It’s onerous, draining a swamp.

The DOL recently revealed its highly anticipated final fiduciary rule. Its main component is protecting retirement savers by changing the investment advice fiduciary standard set by the Employee Retirement Income Security Act and the Internal Revenue Code.

Forbes summarizes the meat of the new standard:

In short, retirement investment advisors must provide prudent, loyal, and honest advice free from overcharges.

The big takeaway is forcing brokers to equate their responsibilities more closely with the fiduciary standards long employed by RIA firms.

Many investors still face heinously expensive fees. The Council of Economic Advisors estimates that conflicted investment advice costs Americans up to $5 billion annually. The kicker is that this is for just one product- fixed index annuities.

I’m a big fan of much-needed reform for an industry with a well-deserved reputation for egregiously overcharging its clients.

Universally, Adopting such an obvious standard would be a no-brainer in an ideal world.

We don’t inhabit an ideal world.

We experienced this first hand when Dina and I traveled to Washington, D.C., a few years back to voice concerns over our objections to a pseudo-attempt to regulate the bad guys.

Despite Dina’s impassioned plea for justice for the average investor, she encountered the equivalent of a congressional roadblock.

Why would our civil servants take the side of the moneybags over their constituents?

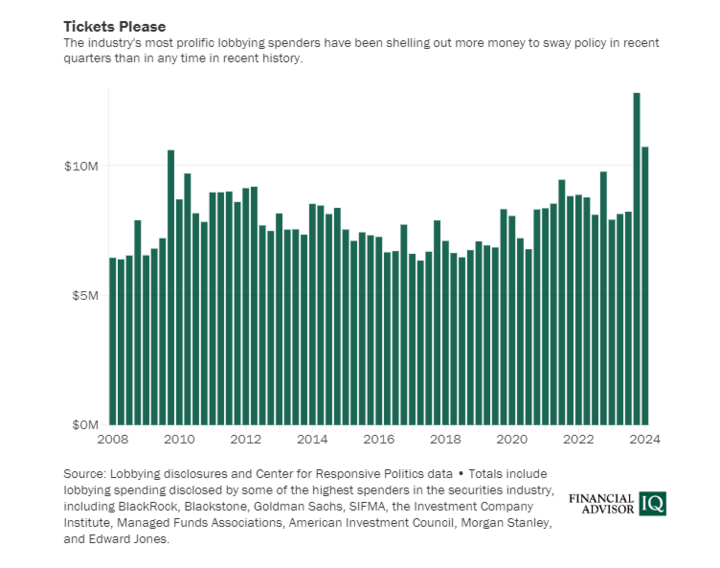

One Word- Lobbyists.

Source: Open Secrets

There’s an excellent reason why the few acquire riches beyond their wildest dreams by exploiting their fellow citizens.

It’s not an accident that more Americans than ever suffer from obesity, depression, and legal and illegal drug addictions in addition to being virtual bots to social media algorithms.

Giant Food, Pharma, Tech, and the Financial Services Industry are the constituents of our elected representatives. Their money purchases legislation that boosts profits and blocks laws that decrease them.

If you don’t believe that, you haven’t been paying attention.

The barrage of legal challenges has commenced with the ink barely dry on the new fiduciary legislation.

These objections to fair play will multiply as the September commencement date draws near.

The rich and powerful exert disproportionate control over the lives of American citizens.

Nothing is more grievous than so-called Leadership PACs.

Source: Open Secrets

Congress deploys these legal entities as slush funds to live the opulent lifestyles of the Rich and Famous.

Guess who bankrolls these PACs?

It’s not surprising that Corporate PACs and business executives are the chief financiers.

92% of lawmakers utilize leadership PACs. These are separate from campaign accounts and don’t fall under the same guidelines regarding spending donors’ money.

According to The Hill, this is how things went down.

The report found that in the 116th Congress, 120 leadership PACs spent less than 50 percent of their money on politics, with the rest going to things like meals at upscale restaurants and stays at elite resorts. Those PACs spent over $2 million at hotels and resorts, $220,000 at sporting events and concerts, $190,000 at ski resorts, and $150,000 at steakhouses.

Issue One CEO Nick Penniman took these PACS to the woodshed.

“Leadership PACs represent the worst of pay-to-play political giving,”

I hope I’m wrong about the Fiduciary Rule. I sincerely hope it’s implemented and protects ordinary Americans against the legions of financial predators.

The problem is that investors are pushed to the back burner when the insurance and broker money flows in, and Congress must choose between fully paid vacations at 5-star resorts and doing the right thing.

It gets worse.

In a shocking turn of events, guess who regulates Congress?

Congress!!!

Unsurprisingly, one of the few things both parties agree on is letting their members trade stocks after they are privy to classified information discussed in non-public committees.

Until this system changes, God help us all.

Unless we reform this nefarious pay-to-play system, everything else will be akin to rearranging the deck chairs on the Titanic.

Congress is the antithesis of a fiduciary. Putting the Fox in charge of the Hen House never ends well.