Who knew that the key to making money is buying high-fee mutual funds with sales loads?

Contrary to data and common sense, high-fee products generate the best returns over the long term, according to Jared Dillian’s article, “Sure, everyone loves low mutual fund fees. But the fee wars will encourage bad behavior.” Dillian contends that high fees are good because they serve to control our worst impulses.

“Sort of lost in the whole discussion about expense ratios is that there are still a lot of mutual funds that charge significant sales loads — fees paid when you buy or sell a fund — usually to pay for marketing and distribution. One might ask why someone would pay 4.5% off the top with no discernible difference in the quality of a fund. But fees on investment products can actually be good. Sometimes, such as with high commissions on stock trades, the sales loads ensure that investors are much less likely to churn their funds if they have to pay 2% to 5% each time they want to get in or out.”

Dillian also believes, “With the exception of Warren Buffett, the evidence on buy-and-hold investing is somewhat mixed.”

What should John Q. Public do?

“Based on my own experiences, investors who held a somewhat narrow portfolio of individual stocks for a period of decades have done the best. Out of any basket of 30 or so marquee large-cap companies, there is bound to be one Apple Inc. or Amazon.com Inc.”

Finally, Dillian does some serious hating on Vanguard and their low-fee indexing approach.

“I have always been of the opinion that investors have done best in high-fee products with high transactions costs, bought and held over time, which are a built-in form of “advisor alpha.” I will change my mind when I meet my first Vanguard customer who is a billionaire.”

So there.

Is Dillian correct?

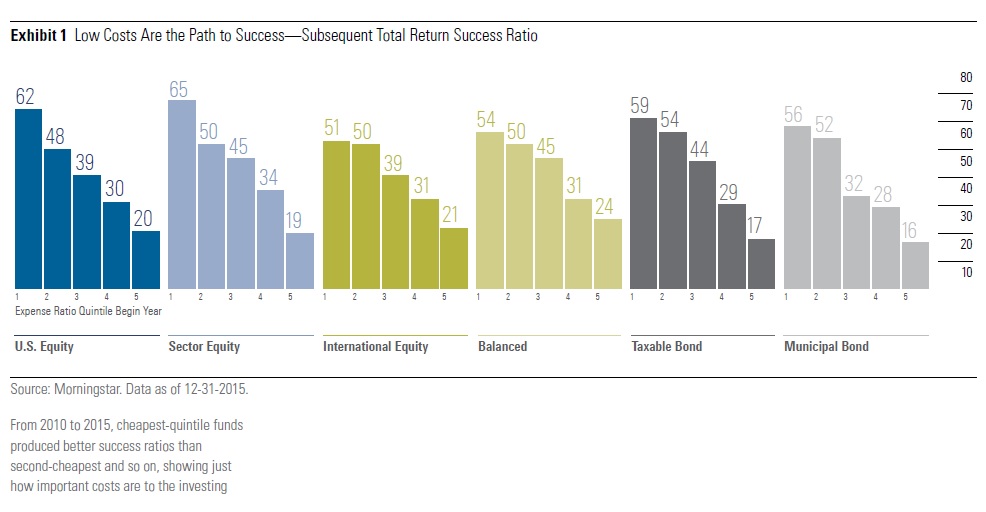

Morningstar did a famous study on the effect of fees on mutual fund performance. Their conclusion: “The expense ratio is the most proven predictor of future fund returns. We find that it is a dependable predictor when we run the data. That’s also what academics, fund companies, and, of course, Jack Bogle, find when they run the data.”

Strike one!

Dillian believes the only thing stopping investors from trading stocks like chimpanzees on amphetamines is a 5% sales charge. Does this pass the smell the banana test?

Would the author agree to double the cost of a home purchase because the overpriced mortgage will keep you from moving?

Since 2007, the average holding period for Vanguard’s easy-to-trade ETFs is 34 months. Vanguard mutual funds clock in at 42 months. Columbia’s Blue Sky Blog reports over a similar time period the average holding period for all funds is 15-17 months. In other words, Vanguard’s low-cost $4 trillion-plus in assets are held for LONGER periods than much pricer active funds.

Strike two!

How does the idea of buying and holding a concentrated group of individual stocks hold up?

According to The New York Times:

“Only 4 percent of all publicly traded stocks account for all of the net wealth earned by investors in the stock market since 1926. A mere 30 stocks account for 30 percent of the net wealth generated by stocks in that long period, and 50 stocks account for 40 percent of the net wealth.”

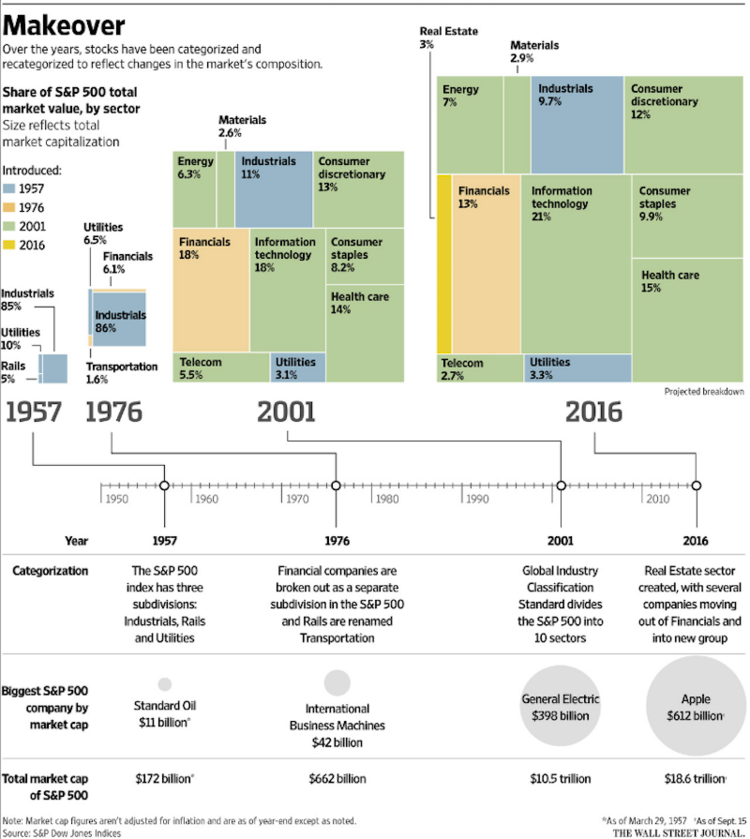

In addition, the S&P 500 has changed drastically over several decades. There is an excellent chance a stock purchased years ago is no longer in existence or considered to be blue-chip quality.

General Motors or Enron, anyone?

Strike three!

There are no billionaire Vanguard investors because Dillian has never met them?

Maybe Dillard would like to debate Warren Buffet on the “mixed evidence” for the buy-and-hold low-cost index fund crew.

“Consistently buy an S&P 500 low-cost index fund,” Buffet told CNBC’s On The Money. “I think it’s the thing that makes the most sense practically all of the time.”

If your advisor recommends a strategy centered on high investment fees, it’s time to find a new advisor.

High-fee funds are not the solution for your retirement dreams unless you are the broker selling them.