Investing is difficult for most people.

This doesn’t mean they aren’t smart, successful, or nice. Nobody ever taught them. Emotions and commission-hungry financial salespeople fill the vacuum.

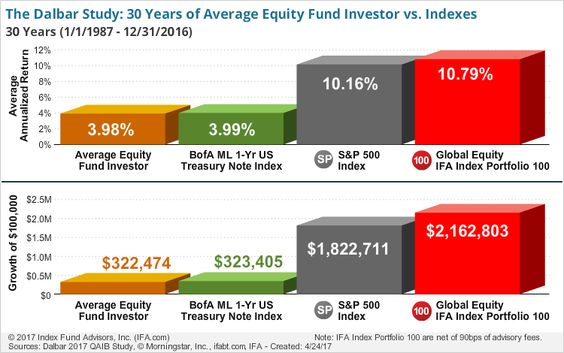

Experience verifies this point. We see the worst of the worst on a daily basis; don’t take our word for it, look at the data.

Many advisors foolishly let clients run the show. Kerosene doesn’t put out a fire. Tips, timing, and terror rack up commissions, but they are a nightmare for returns.

Some advisors are afraid to lose business, so they indulge any investment whims clients have.

Onboarding the wrong people, focusing solely on growing their assets and having no clear investment philosophy get advisors to this place. Disaster and defection are inevitable.

Advisors need to make it very clear: Some things are non-negotiable. Comprehensive financial planning is a two-way street. Cooperation and empathy are essential components. But, a hard line needs to be drawn in the sand regarding investment management.

Managing money can’t include Burger King’s mission statement; having it “your way” won’t work.

Clients have a choice of portfolios, not what goes inside them. Breaking this rule leads to chaos and worse.

In a firm but respectful way, potential clients need to know the following:

- You are not and will never be part of the investment committee. Trained professionals make decisions using a rules-based process that excludes emotion.

- You may take a small portion of your money and speculate. Good luck, you’ll need it. Better prepare yourself to accept the possibility of losing all or most of this money.

Adults are sorely needed in this industry. “No” is a huge part of any successful advisor’s vocabulary.

“Yes-men” placate clients; temporary appeasement leads to irreversible harm. This is a hard job. Prepare for people to walk away.

Clients desire to invest in things like the Iraqi Dinar, naked options, and penny stocks.

My answer never wavers.

“I am going on record. I am 100% against this extremely speculative and dangerous investment. If you insist on doing this, I will not assist you in any way. I do not want any association with this impending debacle.”

This usually puts the fear of God into them. We move on to more productive discussions, like college, estate, and tax planning.

Having a huge slug of GE in a client’s 401(k) plan is off limits, no matter how much they love the company.

My colleague Josh Brown says it best:

“Many investors will demand that their advisors change what they’re doing. ‘It’s not working!’ the squeakiest wheels will shout. Advisors will succumb and go looking for oil to quiet those squeaks. They will find snake oil and apply it liberally. This is the easy thing to do.”

“‘Give ’em what they want,’ is the paramount rule of salesmanship, not ‘make sure they understand what they need,’ which is much harder to pull off.”

We are interested in doing the right thing for the right people.

This includes removing democracy from our investing process; for our clients’ own good.