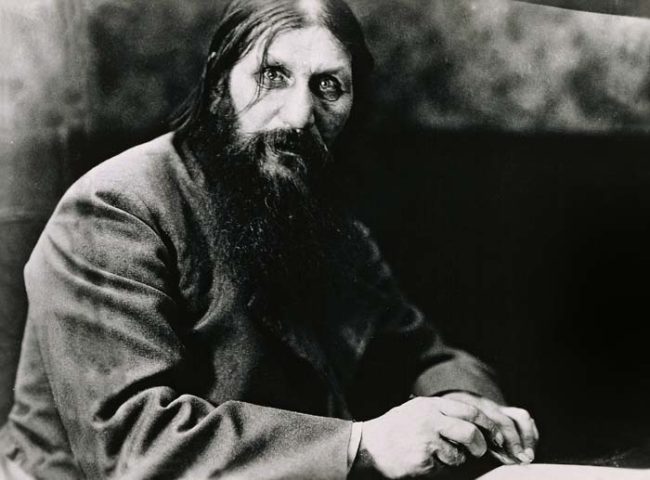

“We have met a man of God today”- Czar Nicholas II

The 401(k) plan is the poster child for the law of unintended consequences. The unanticipated and unintended effects of its ascension as the heir to the traditional company pension plan has changed the way Americans save for retirement; many would say, not for the better.

Being a former history teacher, I try to steer away from the dry concepts of economics. Putting a human face on things makes stories much more memorable and interesting.

Grigori Rasputin was known as the “mad monk.” This former peasant arguably became the most powerful figure in the Russian Empire by 1915. How did this wandering peasant and self-styled “holy man” gain such out sized influence?

The law of unintended consequences can answer this question. Czar Nicholas II and Empress Alexandra had a son, Alexis, the heir to the throne. Alexis, due to the various in-breeding of monarchs during this time, was born with hemophilia. This disease prevented the boy’s blood from clotting and Alexis could die from a minor childhood scrape.

In 1905 Rasputin appeared and promised the royal couple he had magical healing powers and would save their beloved son from a near-certain early death. Rasputin delivered. When he was not participating in orgies or insulting the nobility, he stopped the boy’s bleeding on numerous occasions and soon became a fixture in the royal household.

Eventually the Czar and his wife started to believe that Rasputin’s seemingly “magical” powers would carry-over on a national level. In 1915, Czar Nicholas took control of Russia’s disastrous World War I adventure. The Czar was completely incompetent at this task and did not help his case by leaning on the advice of Rasputin, who knew even less.

Predictably, the jealous aristocrats rose up and killed Rasputin. The Russians dropped out of the war after agreeing to give up a large section of their empire to Germany. The Czar and his family were later executed and Russia was thrown into civil war.

This led to the rise of Communism, which often made the former Czars look like humanists when compared to the genocides committed by the likes of dictators like Joseph Stalin.

Bringing Rasputin into the royal fold, to solve an individual family problem, eventually helped lead to the demise of an entire system; an unintended consequence.

The 401(k) may be our nation’s version of Rasputin. It was created by a 1978 decision by Congress to change the tax-code at line 401(k), so top executives had a tax-free way to defer compensation from bonuses or stock options according to The Wall Street Journal’s Timothy Martin.

Eventually this small tweak to the tax system, which was meant to benefit a minuscule portion of the populace, came to replace the guaranteed pension system. Over the years it became the dominant way Americans save for retirement.

Just like Rasputin’s so-called “magical powers,” people were told “they would have enough to retire if they put away just 3% of their paychecks in a market that rose 7% a year.”

While not as bad as Russia’s World War I debacle and the following socialist contamination of their economy, the results of this retirement experiment leave much to be desired.

Workers were given no financial training and told to jump in and manage their own money; which is kind of like me being given the responsibility of wiring the electricity in my house when I am barely capable of changing a light bulb.

Worse yet, many plans were turned over to financial sharks who often defined the word “price gouge” in their implementation of the investment options for many financially illiterate workers.

In lieu of having a predictable pension, unprepared and financially uneducated workers were now shouldering the responsibility of creating their own retirement portfolios, which often came with the assistance of conflicted investment advisers.

It should come as no shock that, according to the National Institute on Retirement Security, currently 45% of all households have a grand total of zero saved for retirement!

30 million workers do not even have access to any type of company retirement plan.

As our CEO Josh Brown stated, people should be talking more about the wealth gap, rather than the income gap.

According to The Wall Street Journal, “For people ages 50 to 64, the bottom half of earners have a median income of $32,000 and retirement assets of $25,000, according to an analysis of federal data by the New School’s Schwartz Center for Economic Policy Analysis in New York…while the top 10% make $251,000 and have $450,000 socked away.”

When Czar Nicholas was told Rasputin had become too embedded in the intricacies of public policy and the system was not working, the Czar supposedly said, “There is nothing I can do about it.”

America cannot afford to mimic the actions of an inept Russian Czar relying on the advice of a sex-crazed, drunken mystic.

[…] ‘The 401(k) Road to Serfdom’ – Anthony Isola – A Teachable Moment […]