Our nation’s personal finance nightmare is destroying the American dream.

The data backs up our woeful lack of knowledge and poor decision-making.

We owe way too much money. The average household holds $137,879 of various forms of debt:

- $7,104 in credit cards

- $192, 618 in mortgages

- $29,934 in depreciating asset auto loans

- $46,679 in student loans

Source: nerdwallet

We don’t save enough for retirement. Only half of the households have any retirement savings in a 401(k) or IRA.

Median household retirement savings by age are discouraging:

- 35-44 years old: $40,000

- 45-54 years old: $97,000

- 55-64 years old: $135,000

- 21% of Americans have no retirement savings.

- 43% believe they will need to work past 65.

Sources: Center for Retirement Research 2017 and WealthyNickel

It gets worse:

- Only 29% of Americans know about 529 college savings plans.

- About 60% of Americans have life insurance, but nearly half of them have insufficient coverage.

- 32% of Americans maintain a budget.

- 30% possess a long-term financial plan.

- 24% of millennials demonstrate basic financial literacy.

- 35% of adults with a credit history have debt collections reported in their files.

- 66% of Americans would struggle to scrounge up $1,00 in an emergency.

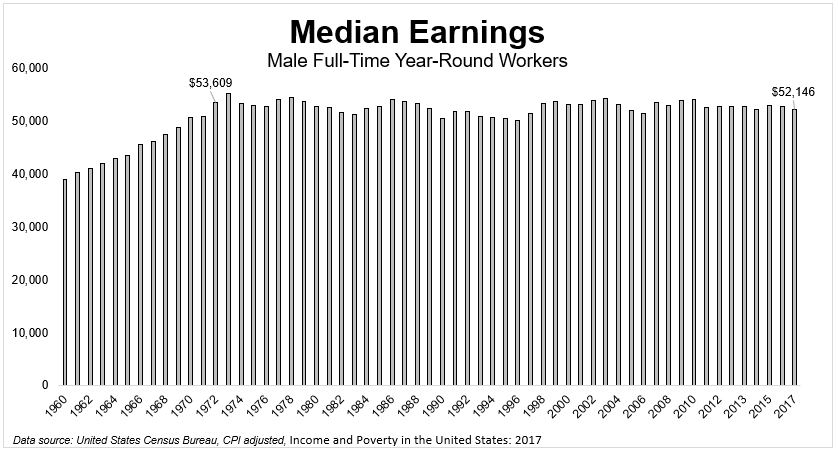

There are many reasons for this sobering data. The failure of public schools to provide rigorous and timely instruction on this topic is a borderline criminal offense. Poor parent role-models and decades of paycheck stagnation are also near the top of the list.

What matters most isn’t debating how we got here, but what are we going to do about it?

We’ve decided to begin regular interactive webinars in addition to our Lesson Plan Series of personal finance outreach. We deal with many teachers who grapple with the basics of personal finance. Based on the above statistics, they aren’t alone.

Our first webcast is Thursday, April 23 and covers college planning during a pandemic.

You can register here to attend and receive access to a recorded episode if you can’t make it.

During these uncertain times, every dollar counts more than ever.

To get a head start on your education, tune into CNBC on Monday at 7:30 for at terrific financial advice special. Our colleague Josh Brown will be headlining an all-star cast. Don’t miss it.

Joining these frightening statistics isn’t an option.

Help us to help you.