Plan for the dash – not the number.

While listening to a speaker at our sons’ new school, I heard something pretty interesting.

They are entering ninth grade and will be the class of 2017-2021. The speaker mentioned the goal of similar schools is to “prep” their students for college. The endgame: high grades and select universities.

This misses the point. These factors are important but ALL the experiences during these four years will shape their character.

Friendships, sports, clubs, trips, jobs, community service, and faith fill the dash. The dash is often ignored to concentrate on SAT prep classes and class rank. The journey is what students will remember, not what they received on their A.P. History test. Losing sight of this is very common and damaging.

Planning the venture and accepting the outcome, rather than focusing on FOMO (Fear of Missing Out), will make students wiser and happier people in the long run.

This brings us to retirement planning.

A thirty-year retirement will look like this numerically, 2017-2047:

- How much money will be there at the beginning?

- What is my “number”?

- How much will be there at the end?

- What is the expected inflation rate?

- How about average returns?

Nobody seems to be speaking about what is happening in the dash.

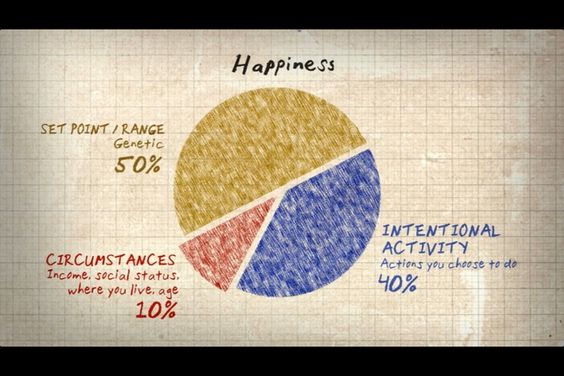

While these numerical questions are important, they are not everything. In fact, the dash will determine the quality of life; the happiness.

I missed the memo if there is anything more important than this.

The words of Daniel Egan cannot be stressed enough, “Don’t find purpose in money. Find money for your purposes.”

What should be included in the dash? How about these for a start:

- A second career, doing something you love.

- A plan to give money to your favorite charity, in a tax-efficient manner.

- Spending quality time with your best friends.

- Organizing and financing family vacations.

- Setting up college funds for your grandchildren.

- Buying the house in the place you always vacationed.

- Keeping as healthy as possible.

- Mentoring people who remind you of yourself forty years ago.

- Living in a community of peers. Don’t make yourself feel poor by comparisons.

- Staying away from negative and destructive people (and media).

- Traveling on a regular basis.

- Volunteering for something bigger than you.

All of these items elongate the dash line.

These are the reasons you saved and sacrificed your entire life. Terrific experiences and giving back will determine if your retirement is successful or not.

Huge amounts of time are spent making great sacrifices to grow wealth; the remainder is often devoted to worrying about depleting it.

Goal-based financial planning can break this endless loop of gloom.

If your financial plan is purely based on quantitative factors and leaves out the things that make you happy, it is time to get a new plan.

Graduating with a 4.0 G.P.A. with a minor in life misery is not a good long-term strategy.

Neither is accumulating a decent sized nest egg and being too frightened or stingy to enjoy life.

Either way, the dash loses – and so do you.

Doing stuff like this for people is in our DNA.

If you are interested in hearing more, let us know.