Paraphrasing Mark Twain, History may not repeat, but it does rhyme.

Cycles of investing are often melodious with significant historical changes.

This time is no different.

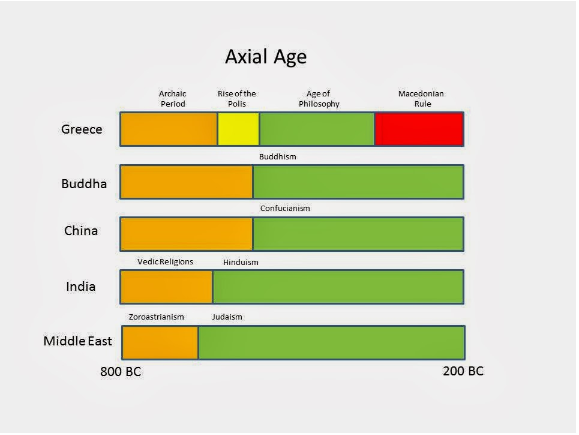

The period from 800 to 200 B.C.E. was called The Axial Age. Axial refers to a pivot. During this period, humanity pivoted in the right direction. People became aware that the Gods wouldn’t come to their rescue, and their various blood sacrifices to appease their deities didn’t alleviate human suffering.

Maximus from Amazon Prime’s 2024 hit series Fallout makes an observation that fits the stagnant religious situation before the Axial Age as he observes the remnants of a nuclear-ravaged California 200 years after the first missiles launched: “It’s the same thing that always happens. Everyone wants to save the world. They just disagree on how. “

Men and women began realizing they must bank on themselves to progress. People became conscious of their limitations and abilities.

It’s no accident that new religions and philosophies filled the gap due to the departure of the old worldview.

According to Karen Armstrong:

The new religious systems that emerged during this period-Taoism and Confucianism in China, Buddhism and Hinduism in India, monotheism in Iran and the Middle East, and Greek rationalism in Europe-all shared fundamental characteristics beneath their obvious differences. It was only by participating in this massive transformation that the various peoples of the world could progress and join the forward march of history.

Broken traditions and endless possibilities characterized this period.

The same can be true for investors in 2024.

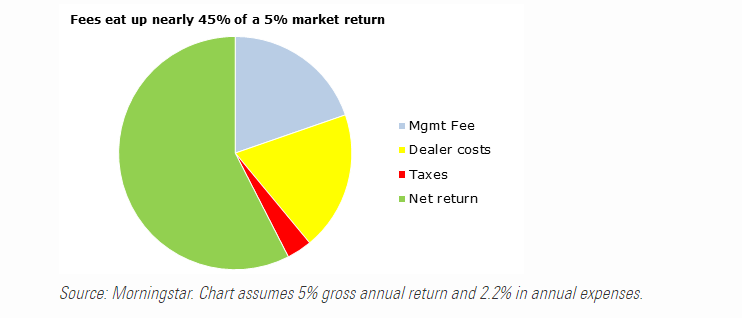

It’s astounding that investors were trying to survive the Dark Ages only thirty years ago. While they didn’t have to sacrifice their firstborn to ensure bountiful crops, their investment options and service models provided a burnt offering to the fee Gods. Confuscious wasn’t providing their financial advice.

Think Class A, B, and C shares with 12b-1 fees instead of low-cost index funds and ETFs. Instead of creating goals-based comprehensive financial plans utilizing realistic inflation and return assumptions, investors did their planning outside-literally.

A five-minute chat about retirement sandwiched between 18 holes of golf and booze: your favorite local stockbroker considered this an annual meeting when he wasn’t cold-calling or ringing doorbells trolling for new business.

There was no such thing as commission-free trades. Fifty dollars a trade was the standard, and full-service brokers often charged much higher fees.

Forget about comparing investment costs by going online to research fund fees. There was no internet, and transparency was a complete joke.

Investors offered monetary sacrifices to their Broker Idols, resulting in vastly lower returns due to egregious commissions and other fees.

The New Axial Age for investors lobbed a machete at these costs.

Despite all the negativity, investors have never had it better than today. Martin Luther would be proud of this reformation.

Many answers to today’s problems circulate in the past. We don’t know where to look.

Lay people found usefulness in Buddhism’s teachings thousands of years ago because it also taught them to be mindful of their money.

Karen Armstrong comments: Monks were trained to be mindful of their fleeting mental states; lay followers were directed to attentiveness in their financial and social dealings. The Buddha told them to save for an emergency, look after their dependents, give alms, avoid debt, make sure that they had enough money for the immediate needs of their families, and invest money carefully. They were to be thrifty, sensible, and sober.

Surprisingly, the Buddha didn’t advise placing a variable annuity inside a tax-deferred 403(b), but I digress.

Investors can pivot into a new world that doesn’t prioritize ripping them off.

My colleague Barry Ritholtz says it best: The patsies at the table soon figured out they did not want to play Wall Street’s games. Their solution was to own the market and let someone else pay a high management fee.

The best news is you don’t have to take my word or that of a false idol to enlighten your retirement portfolio.