Don’t permit perfection to become the enemy of the good.

This advice goes for both your Health and your money.

Two weeks ago, I did a Health and Wellness presentation for our firm’s Academy program.

After all, how can we discuss wealth management with clients while ignoring our most immense treasure—our Health?

Nobody’s perfect. Making unreasonable demands is the worst way to encourage better choices, and discouragement is a terrible motivator.

Two of the more unpopular sides dealt with caffeine and alcohol intake.

The science is pretty straightforward. Two or more drinks per week are detrimental to our Health. Reagrding caffeine, it’s wise to stop drinking coffee roughly ten hours before going to sleep due to its half-life.

Both protocols have caveats. Our bodies are different, so second and third opinions are vital when you receive an alarming diagnosis. Some individuals have a higher tolerance for caffeine and can consume coffee later in the day without hindering sleep.

Regarding alcohol, exceeding the two drinks weekly minimum can work in certain situations. For example, if you casually drink with friends without going overboard, the social connections can offset some of the detrimental effects of alcohol within reason.

We need to establish a healthy baseline regarding these two drugs.

An all-or-nothing approach is doomed to failure. It’s like never running but deciding to enter a marathon in a month. Pain, misery, and failure are the guaranteed results.

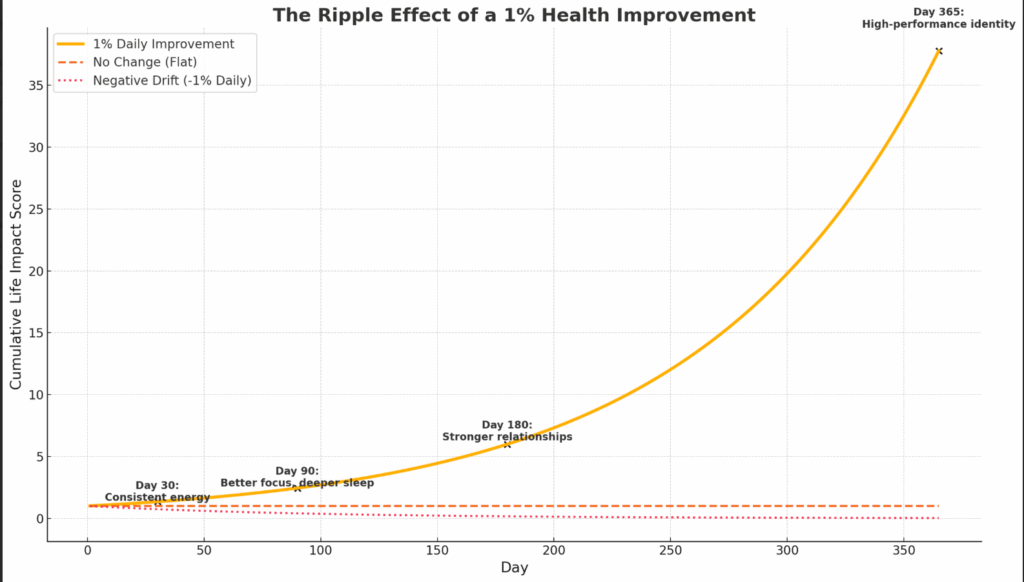

Here’s how positive change can lead to a bridge to better long-term wellness.

My suggestion went something like this?

For those who would find it impossible to meet the two-drink maximum, how about cutting your alcohol intake in half? If you consume twenty drinks weekly, can you cut it to ten?

For those coffee drinkers who are having trouble sleeping: Instead of cutting caffeine ten hours before bed, how about starting at five and see how that goes?

In both cases, setting achievable goals with potential improvement over time became the baseline for progress.

This philosophy is transferable to the world of personal finance.

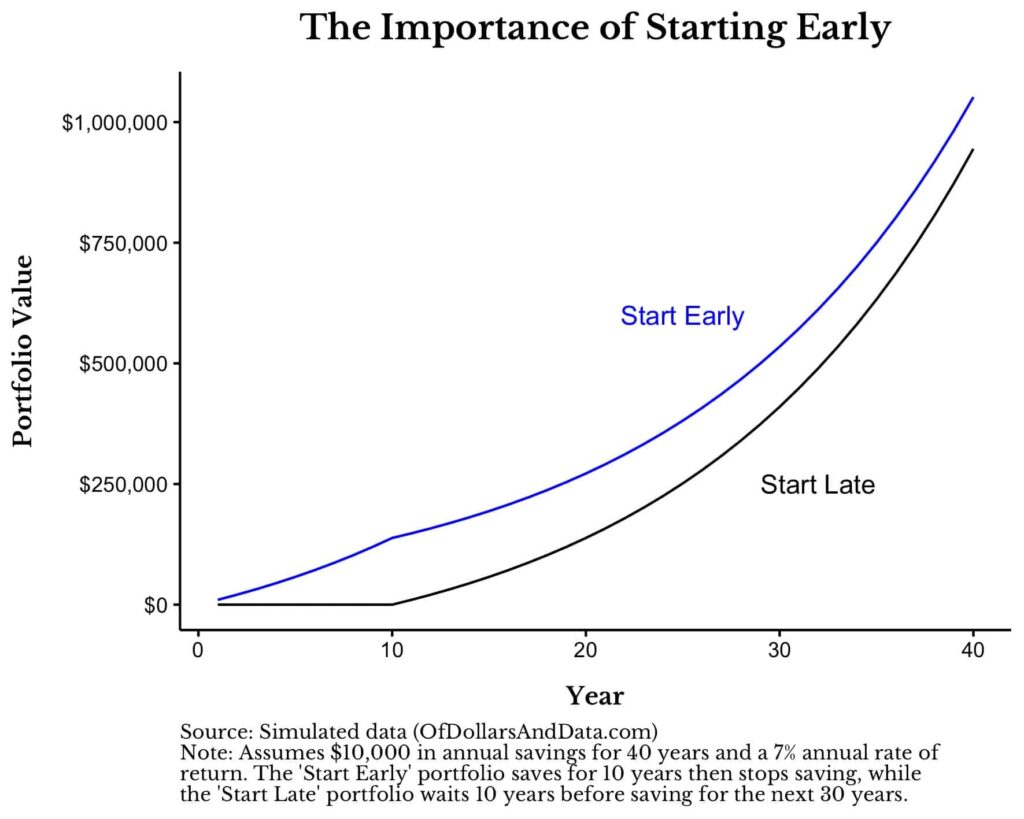

Many are overwhelmed by the guidelines established by experts, become discouraged, and do nothing. The costs of delay are irreversible.

For instance, saving 10% of your salary in a workplace retirement plan is optimal. Unfortunately, life gets in the way, and this goal becomes unachievable due to rising costs of food, shelter, and health care.

How about starting at 5% and raising your contributions 1% annually for five years to achieve this goal?

Much less painful and worlds better than doing nothing.

This same principle connects directly to other personal finance goals.

If you don’t have the funds for a 6-month emergency fund, would 3 months work?

How about that $1 million term life policy? If paying that premium is a stretch, half a million would go a long way toward providing for your dependents.

Nothing gets accomplished without taking action. The most challenging but essential part is rolling the snowball down the hill.

Sahil Bloom provides this sage advice:

When you allow the optimal to get in the way of the beneficial, you ignore the most powerful principle in life: Anything above zero compounds.

A little bit is always better than nothing. Tiny wins stack over long periods. Small things become big things.

Thinking about your Health and wealth won’t make you healthy or wealthy.

Do something!

Source: Dan Go