Student loan debt recently surpassed one trillion dollars. Many private and public universities are contributing to this spiraling problem by massively overpaying hedge funds to manage their large pools of endowment funds. To make matters worse, they are often receiving returns that are inferior to almost zero-cost index funds.

Hedge funds are often looked at as investments that provide safety in times of market turmoil. Providing steady returns that are uncorrelated to the direction of the overall market. It seems many schools are receiving uncorrelated returns. Unfortunately it is not the type that benefits their investments or their students.

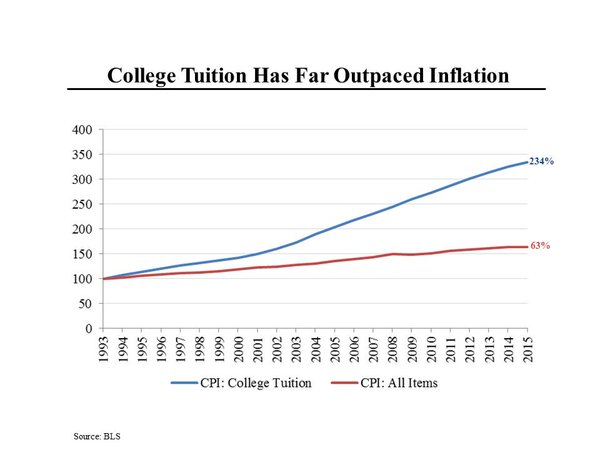

University tuition has been increasing while endowment returns have been decreasing compared to general market indices. This double whammy means schools will have less aid to give to students due to lower returns and high hedge fund fees. This is not a sustainable business model. The charts below show how this relationship has played out over the past several years.

:

Source: A Wealth of Common Sense

In a ground breaking article in The Nation, by Astra Taylor, the underbelly of this beast has been exposed. Over $100 billion is invested in hedge funds by university endowments. These funds generate an astonishing $2.5 billion in fees!

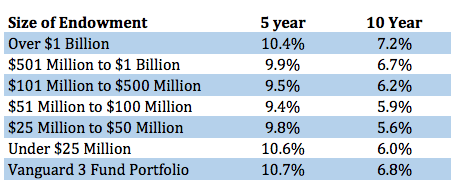

As my colleague Ben Carlson points out in his terrific post Bogle vs. Goliath, a simple three index fund portfolio would have outperformed the majority of these hedge fund heavy endowments at a fraction of the cost.

This money could have been used to send more deserving students to college, lower tuition, or reduce student debt. All three of these choices are far superior to financing a hedge fund manager’s purchase of a 100 foot yacht or his cosmetic surgery!

Taylor’s article points out another delicious irony: Shamelessly, some of these hedge fund managers toss the schools a bone by making a donation to the institution. In return for returning a small portion of their grossly overpriced fees, these guys get a building named after them and general kudos for being a mensch. This would actually be quite funny if the consequences were not so devastating.

Taylor also points out the outrageous conflicts of interests on many endowment boards:”One 2011 survey showed that 56 percent of endowments allowed board members to do business with the university. In 2013, Dartmouth came under fire when it was revealed that some trustees—including Stephen F. Mandel Jr., who was both chairman of the board of trustees and head of the hedge fund Lone Pine Capital—also managed investments for the school.”

On top of all this, many schools do not understand how to properly position hedge funds in their endowment portfolios. My colleague, Ben Carlson also points out in his post:

“Institutional funds can hold anywhere from 50 to in excess of 100 different money managers. This is a problem on a number of fronts.

First of all, the due diligence and monitoring costs for a portfolio with this many managers can be enormous. Not very many funds, even at the institutional level, have the resources, expertise or operational capabilities to oversee that many managers. Second of all, throwing a bunch of different funds and strategies into a portfolio is not exactly diversification — it’s a form of phony diversification.”

Let’s sum things up. Many endowments are grossly over paying for inferior returns. Most endowments have no clue how to implement, understand or monitor these funds. Finally, their students bear the cost through higher tuition and unmanageable debt which inhibits our nations’s economic growth.

This is not to mention the fact that poor endowment returns could possibly have a negative effect on future donor contributions. After all, most rich people do not like to give to organizations when they feel their hard earned dough is being wasted.

To be fair, there are a select group of schools where a hedge fund based strategy makes perfect sense. They have the personnel and expertise to gain access to the small group of managers that actually add value to an endowment portfolio. It also helps these schools have huge amounts of money to overcome the very high minimum investment that this select group of managers demands.

In the words of the famed endowment manager, Yale’s David Swenson, “The framework of the Yale model applies only to a small number of investors with the resources and temperament to pursue the grail of risk-adjusted excess returns.”

Translation: this strict criteria rules out about 95% of current endowments regarding implementing a multi-hedge fund strategy over low-cost index funds.

Endowment funds, just like retail investors, need to be educated about their low probabilities of success when they use high-fee investment products. More importantly, they need to be made aware that options are available for them that benefit all stake holders, not just overpriced Wall Street guys wearing suspenders.

Until this happens I am afraid Malcolm Galdwell sums up the current situation pretty well. He states, “I was going to donate money to Yale. But maybe it makes more sense to mail a check directly to the hedge fund of my choice.”