It is no coincidence that investment products that pay out high commissions are often near the top of the list regarding financial misconduct. The temptation of high monetary rewards is a tremendous incentive to cheat.

This could apply to brokers pushing clients into high-fee Class A funds when a simple index fund would do the trick. Insurance products are prime candidates for deceit.

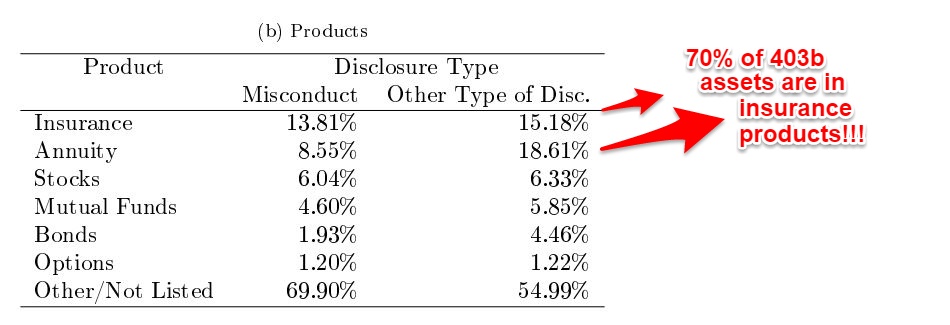

It was no surprise a recent study found insurance products at the top of the list for financial misconduct. With double digit up-front commissions on products like variable annuities, these finding should only shock people who have been living under a rock for the past few decades:

This data, provided by Michael Batnick of Rithholtz Wealth Management, is pretty damning toward the insurance industry as a whole, and teacher’s 403(b) plans, in particular.

This data, provided by Michael Batnick of Rithholtz Wealth Management, is pretty damning toward the insurance industry as a whole, and teacher’s 403(b) plans, in particular.

If one looks at the data, it is clear investors will have a much greater probability of becoming victims of financial misconduct if they purchase an insurance product rather than just a plain vanilla mutual fund.

What is more disturbing is the impact of this study on teachers’ retirement plans. In simple English, they have a much higher probability of being screwed over than most.

Why is this the case? The answer lies in the fact that about 70% of teachers’ 403(b) retirement assets are held in insurance products, like fixed and variable annuities.

In effect, they have the worst of both worlds. They own the product that has been proven to have the worst track record in regards to instances of financial misconduct.

On top of this, insurance products are often the default investment in the lineup of 403(b) options. Based on these numbers, teachers have about three to four times a greater chance of falling victim to financial fraud than the average investor!

Here is the financial formula that is the rule in retirement plans for most K-12 public school teachers.

Perverse Sales Incentives + Complicated Non-Transparent Insurance Products = X

X = Victim of Financial Misconduct by a Sales Agent

Though many teachers can guide their students through complicated mathematical theorems regarding calculus, they are baffled by this simple equation.

Though they are very bright people there are no clear transparent rules for their retirement plans, like those found in their teachers’ editions math textbooks.

Their retirement plans come with no answer sheets in which they can check their work. Instead, all they will find are numerous conflicted parties and salespeople highly skilled in double speak.

These are not the raw materials to solve any type of problem, especially those that are financial in nature.

The odds are stacked against public school teachers receiving a fair shake in their retirement plans. Unless some form of fiduciary responsibility is placed upon their employers, or third part administrators, regarding teachers’ investment choices, this problem will only get worse.

Perhaps one day teachers’ plans will make it onto a list not involving financial misconduct. It would be nice to see them at the top of the class instead of on the retirement plan version of America’s Most Wanted.

[…] I have stated here, here, and here, financial predators have used these products to infect 403(b) platforms […]