The DMV demolishes the lowest of expectations.

Last week’s excursion was a debacle.

After purchasing a car, the next step is registering it.

After gathering all the necessary documents, the journey into the wasteland, or local DMV, commenced.

Assuming the worst, I brought along reading materials for a 2-3 hour wait—a small price to pay for coming home with new license plates and car registration.

After pulling into the parking lot, a nightmare scene ensued. Dozens of people were lined up outside in a maelstrom of anger. The wind chill had caused the temperature to fall to about thirty degrees, adding insult to injury.

I assumed this was due to the federally compliant Enhanced or REAL ID, whose deadline was approaching. After leaving the car, I asked one of the motor vehicle hostages waiting in the windswept cold: What’s going on?

My assumption that this was just a group of people who didn’t have appointments was wildly incorrect. These weren’t a group of Ne’er-do-wells, paying the price for procrastination. They all had scheduled times!

Surely, this growing, unruly mob wouldn’t impact my simple car registration, but the security guard at the door begged to differ.

No, you can’t come in without an appointment, which you can make online.

After wasting an hour, I went home and logged onto the DMV’s site. Indeed, a time would be available in the next day or two. Another assumption gone down in flames: the nearest appointment was in two weeks!

The DMV is a land that time forgot. It is stuck in 1995 and does not seem to care. Monopolies tend to cultivate this mindset.

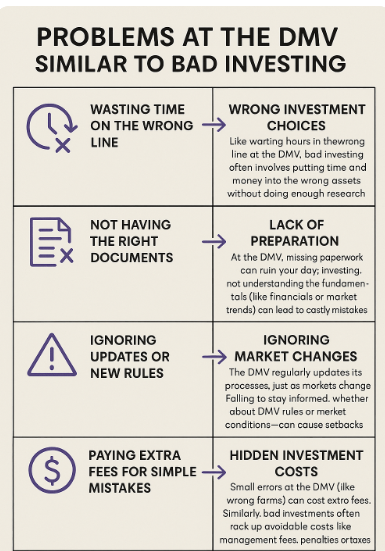

That said, life and investing run on the fuel of personal responsibility.

Instead of assuming I could drop in unannounced, calling the DMV would’ve been the right move. One can never get back wasted time.

This concept doesn’t exclude your portfolio. Spending time and treasure trying to beat the market with individual stock picks and timing the market is a DMV-like misallocation of resources.

On the next journey to this hellscape, checking and double-checking, bringing along the proper documentation is imperative.

Your investments deserve the same rigorous preparation. Not understanding if your advisor is a fiduciary and ignoring critical aspects like diversification and tax management makes missing documents at the DMV seem like a day in Disney. Preparation doesn’t require a 160 I.Q. Doing it is the act of a genius.

Another mistake was misjudging the Role of the enhanced ID in motor vehicle wait times. The same rules apply to unexpected market shocks. COVID and the current Tariff fiasco were on a few investors’ bingo cards.

Markets constantly throw curveballs at investors’ heads. Not considering bear markets when creating a financial plan is a recipe for disaster.

Overconfidence obliterates more portfolios than any other outside factor. Thinking that one can waltz into the local Motor Vehicles and achieve one’s objectives with decades of data pointing to the contrary is unbridled arrogance.

I plead guilty.

Buying exotic crypto, naked options, and inverse ETFs all spring from the same sources. Knowing what you don’t know and acting accordingly is an investing superpower. Never underestimate the complexity of financial markets and assume you’re their lord and master.

There are no guarantees in the markets or when registering one’s new auto.

My appointment is today.

Wish me luck.