Our lives are overflowing with vast emptiness.

We should comparably view our investments.

Emptiness has a negative connotation. In reality, its definition is centered upon unlimited potential.

As human beings, we confront this daily, though we may choose to ignore it.

The four most frightening words in English are: Anything can happen anytime.

Our day-to-day existence is alive with hope, although our future is not guaranteed. There is no guarantee that tomorrow, at this time, we will be here. We need to make the best use of our time.- Dalai Lama

This applies to both good and bad.

Uncovering true happiness is conditioned upon grasping this reality and accepting uncertainty unconditionally.

The ultimate antidote to living in the past or future relies upon this precept if the goal is making your brief time on this planet an enjoyable experience.

For example, we can wake up and win the lottery. Conversely, a speeding bus may have your name engraved on its bumper.

We love to create stories of control, but these are just fantasies to subdue our terror.

In the words of Morgan Housel, People only communicate perhaps 1% of what’s going through their head, so the world is probably 100x crazier and messier than it looks.

Training our minds to think like this takes time and effort. The sacrifice is well worth escaping a life of delusion.

Imagine if we could insert this thought pattern into our investment philosophy.

It would make it virtually impossible for the media or others to frighten us from reaching long-term goals by panicking at the most inopportune moments. Accepting a wide range of outcomes as a feature and not a bug of the markets is a kryptonite to the prophets of doom.

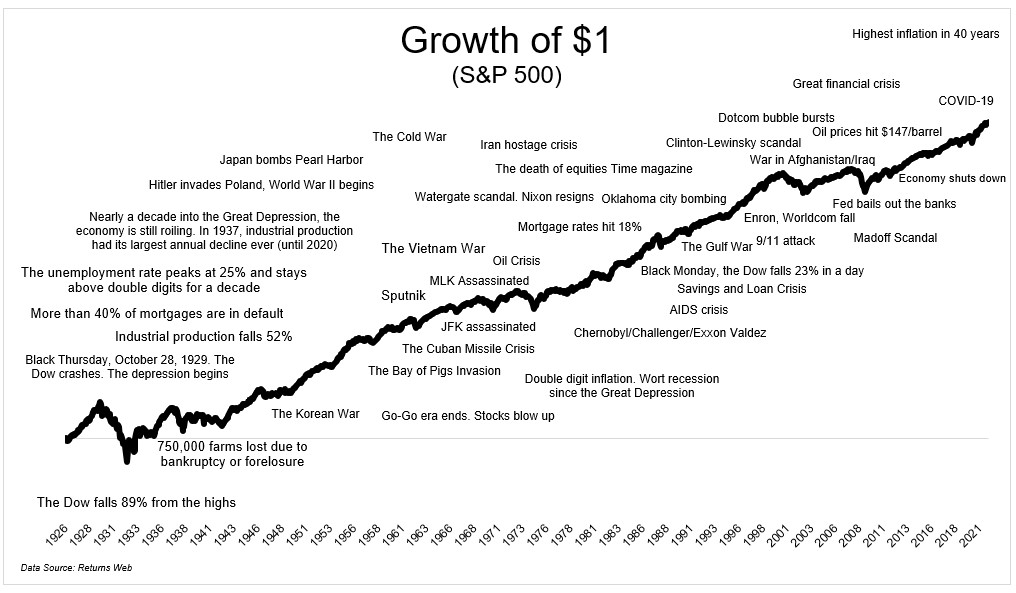

The list of market reigns of terror is endless.

Debt Crisis

Inflation

War

Pandemics

Political Chaos

Natural Disasters

Recessions

Terrorist Attacks

All are unsettling, and investors have every right to experience frazzled nerves.

Adopting Anything Can Happen At Any Time is achievable as a bedrock philosophy rather than a nightmare outlier.

The goal is to trim the emotional reactivity period rather than wallowing in it.

Understanding everything that can arise will also pass away is the path to removing angst from your retirement portfolio.

If it doesn’t, investors will have more significant problems than their 401(k) balance.

It’s wise to heed the words of Shantideva, an eighteenth-century Indian Philosopher, if you are searching for the ultimate investment alpha.

If there is a solution, then what need is there for rejection?

If there is no solution, then what point is there in dejection?

In a world filled with anachronisms, one can do worse than focus on the fact that emptiness is fulfillment.

Open-ended possibilities are terrifying at first.

Convincing yourself that the delusion of control is reality is an absolute nightmare.