“Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.”

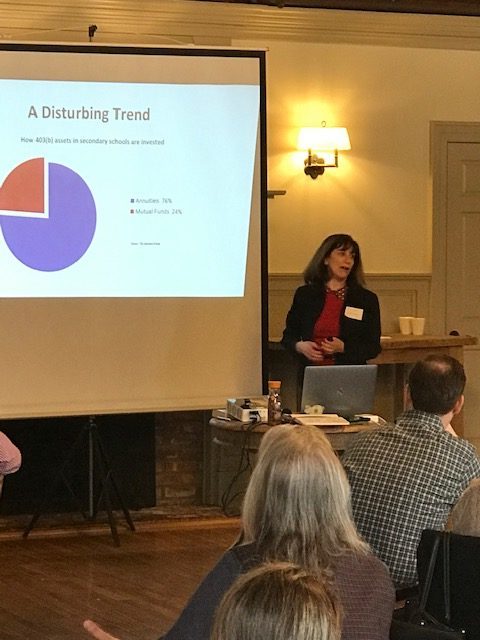

If teachers don’t understand why having an expensive annuity in their 403(b) is a horrific idea, how can we expect them to teach our kids about money?

We may have found the answer.

On Monday, we participated in a conference with the best financial literacy company on the planet, NGPF.

It was an all-day affair which included a terrific breakfast and lunch at The Oldfield Club in Setauket, N.Y.

NGPF’s co-founder, philanthropist Tim Ranzetta, believes nothing is too good for our teachers.

Many were shocked when their cars were valet parked; this is not the norm for a public school teacher conference. Tim generously pays the school districts’ costs for hiring substitutes for attendees.

Active learning took precedence. Movement and discussion were prioritized over sleep-inducing lecture;a lesson plan all public schools should follow.

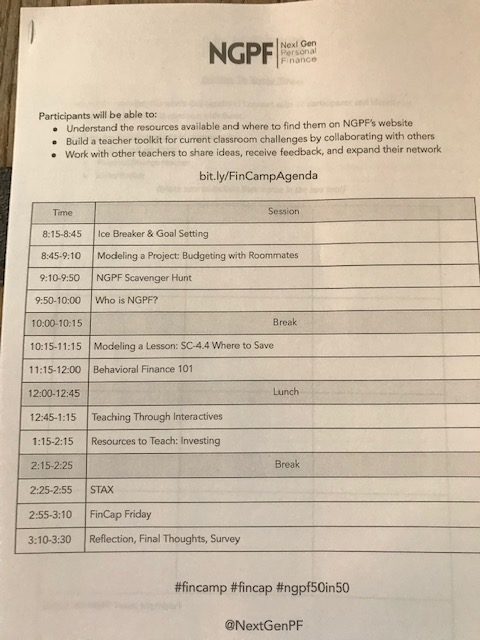

The agenda was filled to the brim.

The activities included passing around a jar of pennies and guessing how many were in the bottle.

We went around the room and surveyed the numbers. Then we did it again.

Two important conclusions can from this exercise: the average was pretty close to being accurate and people changed their original guess when they heard what their peers did. Lesson learned: Markets are efficient and people are irrational.

We watched a video that featured Warren Buffet extolling the virtues of a simple index fund. Not once did he mention a variable annuity.

Pieces of papers containing a stock symbol and the prior year’s return were handed out. We had the teachers line up in descending performance order to show them how index funds are created.

We played a stock market game that focuses on long-term performance, rather than ten-week noise. This is really cool; play STAX with your kids

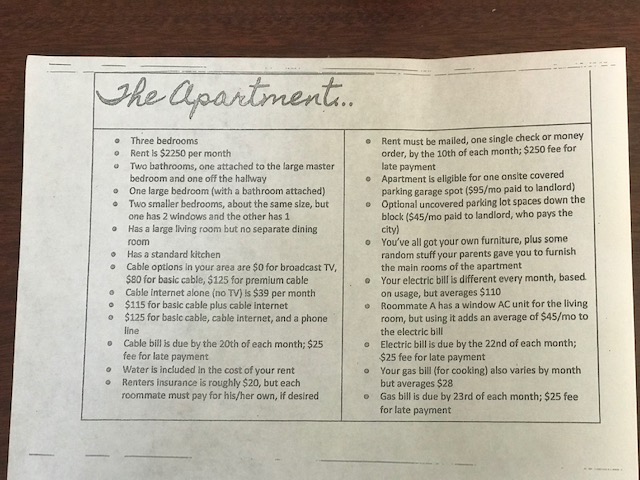

Teachers researched online banking rates and focused on creating budgets given specific spending needs.

Dina and I summed things up by pointing out all of the days’ lessons were useless unless it was applied to teachers’ daily lives.

We asked: Why don’t you own index funds in your own retirement plans?

We showed them the conflicted and exploitative reasons why.

Imagine if conferences like this were mandatory throughout our nation’s vast system of public education?

A well-informed generation of young investors would do wonders for our economy, not to mention eliminate billions in dollars paid to unnecessary fees in investors’ retirement accounts.

There has never been any great movement whose solution was not ignited by a small group of dedicated people. These two problems are no different.

The impact of teaching financial literacy is both immediate and generational and NGPF is on a mission to make that happen.

We are doing our best to help spread the word.