Misleading investors using confusing jargon is a feature, not a bug of financial services. Introducing: Fee-based financial advice!

This is not as bad as the infamous “fee-free” moniker but still misleading at best; unethical at worst. Investors face a mind-blowing array of bewildering acronyms regarding advisor credentials. Do they need a new designation to ponder?

Clients pay fee-only independent RIAs directly. Fee-based, dual-registered advisors are compensated by clients AND various forms of commissions.

Fee-based is easily confused with fee-only and this is no accident. Befuddling retail investors is a sport for many financial firms because they know most retail investors can’t coherently explain the difference between a stock and a bond; this leaves investors open to exploitation.

Putting these pieces together brings up some interesting questions.

- Do you think retail investors can distinguish subtle nuances between fee structures?

- Do you think it’s a coincidence the term fee-based closely resembles fee-only?

- Do you think fee-based RIAs want people to know the difference?

No, no, and no!

Commissions combined with high AUM fees are a bonanza for fee-based firms and a nightmare for many investors. Don’t take my word for it.

Nicole Boyson PhD, a distinguished professor at Northeastern’s School of Business, wrote a granular research paper confirming the stark differences between the two models.

The Worst of Both Worlds? Dual Registered Investment Advisers provides enormous amounts of data backing up her claims.

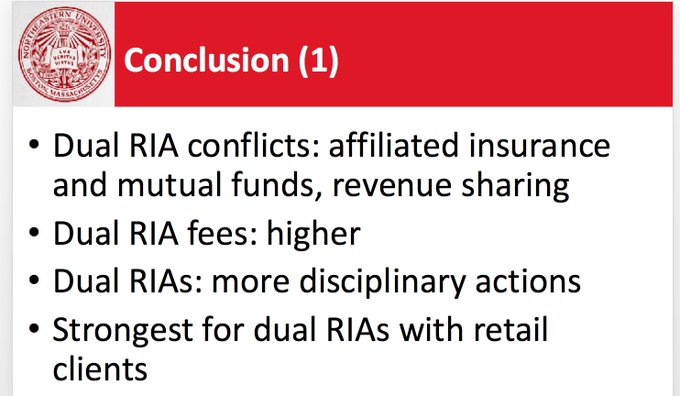

In a nutshell, her key points are:

Professor Boyson concludes that fees have a disproportionately high, negative effect upon investors of limited means.

Many independent, fee-only RIAs have high minimums (a whole other issue) because they view small accounts as unprofitable.

So where does Joe Six-pack go for advice?

He turns to dual-registered advisers/fee-based RIAs or full commission brokers.

High AUM fees plus expensive mutual funds with a dash of commissions greet him at the door. 81% of RIA assets fall under the fee-based model.

Fee-based revenue grew astronomically from $3.5 billion to $11 billion from 2007-2016.

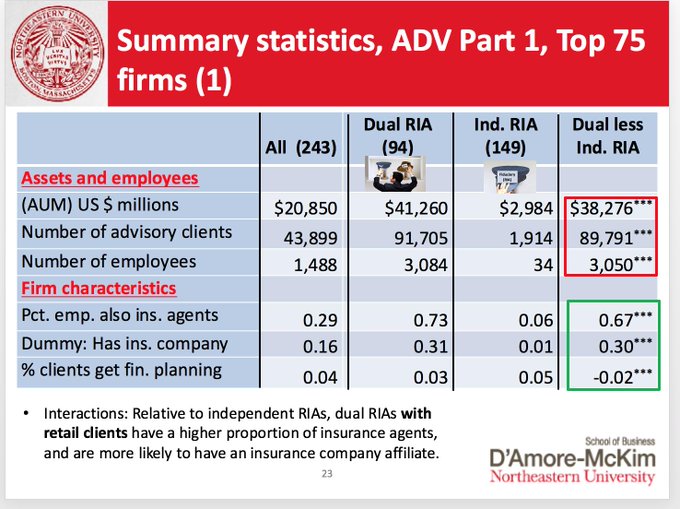

These firms average $4.5 billion in assets under management compared to $369 million for fee-only RIAs.

This wouldn’t be an issue if clients received added value for their money but they don’t.

Customers pay higher fees with no corresponding increase in planning services, not exactly a value investment.

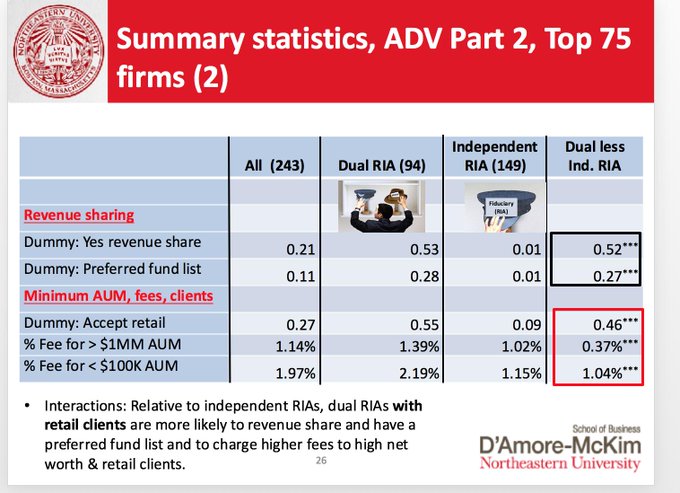

Fee-based firms charge clients an average of 2.2% for money management. This compares to 1.2% for independent fee-only firms.

It doesn’t end there.

A dual-registered firm is a strong predictor of subsequent fraud.

According to Professor Boyson:

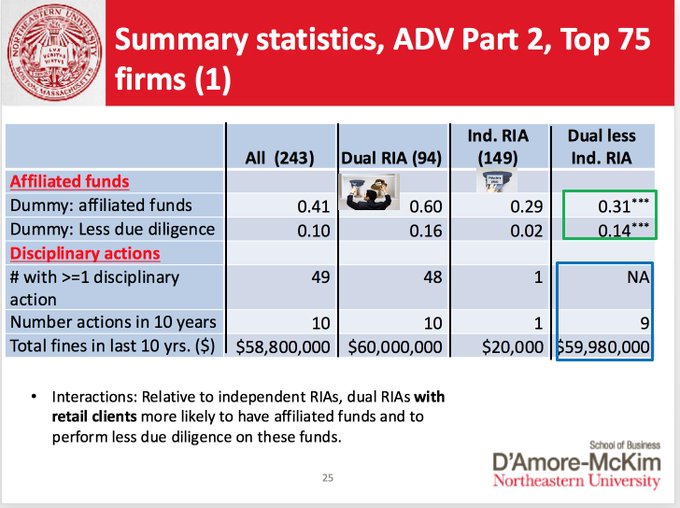

- 21% of dual-registered advisors made false claims to the SEC, compared to 1% for the independents.

- 10% of dual-registrants employ a convicted felon, compared to 0% for independents.

- Dual registrants are more likely to hire advisors with checkered pasts.

- Dual-registered RIAs consistently engage in a practice called revenue sharing with mutual fund companies.

Fund companies pay fee-based advisors, directly, or indirectly for selling their funds. Payments include sponsoring conferences and reimbursing training, entertainment and travel. Purchasing sales data analytics from brokers is another form of reimbursement. Given the ability to gain access to a “preferred” distribution list, many fund companies are happy to “pay to play.”

Funds employing this practice display worse performance due to a higher fee structure, according to Professor Boyson and COMMON SENSE.

Revenue sharing is bad news for investors. The practice of putting clients last doesn’t end with revenue sharing. Many fee-based firms use wrap accounts for their clients.

This structure “bundles” all fees under one umbrella, supposedly saving clients some money. Unfortunately, this opens up a Pandora’s Box for additional fee grabs.

The additional cost of high-fee mutual funds are not included in the bundle; neither is “traded away” broker fees (when fee-based RIAs outsource trading to another brokerage). All of these additional costs are added to the client’s bill.

Few, if any, independent fee-only RIAs employ this structure.

Finally, clients of fee-based firms are more likely to purchase unnecessary insurance products compared to their independent counterparts.

77% of dual-registered RIAs advisors are licensed to sell insurance, compared with 21% of independent RIAs.

Insurance is a vital component of a holistic financial plan. Nobody disputes its value when placed inside a comprehensive plan.

In many dual-registered firms, this isn’t the case. Insurance is sold as a separate stand-alone product. Advisors are given incentives to sell clients expensive and often unnecessary whole life insurance along with tax-deferred annuities in their already tax-deferred retirement accounts.

After extensive research, we have identified the top 5 tax-deferred variable annuities in teacher's tax-deferred 403(b) accounts.

1.

2.

3.

4.

5.— Anthony Isola (@ATeachMoment) August 15, 2019

Professor Boyson concludes. “Advised clients suffer compared to relative to unadvised because of putting employers’ interest first.”

Painting all fee-based advisors with a broad stroke is unfair. Many want to do the right thing for their clients and are honest, hard-working good people.

That being said, there is very strong evidence retail investors should stay clear of this model. There are too many potential conflicts that advisors find too tempting to resist.

There’s a good reason why many CFP advisors falsely labeled themselves as fee-only. According to Bob Veres, “Some of us are still a bit angry over the fact that the Board allowed thousands of brokers to reclassify themselves from a misleading “fee-only” checkbox without consequence, so this just adds more fuel to the anger.”

Investors are starting to take notice.

Professor Boyson brings up an excellent point. She believes the SEC is missing the big picture regarding regulation. Focusing on commission-based brokers to follow a fiduciary standard isn’t the path of least resistance.

Dual registered firms are already obligated to act under a fiduciary standard. The SEC should spotlight enforcing existing rules on the trillions of dollars that dual-registered firms currently manage. There isn’t a need for additional regulation to do the right thing for investors

Intrigued by this discussion?

Join Nicole Boyson, Barbara Roper, and Dina Isola in Scottsdale, Arizona for WEALTH/STACK on September 8-1o to learn more.

You won’t be disappointed.

Source: The Worst of Both Worlds? Dual Registered Investment Advisers by Nicole M. Boyson