Passing a stress test isn’t what you think.

Stressing your portfolio with various forms of market mayhem to determine the success of your retirement is a small component of a successful financial plan.

The real challenge lies in not reacting emotionally to social media’s daily barrage of negativity and carnage.

Heisman trophy winner Travis Hunter found the ultimate winning strategy is to stop playing the social media game.

Hunter deployed a new game plan after various unpleasant incidents involving his relationship with fiancee Leanna Lennee.

Hunter explained his change of heart here.

“It’s bettered me. I live life happy. I walk around the house happy not having social media, watching YouTube, on the phone with my friends, playing a game with my friends, just having fun. I just have a different type of joy now, not having that stress.”

Investors could learn much from this talented 21-year-old.

Over the last couple of Mondays, the stock market was purportedly about to face two extinction-level events. First, an upstart Chinese AI company would decimate our tech behemoths by generating their own Chat GPT at a fraction of the cost.

The following week, President Trump imposed Tariffs on Mexico and Canada. Sunday evening, investors read specific social media feeds, bracing for a coming 1987-style crash or worse.

While anything can happen anytime, these two market killers proved to be much more bark than bite.

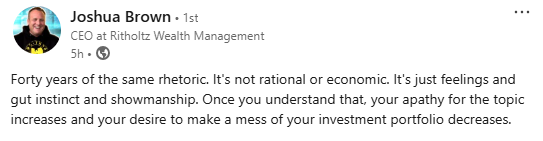

The good news is that there are many strategies for destressing, but they don’t include liquidating your portfolio and going 100% cash or gold coins. My colleague Josh Brown posted this terrific advice on LinkedIn regarding the endless drumroll of levying tariffs on friends and foes alike.

Though not common knowledge, Apathy is an investment strategy. Targeted Apathy counteracts social media’s four horsemen of the apocalypse: Repetition combined with generating fear, doubt, and uncertainty.

Ben Carlson takes on the cause of defending ordinary investors from their worst enemy: themselves. In his timely post, “Don’t Freak Out,” Ben waxes poetic about the dangerous game of unthinkingly following social media and others’ hysterical sentiments.

The media is going to overreact.

Politicians are going to overreact.

People on social media are going to overreact.

Your co-workers are going to overreact.

I know it’s easy to freak out when you see scary or uncertain headlines, but freaking out is not a strategy.

It never is.

While Apathy and not freaking out might not sound like appealing choices, the alternative is far, far worse.

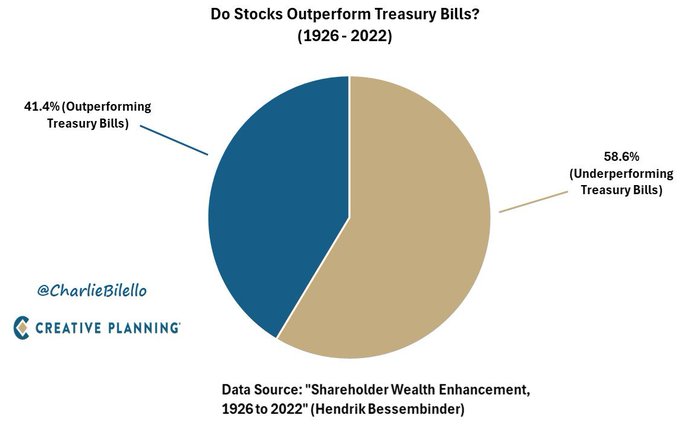

Picking stocks to capitalize on scary headlines is a loser’s bet.

If you don’t believe me, look at this pie chart. Over long periods, most stocks underperform Treasury Bills, which is not precisely a high-probability wager for funding your retirement goals.

Travis Hunter observed in real-time how reacting to every shit post on social media nearly destroyed his personal life. If you find yourself in the same situation with your portfolio, there are alternatives to being hyper-reactive regarding your investments.