We buy too much stuff.

There are a multitude of reasons for our affliction of overconsumption. One of the biggest is Government Policy. Since World War II, our government has become consumerism’s biggest champion.

According to Lizabeth Cohen, an American History professor at Harvard:

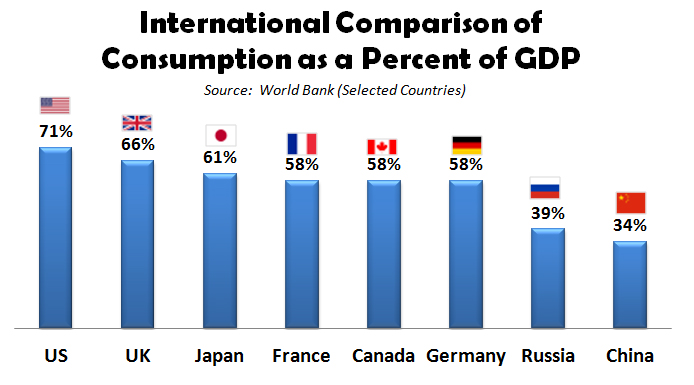

“Consuming has been a way of demonstrating that the economy and the society are continuing to be vital and viable,” Cohen says. “This is a real dilemma, I would say, today, where 70% of GDP is dependent on consumption … which does lead to a great dilemma around our growing awareness of environmental degradation that comes with these high levels of private consumption.”

Mass consumption functions as a way out of crisis or decline.

Source: Jobenomics

The unintended side effects of this policy are staggering. Clutter overruns our homes and the surrounding environment. Here are some mind-blowing statistics regarding our uber-wastefulness.

- There are over 300,000 items in the Average American home. LA Times

- 25% of people with two-car garages don’t have room to park cars inside them, and 32% have room for one vehicle. U.S. Department of Energy

- 3.1% of the world’s children live in America, but they own 40% of the toys consumed globally. UCLA

- Americans spend $1.2 trillion annually on nonessential goods. WSJ

- Americans spend more on shoes, jewelry, and watches than on higher education. Psychology Today

- Throughout our lifetime, we spend 3,680 hours or 153 days searching for lost items. The Daily Mail

- The average American throws away about 81 pounds of clothing yearly. The Saturday Evening Post

It gets worse, according to the Simplicity Habit, our clutter is playing havoc with our mental health. Women’s stress levels are directly proportional to the amount of stuff in their homes. 54% of Americans are overwhelmed by the junk, but 78% have no idea what to do with it!

It’s not only people who suffer from binge purchasing who suffer. We’re practicing the equivalent of environmental war crimes by killing our oceans with plastic refuse. Despite what you may think regarding your neighborhood recycling program, only 5.9% of plastic waste ends up recycled. The rest ends up in the ocean.

We have over $1 trillion in credit card debt, and most Americans live paycheck to paycheck. While many cannot afford basic needs, large groups spend too much money for the wrong reasons. I can’t help but think this needless spending would be better saved in emergency funds, paying down debt, contributing to charity, and funding workplace retirement plans, rather than deeming it necessary to own 25 pairs of shoes.

Nobody says you shouldn’t spend money and enjoy yourself. However, the stats above suggest we have taken this philosophy too far.

In the words of my colleague Ben Carlson,

I just find that when it comes to your finances, there is a liberation to limiting yourself where defining the things you won’t spend money on, won’t invest in, won’t pay attention to, or won’t waste your time on are often more important than the things you will partake in.

Prioritization is one of the best ways to both enjoy and save money.

This overspending crisis is a symptom of a deeper problem in many ways. If people were at peace with themselves and their lives, they would not feel the need to purchase stuff to make them feel better. Buying more only compounds the problem since it’s impossible to satiate this voracious appetite without constantly adding bigger and better items to the waste pile.

Outer riches are often a sign of inner poverty.

Clinging to and craving transitory, mindless consumption shouldn’t be the center of a goal-based financial plan.

Albert Ellis sums up our current dilemma. You never truly need what you want. That is the primary and thoroughgoing key to serenity.

Appreciating what you have instead of desire makes more sense than ever.